"Blockchain technology has the potential to revolutionize the way we conduct business and exchange value."

une

In the world of cryptocurrencies, highs and lows follow each other, leaving investors in a whirlwind of emotions. Just as we celebrated the peaks reached by Bitcoin, the cryptographic market plunges once again into the abyss of red.

In a context where Bitcoin has surpassed its previous 2021 high, the price of gold also reached an unprecedented level on March 5, hitting $2,140 per ounce. This 4.97% increase in a week for the global safe haven asset is sounding the alarm about a possible excessive easing of monetary policy.

Bitcoin (BTC) is on fire and Bitcoin Spot ETFs as well. Yesterday, the flagship cryptocurrency reached its highest price level since its previous 2021 record. Meanwhile, the Bitcoin Spot ETF market has demonstrated remarkable performance in daily transactions.

Discover the three cryptos that defy market trends and offer promising opportunities to savvy investors

After months of growth, Bitcoin has just reached its ATH of $69,000! Reaching a new peak that raises hopes and concerns

In an era where blockchain technology and cryptocurrencies are redefining the boundaries of global finance, the BRICS are positioning themselves as pioneers of radical change. With the announcement of an innovative payment system, these emerging powers challenging the hegemony of the US dollar are outlining the contours of a new global economic order based on inclusivity, security, and the speed of financial transactions.

According to Markus Thielen, Bitcoin is about to experience a spectacular surge that will surprise everyone this week!

Blast, a layer 2 scaling solution for Ethereum, has just experienced a new development. It has joined the Web 3.0 wallet of the crypto exchange Binance. A development that promises significant impacts, especially in terms of user experience.

The past week has been particularly rich in major developments for the crypto sector. From the imminent Bitcoin halving that promises to reshape the mining landscape to the announcement of the successful deployment of the Dencun upgrade on Ethereum's testnets, along with Binance's asset recovery initiatives and Ripple's legal challenges, each event carries the potential to redefine the future of the crypto market. This article provides an overview of the most significant news and gives you an essential insight to understand current dynamics and anticipate future movements in the crypto space.

Bitcoin breaks boundaries with a 3.97 MB block, paving the way for major advancements in the cryptosphere.

In a universe where volatility reigns supreme, Solana (SOL) stands out with a stunning growth, reaching an unmatched peak for 23 months. This surge of over 30% in just one week has sparked both confidence and curiosity within the cryptocurrency community. This article explores the dynamics underlying this spectacular rise and highlights the key factors and implications for the future of Solana and the crypto market as a whole.

Nexity's CEO reveals the challenges facing an unprecedented crisis, involving a quick adaptation to turn the situation around.

The web giant Microsoft is betting on artificial intelligence (AI) through Copilot. This AI tool that it has developed has just made a major breakthrough by integrating services typically dedicated to finance.

As it tries to get back on its feet after the legal troubles that have cost a lot, the crypto exchange Binance is facing new regulatory challenges. This time, the problems come from Nigeria where authorities are criticizing the potential influence of the platform on the country's economy, causing concerns among local traders.

Bitcoin, the cryptocurrency that has, over the years, shaken the very foundations of the traditional financial market, finds itself today at a decisive crossroads. After flirting with the $59,000 mark, stirring near-unanimous excitement among investors, the time has come for reflection: is this meteoric rise a prelude to an equally spectacular fall?

Propelled by the success of Bitcoin ETFs, Jim Cramer makes a surprising prediction about the future of Ethereum ETFs!

According to latest reports, MicroStrategy's investments in bitcoin (BTC) are proving to be very profitable. Despite some suggestions, the company seems determined not to cash out these profits. On the contrary, it is doubling down on its acquisition strategy as evidenced by MicroStrategy's recent significant purchases of bitcoins. This is happening as the price of the leading cryptocurrency continues its remarkable surge.

Three crypto assets coming out of nowhere causing an unprecedented shockwave in the market in 2024!

The Ethereum Foundation has just announced the official launch of the Dencun upgrade on the testnets!

Bitcoin (BTC) is not the only one attracting attention from the crypto community. Several cash-settled ETFs linked to the leading crypto are also gaining traction through their trading volumes. In the past 24 hours, they have seen a remarkable surge. Here is exactly what happened.

The recent Ethereum rally rekindles interest in the altcoin market, according to Bitfinex analysts. The crypto star could be paving the way for a new altcoin season.

Bitcoin continues to reach new highs, reaching $57,000. Let's examine together the future prospects of BTC price.

