Crypto: Coinbase opens the doors to legal betting in 50 US states. We provide you with all the details in this article!

Prediction Market

Bitcoin: Institutional accumulation explodes. Here are the figures confirming massive accumulation.

Explosion on the Ethereum network: 447,000 new investors in one day, an unprecedented record in 7 years! All the details here.

An explosive case shakes the crypto market: three Polymarket whales targeted for suspicious bets on Venezuela. Details here!

Bitcoin mining loves podiums. One number climbs, another falls, and the ecosystem tells itself a simple story. Except that in this industry, the way you count matters almost as much as the machines. And that’s exactly what makes the “Bitdeer moment” interesting. Bitdeer claims to have reached 71 EH/s of…

Is XRP preparing for a spectacular comeback? Patient crypto investors may soon reap the rewards of their wait.

Crash or simple pause? Bitcoin drops while gold rises. The refuge asset duel intensifies. Details here!

Stablecoins have long been the discreet plumbing of crypto. Nobody applauds them, but without them, part of the market seizes up. Today, they are coming out of the shadows for a very concrete reason: savings and bank deposits. In the United States, local bank leaders are pressing the Senate to tighten certain points of legislation on stablecoins. Their fear: seeing part of the deposits migrate to dollar tokens, attracted by “rewards” that increasingly look like a yield. On the other side, JPMorgan refuses to give in to alarmism. The bank sees it rather as a new brick in a monetary system already composed of several layers. And this reading gap says a lot about the battle underway: financial stability, competition, or a simple war of models?

Zcash collapses, Monero skyrockets! An unprecedented battle shakes the crypto market between two giants of privacy coins.

Morgan Stanley has never been the type to chase trends. So when the bank announces a digital asset wallet, designed for crypto but also for tokenized real-world assets (RWA), the signal is clear. Wall Street no longer just wants to “tolerate” the sector, it wants to hold the keys. According to Barron’s, this digital wallet is expected to launch in 2026 and aim, from the start, at a hybrid mix: crypto on one side, real-world assets (stocks, bonds, real estate) on the other.

Options traders are betting big: Bitcoin could target $100,000 as soon as this month. Complete analysis in this article.

The Fusaka update propels Ethereum. Its number of holders explodes, analysts raise alarms. All details in this article.

In 2026, the crypto universe will change its face. Binance announces a historic shift driven by different factors. All the details here!

Solana shakes up the crypto market with a massive liquidation in just one hour. All details in this article.

The silver price crash revives Nassim Taleb's criticisms of bitcoin. This renowned analyst sounds the alarm.

Michael Saylor's company Strategy resumes its weekly bitcoin purchases at a time when the markets are doubtful. Details here!

Bitcoin threatens to finish the year in the red. Can it still rebound before the end of 2025? An analyst warns of a crucial technical threshold.

Bitcoin did not offer a gift this year. On December 25, in full "holiday" liquidity (that is to say almost empty), the price slipped below $87,000 before bouncing back timidly. And the market’s psychological gauge hardened: fear shifted into extreme mode.

Exclusive analysis: Tom Lee bets on a bullish Bitcoin until 2026. In this article, discover his arguments.

