Crypto: Alameda Pulling the Strings? Solana's Secret Centralization Revealed!

Controversy is brewing in the Solana ecosystem, fueled by allegations that the Solana Foundation and Alameda Research are heavily subsidizing the network’s validators. The debate is crystallizing around the impact of these subsidies on the decentralization and sustainability of SOL, Solana’s native crypto.

Massive subsidies to SOL Validators raise questions about crypto-centralization

Solana, a blockchain known for its speed and direct competition with Ethereum, finds itself at the heart of a debate linked to the substantial subsidy of its validators by the Solana Foundation and Alameda Research, the defunct commercial arm associated with FTX.

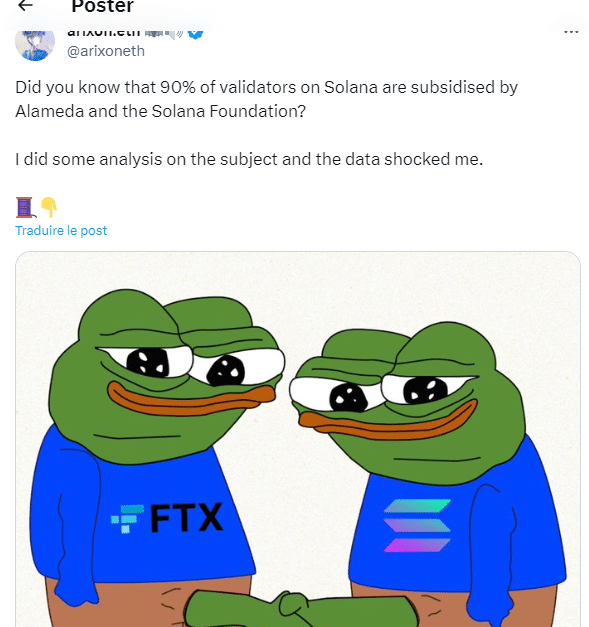

According to analyst arixon.eth, over 90% of Solana’s validators benefit from massive subsidies from the Solana Foundation and Alameda Research. At first glance, these figures are alarming: out of 1,997 validators, 1,818 are said to have received delegations from these two entities. In total, they delegated 106 million SOL, of which 73 million were distributed by the Foundation and 33 million by Alameda Research.

Validators play an essential role in Solana’s blockchain. They are responsible for validating transactions and adding them to the blockchain. To ensure the network’s security and decentralization, each node must store SOL, and this amount of SOL determines their voting power.

The scale of these subsidies raises questions about the centralization of power within the blockchain. Arixon.eth suggests that without these “heavy incentives”, the number of Solana validator nodes would be much lower.

More worryingly, a notable number of nodes seem to be left behind, without delegations from the standard SOL holders, raising the question of the disproportionate influence of two entities on the network.

In highlighting these considerable subsidies, arixon.eth warns of the risk of Solana’s centralization under the hegemony of two predominant players. This, it argues, could potentially undermine the long-term value of SOLs and pose a critical dilemma for the decentralized robustness of the network.

Funding for stability or manipulation?

Faced with these allegations, Anatoly Yakovenko, co-founder of Solana, stepped in to clarify the situation. According to him, although some 2,000 validators secure the network, it is their votes, and not their respective participation, that are essential to the network’s security and stability.

Every time a node withdraws from SOL, its voting power diminishes, forcing the network to rely on other validators to maintain decentralization and security.

The question of centralization is a hot topic in the crypto world. While Solana benefits from substantial funding from two major entities, this raises legitimate questions about the network’s true decentralization.

However, one question remains: can the current model, criticized for its tendency towards centralization, ensure the network’s long-term stability and security, or does the Solana blockchain need to revise its delegation strategy to preserve the integrity of its decentralized architecture?

The revelation of exorbitant subsidies to validators is prompting the crypto community to re-examine blockchain governance structures and business models, and to question the delicate balance between incentives and decentralization.

Maximize your Cointribune experience with our 'Read to Earn' program! Earn points for each article you read and gain access to exclusive rewards. Sign up now and start accruing benefits.

Click here to join 'Read to Earn' and turn your passion for crypto into rewards!

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.