Retired NBA star Scottie Pippen is encouraging everyone to learn about Bitcoin. Experts and recent data show the cryptocurrency’s growing strength and possible price gains ahead.

Technical Analysis/Trend Analysis (TA)

Dogecoin is showing strong signs of a potential rally. With rising whale activity, breakout from key technical patterns, and growing investor interest, analysts are setting their sights on $0.40 and beyond as momentum builds.

Since its last rebound, bitcoin has been in a consolidation phase for the past two weeks. Find Elyfe's analysis to decipher the technical perspectives of BTC.

Bitcoin (BTC) continues to test traders' patience as its price stagnates below the $100,000 mark. Between potential bullish pressure and signs of weakness in the markets, here are the 5 key elements to watch this week.

Drop, liquidation, and rebound: Bitcoin stabilizes above $95,000 while whales strengthen their strategic position.

If the correlation between bitcoin and Ethereum remains high, the cyclicity of the Ethereum price seems to act with as much precision in the structure of this bullish market. Decrypting the indicators and the dynamics of the Ethereum price.

Ethereum crypto: on-chain and technical indicators suggest the imminent arrival of a significant bullish wave.

The leading cryptocurrency is back in the zone around $30k, while maintaining relatively low volatility. US inflation figures on Thursday could bring more movement on bitcoin (BTC). Is the current uptrend likely to continue?

Yesterday's release of the US inflation rate suggests an imminent rise for the queen of cryptos. Bitcoin (BTC) seems headed inevitably for $50,000.

Recent news seems favorable for cryptos. Indeed, a former SEC official's opinion that the Bitcoin ETF should be approved is seen as positive for the crypto market. Is the next Bitcoin (BTC) bull-run imminent?

With the US CPI due for release on July 12, Bitcoin (BTC) and Ether (ETH) are stabilizing, raising investor expectations. The previous month, these two cryptocurrencies soared in response to this economic indicator. Could this trend be repeated this month?

BTC continues to hold in the $30,000 to $31,000 range. Large investors seem to remain optimistic and continue to accumulate. The long-term price trend for bitcoin (BTC) remains bullish, although a new DIP cannot be ruled out. Short-term selling could be attractive.

Ether (ETH) could get off to an explosive bullish start this month, in a context that seems favorable to a bullish recovery. If confirmed, this crypto could reach $2500.

According to this crypto analyst, bitcoin (BTC) could see an explosion in value in July. He points to a pattern reminiscent of the asset's price structure in 2020. Departing from the traditional four-year cycle theory, this analyst sees things from a different angle. But only time will tell if this month will be as fruitful as November 2020 for BTC.

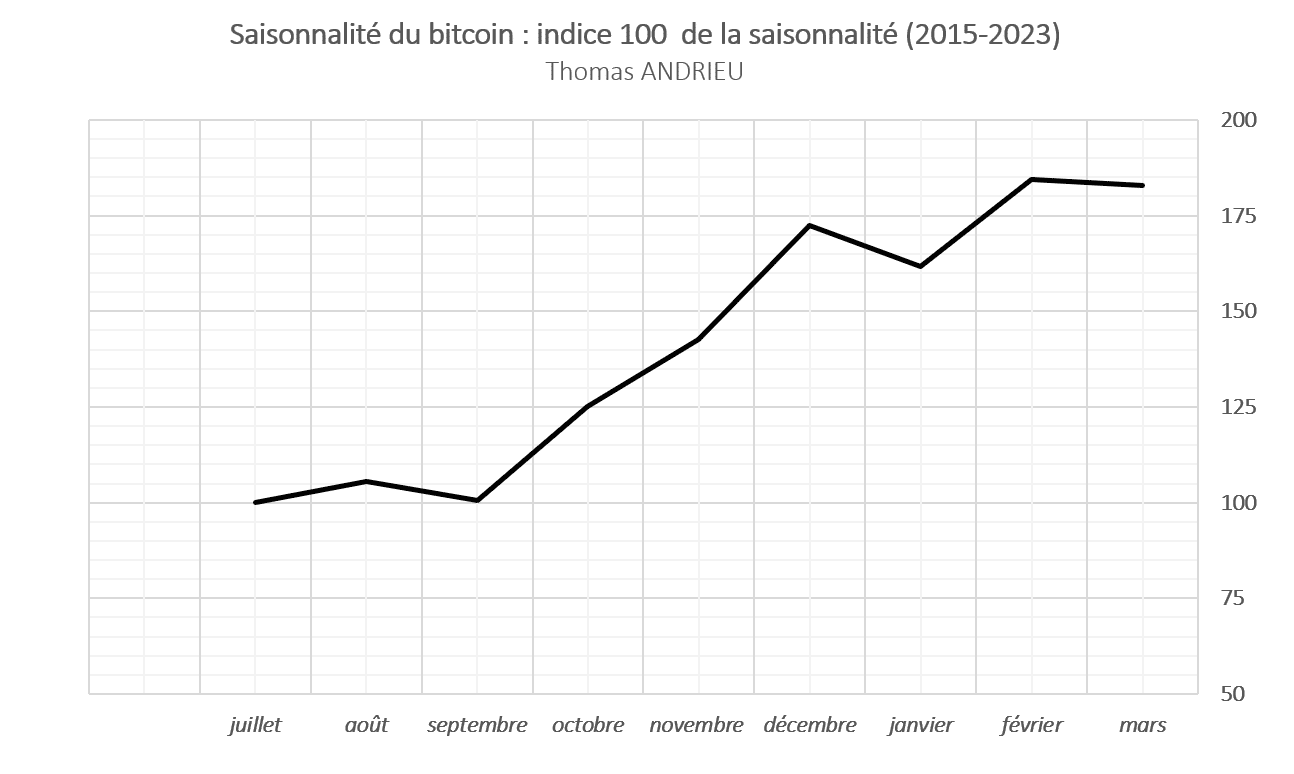

Is seasonality a myth? In this article, we will attempt to give an ideal overview of bitcoin's comparative behavior since 2015. We'll focus on monthly performance, effectively excluding shorter variations. The study of seasonality thus shows that October, February and July are generally the most reliable and best-performing months. Will this be the case in the coming months?

After a week of consolidation, bitcoin (BTC) is at a decisive point. Bullish indicators suggest that the 25% rise could continue. Nevertheless, it's important for investors to be cautious, as a decline is also a possibility.

Ether (ETH) stabilizes around $1850, potentially offering a buying opportunity. The uptrend could indeed continue in a context favorable to cryptos.

Binance étant au cœur des polémiques liées aux attaques du régulateur Américain, le cours du Binance coin (BNB) en a littéralement payé les frais.

The crypto market saw a significant rise on Friday, mainly thanks to a positive announcement from BlackRock. Bitcoin (BTC), one of the big winners following this news, recorded a 6.7% rise, which could signal a resumption of the bull-run.