Despite geopolitical pressure, bitcoin could enter a historic bullish phase according to Bitwise. More details here!

Prediction Market

The four-year Bitcoin cycle has not disappeared into the noise. According to an analysis shared around CryptoQuant data, the 2026 drop resembles, in its internal mechanics, the corrective phase of the previous cycle. Price and on-chain indicators reconnect, like two pieces of the same puzzle once thought lost.

MARA holds 53,822 BTC on the balance sheet, but bitcoin drives Q4 loss explosion. We give you all the details in this article.

The UNI crypto soars 15% in 24 hours after a major vote on the fee switch. DeFi is scaling up. All the details here!

Despite the crypto market pullback, over one billion dollars is flowing into RWAs. Are investors already changing strategies?

ETFs revive bitcoin with $258M inflows. Are institutional investors preparing the next move? Analysis.

The price of the Shiba Inu crypto seems to particularly attract the attention of analysts. Behind the fantasies of a 1 $ SHIB, a more significant figure indeed stands out. It is its market capitalization reaching 3.6 billion dollars. According to crypto experts, this figure changes everything. Explanations.

Bitcoin records a historic decline in active addresses. Simple pause or major warning sign for crypto investors?

The threshold of 50% of ETH "in staking" announced by Santiment looks like a reassuring milestone, almost triumphant. But it triggers a controversy: does this figure really measure active staking or only accumulated deposits? The difference is not trivial, as it changes the reading of supply, network security, and market sentiment.

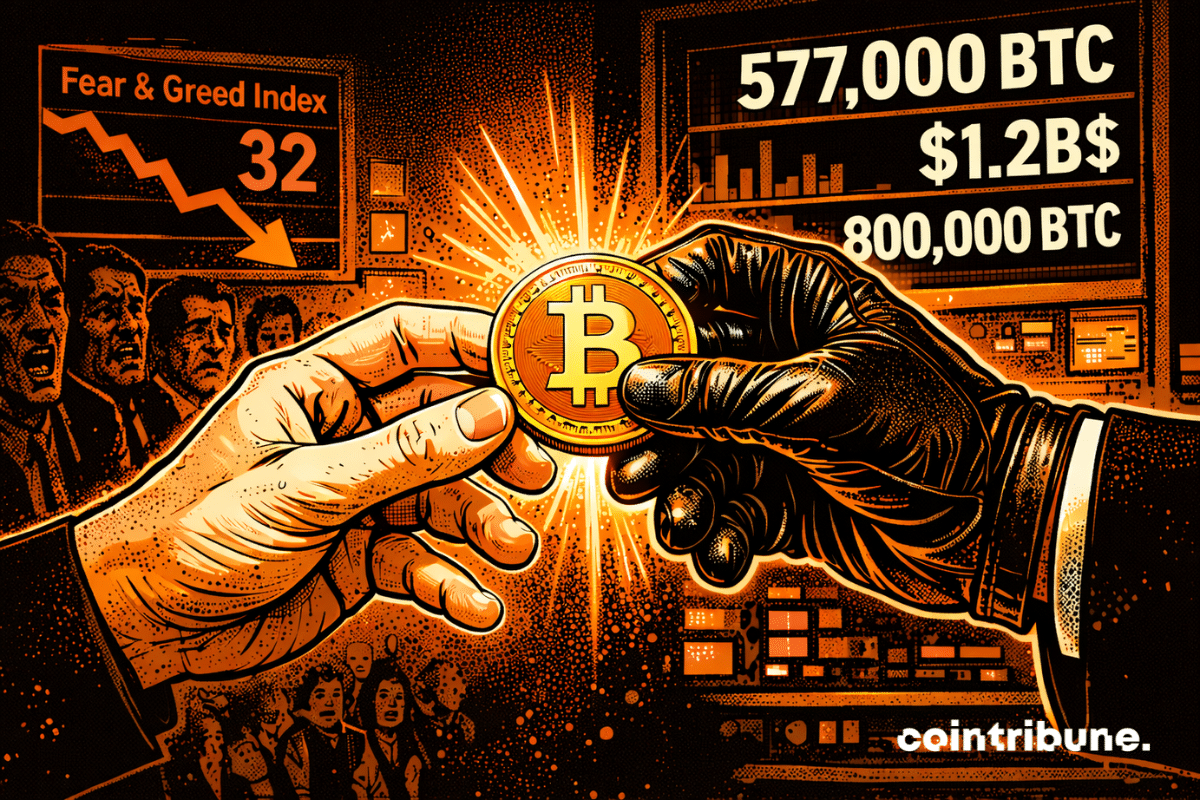

Bitcoin plunges and extreme fear dominates the market. However, institutions are quietly accumulating. Should you buy now?

