A few days before Thanksgiving, Washington and Beijing are preparing to conclude a decisive agreement on rare earths, these vital materials for the technology industry, defense, and crypto mining. In a tense geopolitical climate, this compromise could defuse a crisis with heavy consequences for global supply chains. Faced with the threat of US customs sanctions and Chinese export restrictions, this agreement marks a strategic turning point, but nothing is decided yet.

Mining

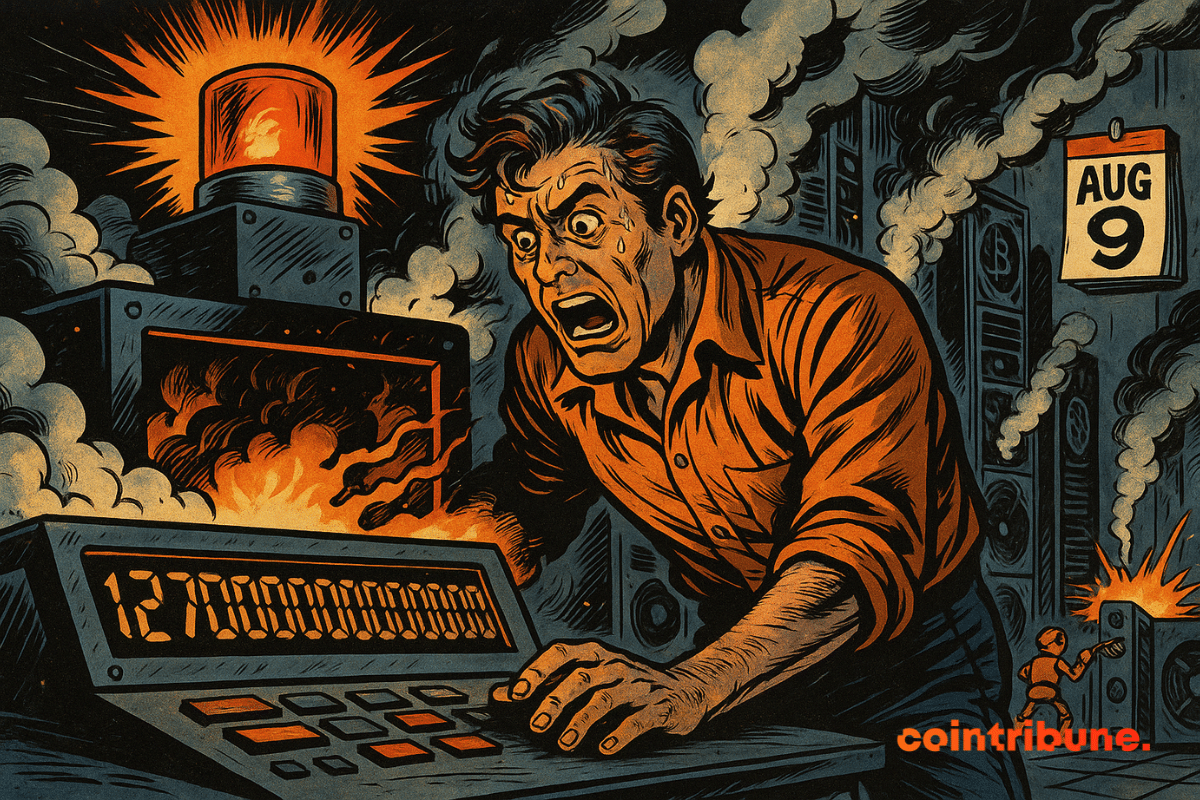

As states tighten their control over cryptos, an old bitcoin theft resurfaces amid a geopolitical rivalry. LuBian, a Chinese mining pool, reportedly lost more than 127,000 BTC in 2020. Remaining discreet for years, the case suddenly resurfaces as Beijing now accuses the United States of having seized these funds, now valued at over 14 billion dollars, through an intelligence operation. The suspicion of a state confiscation reignites tensions between two superpowers.

Germany’s Deutsche Telekom has joined Theta Network as an enterprise validator, marking a major expansion of its involvement in blockchain and decentralized computing. By taking on this role, the telecom leader becomes part of Theta’s growing group of corporate validators.

A record $38 billion contract just changed everything. Oracle is betting on AI, and crypto miners are already benefiting. Discover how this mega-deal is revolutionizing markets, boosting stocks, and opening a new era for crypto.

Bitcoin miners are taking on record levels of debt to finance new equipment and expand operations into artificial intelligence (AI) and high-performance computing (HPC). As competition for hashrate intensifies and post-halving profits shrink, miners are increasingly turning to debt markets to maintain an edge in both Bitcoin production and data infrastructure growth.

American Bitcoin Corp. (ABTC)—co-founded by Eric Trump—has released its October 2025 investor presentation, marking a major milestone in its evolution from a pure Bitcoin miner to a full-scale digital-asset ecosystem. The strategy focuses on building a U.S.-based Bitcoin powerhouse to reinforce America’s leadership in the global Bitcoin market.

Bitcoin mining difficulty fell 2.7% while the network’s hashrate reached a record high, keeping competition fierce for miners.

Bitcoin miners are getting a brief reprieve after months of mounting pressure. At block height 919,296, the Bitcoin network recorded its first difficulty drop since June—a 2.73% decrease to 146.72 trillion. The adjustment offers temporary relief after a prolonged period of rising computational demand that pushed many miners to the brink.

