Bitcoin's momentum tested: Crypto Analysis of April 9, 2024

Bitcoin rebounds after starting April on a downturn. Let’s analyze the future prospects for the BTC price together.

Bitcoin (BTC) Situation

While Bitcoin faced selling pressure in the early days of April, the leading cryptocurrency’s price has recovered after hitting a new low at $64,500. Indeed, it reached $72,000 this Monday. This price level seems to have acted as resistance, with BTC struggling to surpass it. In fact, this Tuesday morning, the Bitcoin price fell back below the previous resistance level identified at $71,270. At the time of writing, Bitcoin is trading around $70,000.

Bitcoin is holding slightly above the value zone located around $69,800, which could serve as support. Overall, Bitcoin’s trend remains bullish, as evidenced by the 50 and 200-day moving averages. Regarding market dynamics, a slight rebound is observed, though it is not yet significant, as indicated by the oscillators. This phenomenon could prove harmful in the long term.

The current technical analysis has been conducted in collaboration with Elie FT, an investor and passionate trader in the cryptocurrency market. Now a trainer with Family Trading, a community of thousands of proprietary traders active since 2017. You will find live sessions, educational content, and peer support around financial markets in a professional and warm atmosphere.

Focus on Derivatives (BTCUSDT)

The open interest in BTC/USDT contracts has followed the direction of its price. Indeed, we can see that they increased before slightly decreasing this Tuesday, April 9th in the morning. It is interesting to note that the majority of the liquidations have recently been of short positions. Coupled with a subtle increase in the funding rate, this indicates that the interest in Bitcoin perpetual contracts has recently been predominantly on the buy side.

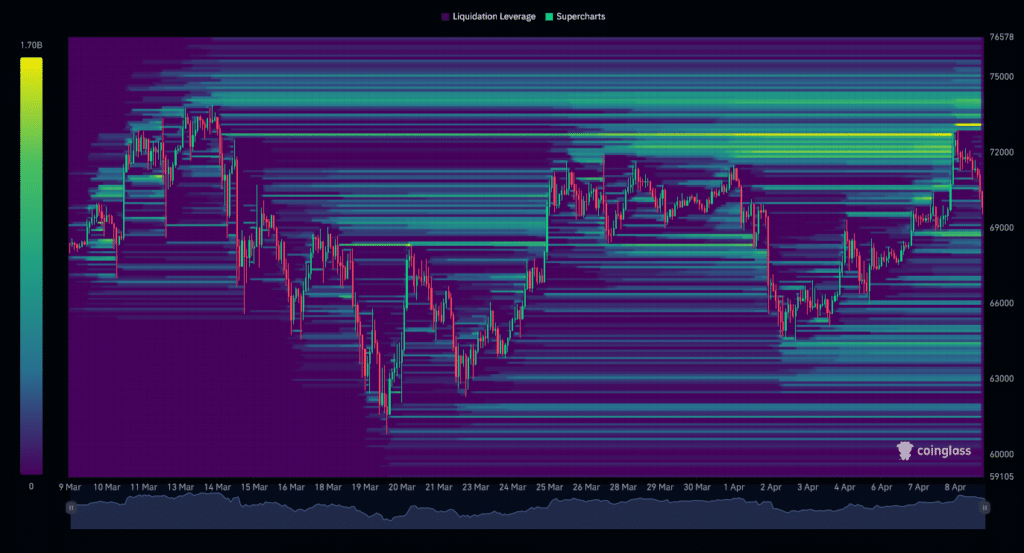

The liquidation heat map of the past month indicates that BTC/USDT has gone through a significant liquidation area, located around $72,000. Currently, the Bitcoin price seems to show selling interest at this level, marking a slight distribution phase. At present, the most significant liquidation zone above the current price is in a price range between $73,000 and $75,000. Below the current price, the notable levels are $69,000 and further down, $64,500. If the market approaches these levels, we could witness a massive triggering of orders, potentially increasing the cryptocurrency’s volatility. These zones, therefore, represent a major point of interest for investors.

Hypotheses for the Bitcoin (BTC) Price

- If the Bitcoin price manages to hold above $69,000, we could anticipate a bullish continuation up to the $73,000 level. The next resistance to consider, if the bullish movement continues, would be $74,000 or even $75,000 and beyond. At this point, it would represent an increase of over 7%.

- If the Bitcoin price fails to hold above $69,000, we might expect buyer support around $67,000. The next level to consider, if the bearish movement continues, would be in a price range around $64,000 and $63,000. At that stage, it would represent a drop of nearly -9%.

Conclusion

In the face of early April’s turbulence, Bitcoin shows a bullish trend supported by signs of resilience above key support levels. Despite the immediate challenges, it seems likely that buyers predominate the market. Nevertheless, it will be crucial to closely observe the price reaction at different key levels to confirm or invalidate the current hypotheses. It is also important to remain vigilant of potential “fake outs” and market “squeezes” in each scenario. Finally, let’s remember that these analyses are based solely on technical criteria and that cryptocurrency prices can evolve rapidly due to other more fundamental factors.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Family Trading est une Communauté de traders a compte propre active depuis 2017 offrant Lives, contenus éducatifs et entraides autour des marchés financiers dont celui des cryptomonnaies avec à ses côtés Elie FT, investisseur et trader de passion sur le marché crypto.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more