The blockchain technology has the potential to revolutionize numerous industries.

une

The Bitcoin ETF market exploded in 2024, generating record daily volumes surpassing $2 billion!

Bitcoin continues to astonish. Far from following the rules laid down by economists and financial analysts, it prefers to carve out its own path, demonstrating resilience and strength that leave skeptics speechless.

Russian bitcoin miners are on track to overtake China with 12% of the global hashrate.

Sora, OpenAI's text-to-video AI, propels AI cryptocurrencies that see their numbers rise following the announcement.

The Bitcoin ETFs are breaking all records despite the outflows from the GBTC ETF, which could soon intensify due to sales from the Gemini exchange.

Vitalik Buterin, the co-founder of Ethereum, the world's second-largest blockchain, expressed enthusiasm for the advancements of "Verkle trees" on the network. This groundbreaking technology is shaping up to revolutionize staking on Ethereum.

Bitcoin is the most significant monetary innovation since the invention of currency. In this article, Edward Snowden explains why.

The year 2024 is distinguished by significant developments in the cryptocurrency sector. Between Bitcoin's halving, Ripple's expansion in crypto custody, and strategic collaborations such as Solana and Filecoin, the crypto landscape is experiencing unprecedented dynamics. These developments, along with Bitcoin's rise in the global asset rankings and increased commitment from Ethereum, as well as calls for appropriate regulation of Bitcoin ETFs by U.S. banks, reflect a growing maturity and integration of cryptocurrencies into the global financial system. Here is a summary of the most notable news from the past week.

Is the current regulation on Bitcoin ETFs on the verge of a major revision? This is what a group of American banks wishes, as they recently invited the SEC president to review certain measures on the regulation of these assets. Details in the following article.

Driven by blockchain technology, ICP HUBS bring together the talents who are reshaping global collaboration around technological innovation.

Hold on tight, the king of cryptos is about to erupt. Destination: shatter its all-time high of $64,100 achieved in 2021!

"Will Nigeria have the courage to de-dollarize in order to join the BRICS?"

Ripple (XRP) investors have hope as the crypto shows signs of recovery after a long bearish period.

The Total Value Locked (TVL) in the context of decentralized finance (DeFi) defines the total value of assets locked in DeFi protocols and smart contracts. In other words, it measures the total amount of locked and utilized cryptocurrencies in various decentralized financial services, including liquidity pools, borrowing and lending protocols, decentralized exchange (DEX) platforms, among others. TVL is often seen as an indicator of the popularity and adoption of different DeFi protocols. It acts as a barometer of this crypto ecosystem. Indeed, according to recent data, the TVL of DeFi is in its best shape thanks to the dynamism of Ethereum. This article explains the ins and outs of this trend.

Bitcoin has just reached a historical record against the yen, Japan's currency. This is also the case in nearly twenty other countries.

Stock Market: Alphabet and Amazon Could Follow Meta's Lead and Announce Their First Dividends This Year, According to Goldman Sachs.

Attract the best Web3 projects through a state-of-the-art incubator! Lugano's winning strategy to become the Swiss crypto capital

In the particularly thriving context of the crypto market lately, choosing wisely to position oneself on Bitcoin or Ethereum can be quite a dilemma. These two crypto ecosystems are market leaders. But they are distinct from each other in terms of functionalities and advantages. Understanding this divergence can be crucial for crypto investment choices.

Exactly one year ago, the price of bitcoin (BTC) was around $20,000. Throughout the year 2023, the flagship cryptocurrency made headlines for its remarkable dynamism despite the ups and downs. Today, the asset is valued at over $50,000. A level it had not reached since December 2021. The surge of BTC to reach this level is from this point of view a major event for the crypto industry, whose resurgence in 2024 has been announced by a panel of experts. But how can we reasonably explain that in the space of a week, BTC has increased its valuation by 19% to currently trade around $51,600? This article will provide you with some answers.

Despite the legal challenges it is involved in, the crypto firm Ripple wants to expand its operational scope. Latest news has it that the company wants to venture into the crypto custody segment. The company still needs to obtain regulatory approval.

A unique alignment of technical and fundamental factors could propel Bitcoin to $100,000 in 2024!

