ETF Bitcoin Spot: Historic milestone reached with 500,000 BTC accumulated

After just over fifty days of activity, it’s time to assess Bitcoin ETFs. Although the timing may not seem ideal, the recent decrease in outflows at Grayscale has not gone unnoticed. What’s the turn of events ?

Bitcoin ETFs: A Meteoric Rise

Since the US Securities and Exchange Commission approved BlackRock, Fidelity, VanEck, Grayscale, and others’ Bitcoin Spot Exchange Traded Funds (ETF), 54 days have elapsed. Noteworthy for the crypto community are Larry Fink’s company’s enthusiasm for acquiring Bitcoin and the significant outflows from Grayscale’s GBTC. The cryptocurrency market has been deeply affected.

Since January 10, the nine new spot bitcoin exchange-traded funds have accumulated over 500,000 bitcoins, representing 2.54% of the total bitcoin supply – 21 million. Their success continues unabated, with a recent inflow day where they collected $287.7 million in bitcoins, emphasizes Cointelegraph.

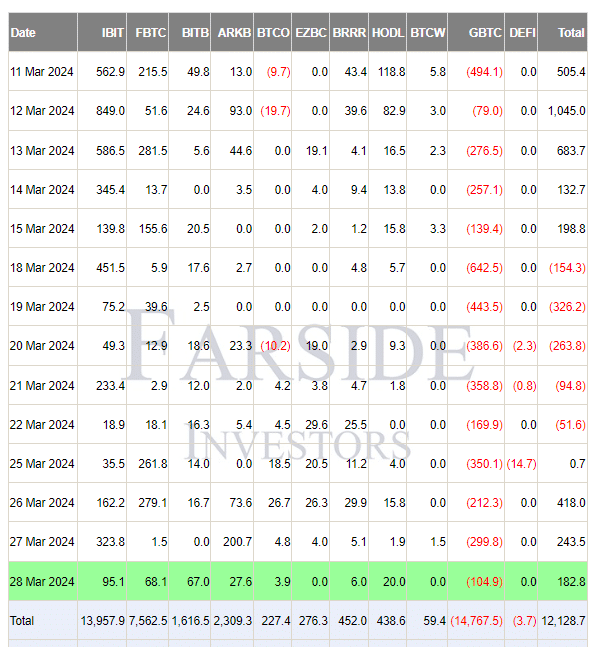

According to Farside Investors, the current value of the bitcoins held by these nine ETFs is $35 billion, in just 54 days of trading. Including Grayscale, American spot bitcoin funds now control 835,000 BTC, representing nearly 4% of the global supply. This rise to power in the world of cryptocurrencies leaves no one indifferent, attracting the interest and attention of investors worldwide.

Massive Inflows into Bitcoin ETFs After a Tumultuous Period

After several weeks of outflows, Bitcoin ETFs are regaining their appeal with entries valued at $845 million this week. A significant turnaround since March 18th.

On March 28th, a total inflow of $183 million was recorded, with BlackRock standing out with $95 million of inflows for its IBIT fund.

Fidelity and Bitwise also benefited from this trend, with similar inflows of about $67 million each. Ark 21Shares, meanwhile, saw an inflow of $27.6 million after a massive entry of $200 million on Wednesday.

However, Grayscale has not been as fortunate, registering outflows of $105 million from its GBTC, the lowest level since March 12th.

Ethereum Spot ETFs under High Tension: Uncertainties and Hopes

ETF analyst Eric Balchunas expresses pessimism regarding the approval of ETH ETFs in May, giving only a 25% chance, or possibly less. With seven weeks to go until the deadline, SEC’s silence is concerning.

However, according to My Betting Edge, the outlook is radically different with an estimated 85% chance of SEC approval of Ethereum Spot ETFs in May.

This possible approval would mark a crucial moment for Ethereum and the entire cryptocurrency market, with high stakes and oscillating hopes.

Noting that Bitwise, hoping to put pressure on the SEC, filed an S-1 application for its Ethereum Spot ETF on March 28th, thus reinforcing the momentum of the cryptocurrency market.

Maximize your Cointribune experience with our 'Read to Earn' program! Earn points for each article you read and gain access to exclusive rewards. Sign up now and start accruing benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.