Accusations against SBF, the former CEO of crypto exchange FTX, continue to make headlines. And one thing is certain, the case won't calm down anytime soon, especially when Michael Lewis adds fuel to the fire. According to his statements, it seems that the relationship between Binance and FTX has never been smooth. Why?

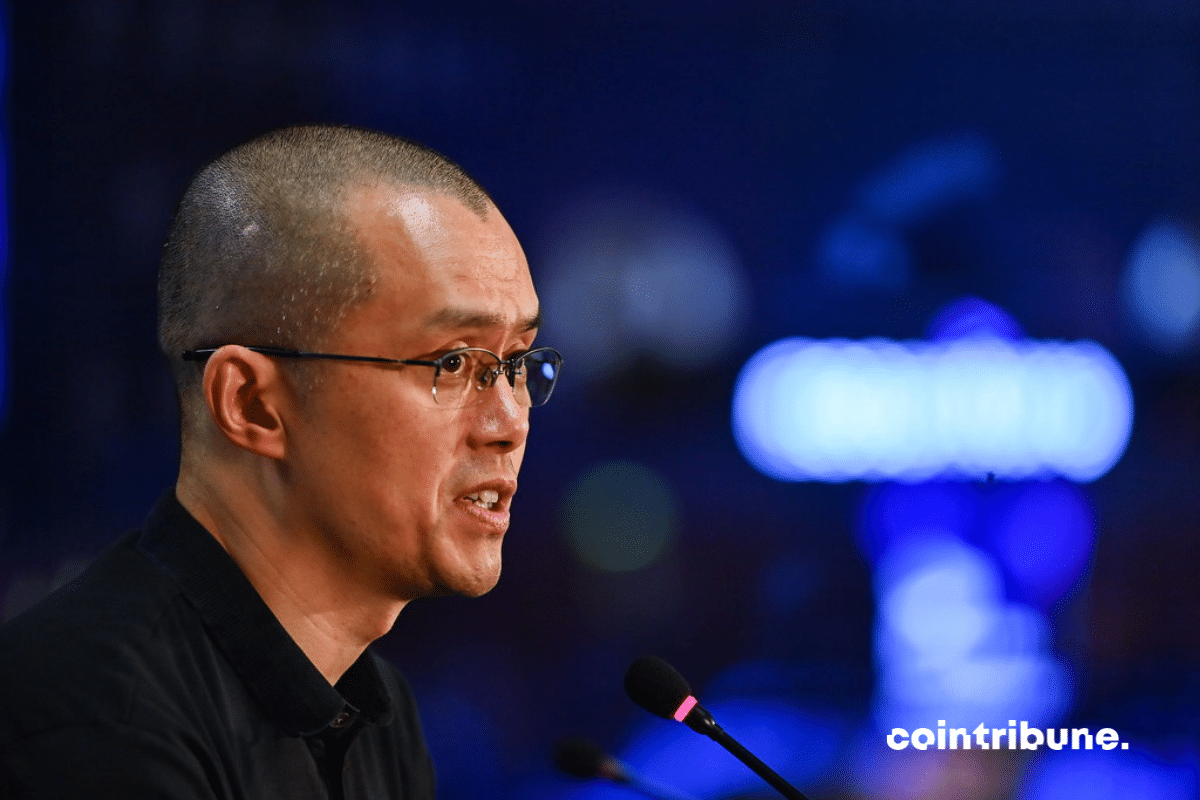

Changpeng Zhao (CZ)

Before November 2022, no one expected the American crypto exchange FTX, valued at over $32 billion, to meet such a tragic end. Colossal losses for the company, its creditors, and its founder Sam Bankman-Fried, investments worth thousands, if not hundreds of thousands, of dollars lost for its creditors (including individuals and institutions), plummeting cryptocurrency prices (Bitcoin, Ethereum, etc.). The toll is heavy. Now that the fallen young CEO of FTX is summoned to court to answer for his actions, we share some details that will send shivers down your spine.

An expert recently insinuated that the Binance exchange may have contributed to the downfall of the high-profile FTX exchange, a story that has been making headlines. This allegation has sent shockwaves through the crypto community, prompting responses from John Deaton, Ripple's lawyer, and Changpeng Zhao (CZ), the founder of Binance.

Did Binance exacerbate the situation as FTX showed signs of fragility? That's what Nir Lahav and his group believe, and they didn't hesitate to file a class-action lawsuit accusing CZ and Binance of contributing to their competitor's downfall through their November tweets.

It's truly the end! Binance and PaySafe are now heading in opposite directions. But after the contract expiration, the cryptocurrency giant is struggling to find new banking partners in France. However, it appears that the crypto exchange may have found a solution to its problems.

No, it's not over yet! The ongoing dispute between Binance and the SEC seems far from reaching a resolution. However, it appears that BAM Trading and BAM Management, two entities of the crypto company, have been granted an extension to respond to court orders.