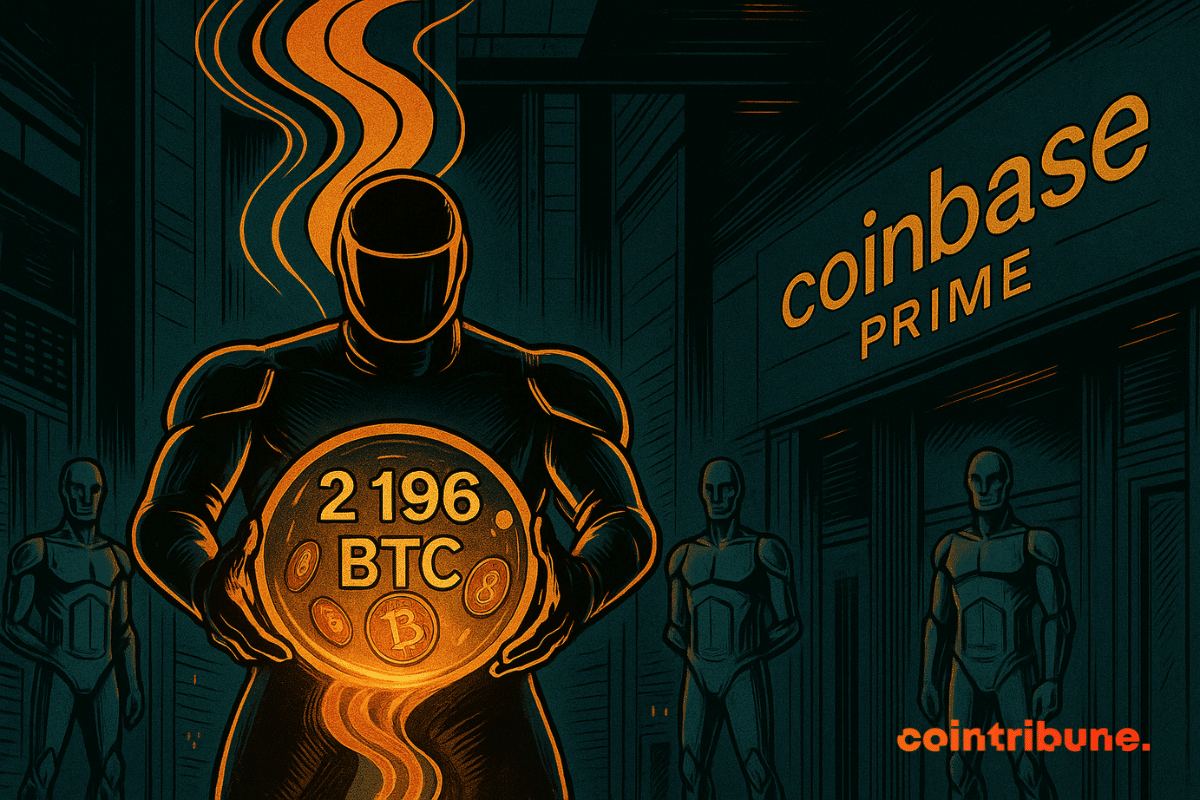

BlackRock transfers 2,196 BTC to Coinbase Prime. A decision that could shake the Bitcoin market. Details here!

Most casual users lose on prediction markets, while well-informed traders pull ahead, amid suspicions of insider activity and platform bug issues.

Polymarket has entered a new phase of expansion as its US relaunch begins after years away from the domestic market. According to recent reports, the platform is moving quickly to bring waitlisted users into its updated app, starting with sports event contracts. Regulatory clearance arrived earlier this year, opening the door for a compliant return.

BitMine buys $70M of Ethereum in 3 days. Supercycle coming? Discover all the details of this massive operation.

Kalshi is pushing prediction markets further into the crypto space as global demand accelerates. Rising interest in event-based trading has prompted the platform to tokenize event contracts on Solana, giving users more in sensitive markets. Analysts say this shift could position Kalshi to challenge competitors and keep pace with the industry’s rapid growth.

Seven Kalshi users have filed a class action lawsuit, alleging the platform operates like unlicensed sports betting, while the co-founder denies the claims.

Bitcoin crash: Strategy reassures investors with a 70-year plan. New era or last gasp? Analysis of a risky bet.

Massive cash-out: Pump.fun withdraws $436M in crypto and triggers a shockwave on Solana. All the details in this article.

The American startup Kalshi has just completed a colossal funding round of one billion dollars, bringing its valuation to 11 billion dollars. This operation reflects the massive enthusiasm of investors for prediction markets, a sector in full swing. But will it be able to dethrone its crypto rival Polymarket?

Bitcoin ETFs are attracting capital again: simple rebound or bearish trap? We deliver the details in this article.

Trading activity on crypto-based forecasting platforms has climbed sharply this year, with services like Kalshi and Polymarket seeing noticeable growth. Amid this upward trend, Coinbase appears to be building its own prediction-market site. Images shared by a tech researcher suggest the project is already taking shape and may involve support from Kalshi.