While the old hands cash in their winnings, Bitcoin is performing acrobatics: it wobbles, balances, and might even leap. The suspense continues, hats off to the moles.

Volatility

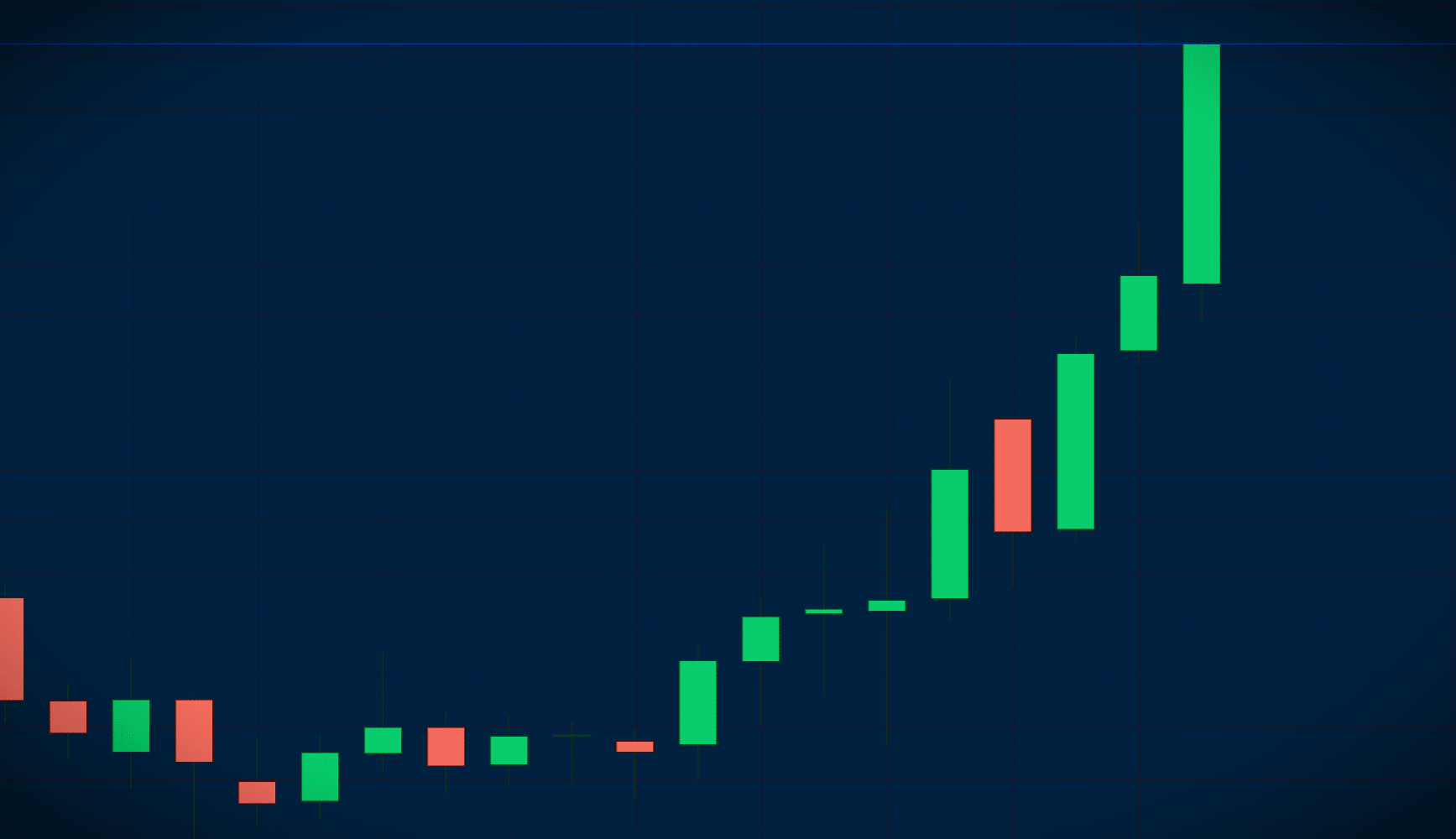

In a crypto market where volatility is the norm, Bitcoin has just reached an unexpected milestone. It is now less unstable than the S&P 500 and the Nasdaq. This discreet yet significant shift, revealed by Galaxy Digital, challenges a decade of perception of an asset deemed too risky for traditional portfolios. More than just a technical indicator, this signal could mark a lasting status change for the first cryptocurrency.