""" You are translator in the blockchain field """

Ledger and Coinbase have announced a strategic partnership to integrate #CoinbasePay into the #LedgerLive application.

Bitcoin has just regained $50,000 for the first time since 2021 in a much more favorable context than before.

While Bitcoin dominates media attention, institutions are quietly turning to altcoins Ethereum and Cardano!

"Wall Street loves bitcoin. They are buying 12.5 times more bitcoins per day than the network can produce," astutely notes crypto trader Pomp on Twitter. According to him, daily acquisitions far exceed the network's production, reaching up to 12.5 times more. For Michael Saylor of MicroStrategy, Bitcoin spot ETFs have played a crucial role in popularizing cryptocurrency, thus propelling its price to new heights.

While the date of his conviction is postponed to April 30, the future of Binance founder Changpeng Zhao is uncertain!

ETF Bitcoin has generated a lot of excitement in recent weeks, but a sharp reversal could occur!

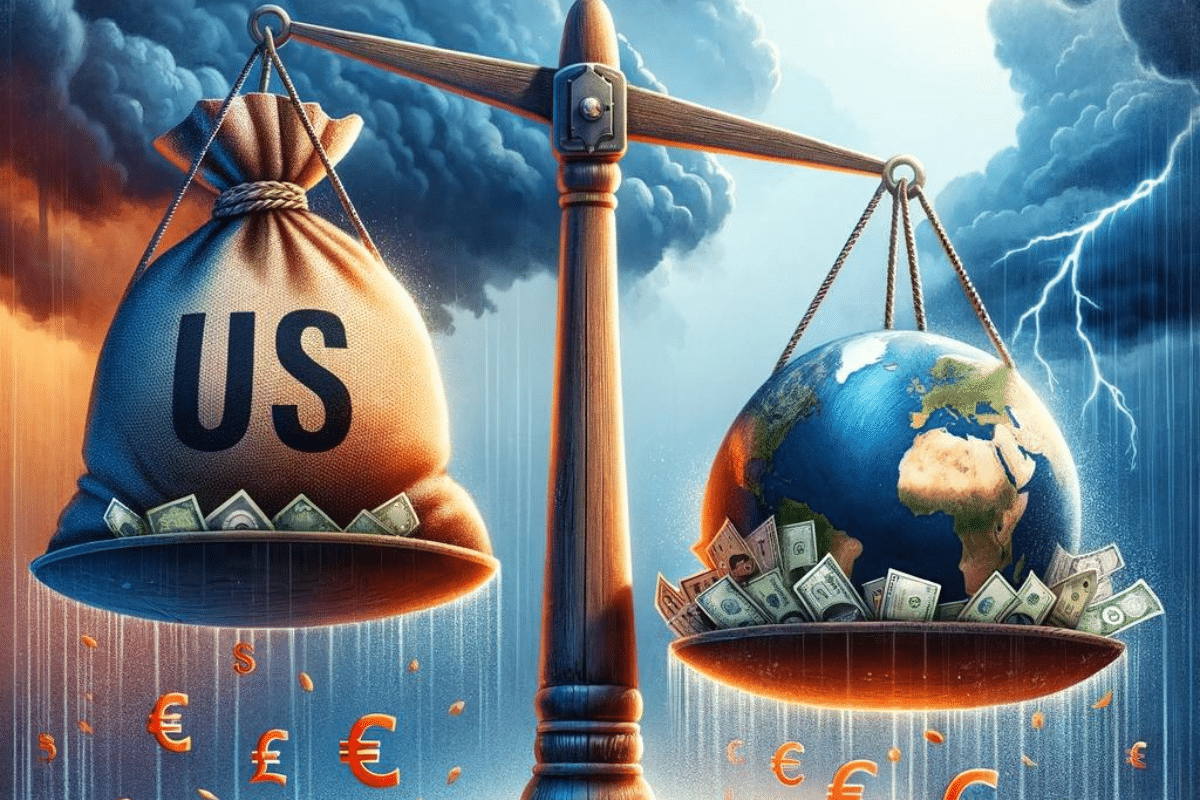

The alarming rise in US debt threatens global economic stability, with insights on BRICS.