The crypto firm Ripple has not yet ended its legal battle with the SEC when another lawsuit could involve it. Ripple is accused by individuals and companies of "illegally" selling them XRP. Here is what is specifically at issue in the context of what appears to be a class action lawsuit.

Satoshi Nakamoto, creator of Bitcoin, joins the top 25 richest in 2024, illustrating the spectacular rise of BTC.

The revelations about Ripple are emerging as XRP struggles to regain its value and momentum.

Paris Saint-Germain makes a noteworthy entry into the blockchain space by becoming the first football club to validate a network

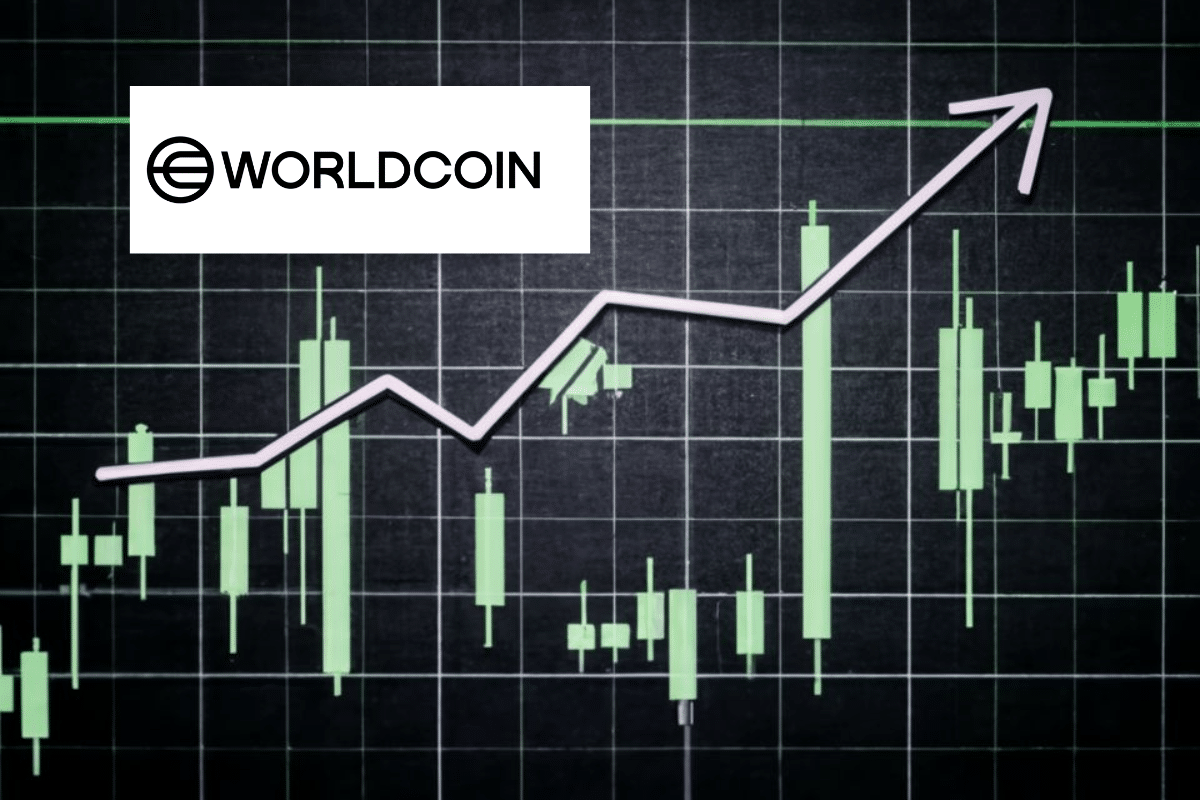

Worldcoin, the innovative crypto project that offers WLD in exchange for an iris scan, is a huge success. Details in this article.

Artificial intelligence is transforming the blockchain! In-depth exploration of high-potential cryptocurrencies in this future field

The financial ecosystem is experiencing a new trend involving baby boomers. This class of investors born between 1943 and 1965 is losing interest in gold. Now, they are turning to Bitcoin Spot ETFs. This dynamic raises questions for many financial market analysts. Historically, gold is considered an asset that secures wealth against financial risks such as inflation. From this perspective, this evolution represents a significant change in the investment preferences of this cohort of investors. What factors are driving this transition and what are the implications for the future of investments? In this article, we provide an analysis on this issue.