Tourmentée par des dizaines de milliers de sanctions infligées par l’Occident, la Russie, bourreau de l’Ukraine, n’a de choix que de se tourner vers les cryptomonnaies et les technologies connexes. Rouble numérique, plateforme nationale d’échange de devises numériques, DAO… forment actuellement un bouquet d’alternatives pour rehausser une économie russe en plein plongeon. Sauf que les États-Unis n’ont pas l’intention de lui faciliter les choses, même avec les cryptos. Washington n’hésiterait pas à faire pression sur Binance pour couper le pont entre les Russes et les actifs numériques. Détails !

With over 100 million users, Binance easily claims the title of the world's largest cryptocurrency exchange. If CZ's exchange were to fall victim to the initiatives of U.S. regulators, others (Kraken, Coinbase, and the like) would melt away like snow in the sun. And apparently, the U.S. Department of Justice is preparing to launch an assault on this crypto behemoth with feet of clay.

Huobi Global and Binance are two prominent crypto companies. In the crypto industry, rivalries are not uncommon. However, Binance CEO CZ remains sportsmanlike in the face of comparisons and extends a hand to his counterpart Justin Sun as his exchange falls victim to a hack.

After complying with the FSMA's decision, the Belgian regulator for cryptocurrencies and finance, Binance had to suspend its activities in the country back in June. Three months later, the world's largest cryptocurrency exchange announces a triumphant return to Belgium. What has changed since then? Let's delve into it.

Recently, the CEO of Binance stepped up to defend his highly popular cryptocurrency exchange. According to the latest news, Changpeng Zhao, aided by Binance.US lawyers, has asked the court to dismiss the US SEC's lawsuits. Let's break it down!

Given its trajectory, the legal battle between Binance and the SEC is expected to persist, akin to the Ripple case. The Securities and Exchange Commission appears to have multiple strategies at its disposal, while Binance remains resolute. Recently, its CEO, Changpeng Zhao (CZ), defended his cryptocurrency exchange on X (formerly Twitter). Here are the key points:

Tether may have reassured the crypto community after a series of depegs in its stablecoin USDT this year, but its instability is a major concern. Early this morning, it was reported that the asset had fallen to a very low level, raising doubts about a Terra bis scenario. Let's take a look!

Tether (USDT) is the largest stablecoin currently on the markets. Present in the crypto ecosystem since 2014, its position is undeniable. However, USDT's lowest parity since the fall of FTX is being recorded, and this could be the work of Changpeng Zhao, CEO of Binance.

Binance, the world's largest crypto exchange platform, will be listing the very first digital dollar. For this occasion, find out everything there is to know about FDUSD, from its creator to how it works, and all the benefits the CZ-based company has to offer.

If Elon Musk continues with his unilateral, often controversial decisions, he may have to face more than just Mark Zuckerberg in the ring. CZ, who has been up in arms about his decision to limit the number of tweets users can access, wouldn't be afraid to face him either.

“We don't need more digital currencies,” said Gary Gensler on CNBC. Is this why the SEC is targeting both Binance and Coinbase, which have hundreds of millions of crypto investors? In any case, the heads of these exchanges declare that they will respond to the SEC's attacks.

The SEC has revealed a whole list of shitcoins that Binance should have registered as securities. What about Ethereum? And wash trading?

Binance is currently facing legal action brought by the SEC. The reason behind the lawsuit is the trading of tokens deemed as securities. Binance CEO has responded to these accusations, while the platform has expressed its disappointment with the filed complaint by the SEC.

After the CFTC, it's now the SEC's turn to go after Binance and its founder Changpeng Zhao (CZ).

The crypto market has promising days ahead. At least, that's what Changpeng Zhao, CEO of Binance, the world's largest cryptocurrency exchange in terms of trading volume, claims. In a recent interview with Bankless, Zhao predicted a series of successes for the industry and highlighted potential future scenarios. Let's briefly decipher his statements.

Binance announces the delisting of twelve cryptocurrencies under French regulatory pressure. Monero is among them.

In a recent interview on the Bankless podcast, Changpeng Zhao, the CEO of Binance, shared his perspective on the crypto industry and the current market. During the conversation, he addressed the persistent rumors (FUD) surrounding his company. Additionally, Zhao provided insight into the next major trend in the crypto space. Let's delve into the details of this interview.

Crypto company Binance seems to be constantly involved in controversies. If it's not regulators suspecting it of fraud, it's the press accusing it of misusing user funds.

Many believed Elon Musk was a big fan of cryptocurrency and the famous memecoin Dogecoin (DOGE). However, the Tesla CEO challenged this belief at a recent summit. The event in question was the Wall Street Journal's CEO Council Summit held in London. During his address, Elon Musk, who wields significant influence over the market, issued a warning to crypto investors. Here's what happened.

In 2017, an offshore exchange burst onto the crypto scene. Quickly rising to become a major player within the crypto industry, Binance is now showing signs of weaknesses though. Some dubious elements related to the centralization of BNB and the recent legal actions brought by the CFTC could well lead to the collapse of the colossus with feet of clay. So should we take the plunge to avoid a FTX-like scenario?

Following Forbes and Reuters, The Wall Street Journal has drawn a parallel between FTX and Binance. The spectre of SBF remains strong…