The Bitcoin options market shows a clear signal: the 40,000 $ put has become the second largest bet before the February 27 expiration, with about 490 million dollars of notional. In other words, some traders are paying dearly for "catastrophe" insurance. Is this a prophecy? Not necessarily. It is often a hedging reflex when the market has just been shaken. Bitcoin currently drifts around 66,000–68,000 $, after a sharp decline from the October highs. In this setting, options look less like a vote on the future and more like a seatbelt fastened at the last moment.

Bitcoin ETF flows plunge by $105M. Behind these withdrawals, a surprising dynamic could reshape the crypto market.

Tuesday, February 17, 2026, eToro (ETOR) stock closed up about 20%, supported by better-than-expected quarterly results and the still central weight of crypto in its model. Even in a less euphoric market than in 2024, Wall Street liked the message: eToro makes money, and the platform remains a crossroads between crypto and traditional finance.

Bitcoin undergoes a drastic drop in open interest, a sign of leverage withdrawal and nervous markets. Full analysis here.

Discover how Metaplanet boosted its revenues by 738% thanks to Bitcoin. An impressive feat in the crypto market!

The crypto Pi Network is going through a critical zone. Its token Pi Coin loses 24% in one day. Analysis of a concerning signal.

Traders are placing sizable bets on Bitcoin’s path through 2026 across leading prediction platforms. Activity on Polymarket, Kalshi, and Myriad suggests a market that expects gradual progress rather than a rapid breakout. More than $84 million in combined volume across seven contracts reflects cautious optimism, balanced by consistent hedging against downside risk. While confidence appears to build later in the year, near-term expectations remain restrained.

The creator of OpenClaw, the new sensation in open source AI, declines several acquisition offers. More details in this article!

Bitcoin is going through a critical phase, but CryptoQuant encourages investors to stay calm. We tell you more in this article.

The crypto market is entering a new phase according to Mike Novogratz. End of explosive gains? Analysis of a major turning point in this article!

Ethereum falls below a major psychological threshold. Blockchain indicators show unexpected accumulation. Analysis.

Polymarket has escalated its dispute with U.S. state regulators by filing a federal lawsuit against Massachusetts, arguing that prediction markets fall under exclusive federal oversight. At the center of the case is whether individual states can restrict event-based contracts already regulated at the federal level. Ultimately, the ruling could determine how prediction markets operate across the United States.

The Financial Times triggers a tidal wave by claiming that Bitcoin will fall to zero. A statement that divides investors.

Crypto.com bets big on a crypto prediction app with up to $500 offered at sign-up. Discover the details in this article.

Nevada regulators have stepped up action against crypto-linked prediction markets. A new lawsuit targets Coinbase over alleged unlicensed sports wagering. The move comes as prediction platforms expand quickly across the United States. State officials argue that existing gambling rules still apply, even when products are offered through crypto or derivatives markets.

Bitcoin sharply dropped this weekend, and the clearest signal does not come from the spot market. It comes from derivatives. The drop of over 10% between a peak at $84,177 and a low at $75,947 opened a rare gap on CME futures contracts, with a price difference exceeding 8% at reopening. It's the fourth largest gap since the launch of Bitcoin futures in 2017.

As the US government slides into partial paralysis, crypto prediction platforms Polymarket and Kalshi find themselves at the heart of a troubling controversy. Their contracts, meant to allow traders to bet on this event, reveal major flaws in their formulations.

Crypto: Coinbase opens the doors to legal betting in 50 US states. We provide you with all the details in this article!

Bitcoin: Institutional accumulation explodes. Here are the figures confirming massive accumulation.

Explosion on the Ethereum network: 447,000 new investors in one day, an unprecedented record in 7 years! All the details here.