Regulatory shock for crypto: insurers ordered to fully cover their risks. We provide you with the details in this article.

Popular in words, forgotten in actions: bitcoin fascinates but does not convince. 4% of the earth's population believes in it, the others watch, perplexed, this digital gold without bars.

The extreme volatility of Bitcoin is resurfacing, fueled by a cocktail of economic uncertainties and government initiatives in the United States. As the crypto market tries to stabilize after a high-tension start to the year, the price of BTC is experiencing violent fluctuations. Within a few days, it peaked at $93,000 before plunging sharply below the $82,000 mark. This dynamic reflects the nervousness of investors in light of two major announcements: the imposition of a 25% tariff by the United States on Canada and Mexico, and Washington's ambition to create a national crypto reserve.

Oklahoma, a pioneer of the Bitcoin revolution, has taken a crucial step by validating its strategic reserve project. However, the enthusiasm is far from being shared by all states. A new war begins.

Bitcoin, the unalterable rock of the market, watches the altcoins sink under the weight of sales. Uncertainty looms, the suspense rises: bullish explosion or abyssal fall?

Between a double peak and a guaranteed plunge, Bitcoin drifts, while Ethereum, a shipwreck of altcoins, sinks into the murky waters of a declining market.

Bitcoin, the tightrope walker of the crypto market, is tightening its margins. A surge of 40% like in 2023 looms in the shadows.

Under the spotlight of speculation, memecoins attract and terrify. Solana leads the dance, Coinbase follows, while traders oscillate between golden dreams and cold sweats.

Eclipsed by a cautious market, Bitcoin finds its way between fears and ambitions. Hidden data whispers: patience before the explosion, as every peak conceals the next challenge.

Bitcoin: when the small players cash in big and the veterans watch, the spectacle is always fascinating.

With its epic breath, Bitcoin tightrope walks on the $100,000 line, ready to tip over.

The Bitcoin pot is bubbling: from record open interest to price surges, crypto is dancing on a volcano!

Millennials? Always fully invested in crypto, treating themselves to a little ETF to cushion the digital shocks!

A documentary digs beneath Nakamoto's mask: Satoshi revealed or just a publicity stunt? The mystery continues.

Bitcoin is frowning: with 8.1 billion options weighing it down, it could take a plunge!

Freefall for Bitcoin and Ethereum: blame it on Japanese interest rates. Other economic events could worsen the situation.

Are you worried about the post-ATH drop in Bitcoin? Explore proven methods to protect and optimize your crypto portfolio.

Recently, the leading cryptocurrency has displayed a considerably low level of volatility. This contrasts with its generally volatile nature relative to other assets. However, some traders and analysts see this low volatility as a precursor to a possible explosive rise in Bitcoin (BTC).

Volatility, an emblematic feature of Bitcoin, seems to be experiencing unusual days. The cryptoasset so well known for its erratic movements is currently displaying lower volatility than even the S&P 500, technology stocks and even gold. A surprising phenomenon, but what is it really hiding? Could it be the calm before the storm?

Volatility is a peculiar topic in the world of finance, and even more so in the world of cryptocurrencies. Indeed, volatility can be analyzed from two perspectives. On one hand, it allows us to measure the likely variations of an asset and, in some cases, anticipate its movements. On the other hand, the overall volatility of assets reveals which ones truly benefit from periods of tension. In this article, we will focus on a historical volatility approach.