Donald Trump declared that the United States is in a trade war with China. This statement, made in Washington, marks an escalation of economic tensions. In the aftermath, the markets wavered. Bitcoin, particularly sensitive to geopolitical shocks, plunged. This declaration comes as the administration targets Chinese technological imports, directly threatening the mining industry. The American trade offensive now takes a strategic turn with immediate repercussions on the crypto ecosystem.

Galaxy Digital secured $460M to develop its former Bitcoin mining site in Texas into a large-scale AI and high-performance computing data center.

When Washington hastily drafts a law, AI becomes a matter of state, crypto miners suffer, and exporters bite their nails. All this, just to stay first.

France is preparing to give up its surplus nuclear energy to an American bitcoin miner instead of favoring the French solution.

The Bitcoin network has never been stronger. Its mining difficulty has just reached an all-time high at 142.3 trillion, up 29.6% since January. This figure reflects both the rise in hashrate power and the growing pressure on mining companies. While the blockchain strengthens against potential attacks, technical and economic requirements impose an increasingly tough selection among sector players.

On CNBC, Eric Trump stated that Bitcoin has "taken the role of gold in today’s world," elevating crypto to the status of a strategic safe haven asset. This media appearance coincides with the launch of American Bitcoin, a mining and BTC holding company he is close to. Far from a mere announcement, this statement fits within a dynamic where publicly traded companies are beginning to integrate bitcoin at the heart of their reserve strategy.

Bitcoin mining difficulty touched a new all-time high as the crypto market descended into volatility following the latest US job data. After hitting an all-time high (ATH) in August, market commentators projected that the difficulty of Bitcoin mining would decrease. However, the mining difficulty has steadily increased as the month progressed, with large players dominating the space.

In August, bitcoin miners generated revenues close to 1.65 billion dollars, a level almost identical to that of July. This maintenance reflects an impressive resilience of the sector, despite a context marked by rising costs and energy pressure. But behind this apparent stability lie structural vulnerabilities that raise questions: can the current mining model really hold in the long term?

Behind Bitcoin's apparent stability, an imbalance threatens the network's sustainability. Since April, transaction fees have dropped by more than 80%, shaking the remuneration model of mining companies. Amid the rise of ETFs and after a demanding halving, it is Bitcoin's internal economy that is faltering. Lower fees, fewer incentives, more risks to protocol security, the crisis is here, structural, and raises a question the ecosystem can no longer ignore.

The United States and the presidential circle are all-in on bitcoin while Europe continues to fall behind.

An exceptional technical show of force is currently shaking the crypto ecosystem. Qubic now controls 58% of Monero's (XMR) total hashrate during its marathon periods, setting a new record of computational power while simultaneously proving that technical innovation and responsibility can coexist. This remarkable performance illustrates the unique capabilities of the Qubic network and its revolutionary vision of Useful Proof of Work.

A solo Bitcoin mining success earned an independent miner $365,000 from block number 910,440.

While mining profitability erodes and hashprice declines, the Bitcoin network records an unprecedented power rebound. On August 18, the hashrate climbed to 966 EH/s, nearing a historic peak, despite nearly zero transaction fees and growing economic pressure on mining companies. This striking contrast between economic tension and technical robustness raises questions: how does the mining ecosystem manage to maintain, or even strengthen, its security in such an unfavorable context?

When energy-hungry AI comes to steal the watts from bitcoin, things heat up in data centers! And the miners, they dig... to stay connected.

In a few days, one of the key indicators of the robustness of the Bitcoin network experienced a striking turnaround. On August 8, the hashrate reached a historic peak before declining sharply, a sign of a sudden adjustment in the computing power mobilized to secure the blockchain. This reversal, occurring while BTC still hovers near its annual highs, rekindles debates on the balance between technical performance and economic constraints for mining specialists.

MARA Holdings, American Bitcoin mining giant, plans to acquire 64% of Exaion, a subsidiary of EDF specializing in data centers and artificial intelligence. This operation, estimated at 168 million dollars, reflects the group's desire to diversify its revenue sources while strengthening its BTC accumulation strategy.

The Qubic network (QUBIC) surprised by temporarily reaching 52.72% of Monero’s (XMR) total hashrate, with a computing power of 3.01 GH/s. This technical performance, although brief, shows the power of this project.

Is bitcoin undervalued? A key indicator, the "Energy Value" from Capriole Investments, estimates that its "fair value" reaches 167,800 dollars, 45% above its current price. Designed by Charles Edwards, this model is based on the energy power used by the network. The unprecedented gap it reveals revives the debate about the true valuation of the asset and the market's ability to close this gap in the coming months.

The Bitcoin network has just crossed a new milestone with a mining difficulty reaching an all-time high of 127.6 trillion. While this figure indicates enhanced security, it raises crucial questions about the sector's economic balance. Between maintained profitability and a frantic technological race, does this escalation mark the beginning of a new era of mining?

Bitcoin miners generated $1.66 billion in July, a record since the 2024 halving. Profitability, difficulty, projections: the mining economy is undergoing major changes. Discover the key figures, trends to watch, and what August holds.

While the price of bitcoin is holding steady, its mining difficulty is climbing sky-high: a technical record that may hide more gold than speculation…

As distrust settles in the crypto ecosystem, Pi Network fuels tensions with a controversial decision: a voluntary token lockup in exchange for a mining bonus that can rise up to 200%. In a context of free-falling prices and lethargic liquidity, the initiative provokes the outrage of a community already tested by technical delays and the lack of use cases.