In December 2024, memecoins were leading the trends. Their capitalization flirted with unprecedented highs. And then, in 2025... everything collapsed. Who would have thought that only one year would separate the spotlight from oblivion? Digital fortunes melted away. Beloved tokens disappeared. What could possibly have happened? Volatility, scams, saturation, or mutation? An analysis of a sharp turn in the ruthless world of the most bizarre cryptos. Nothing hinted at such a reversal for such a popular crypto market.

Europe

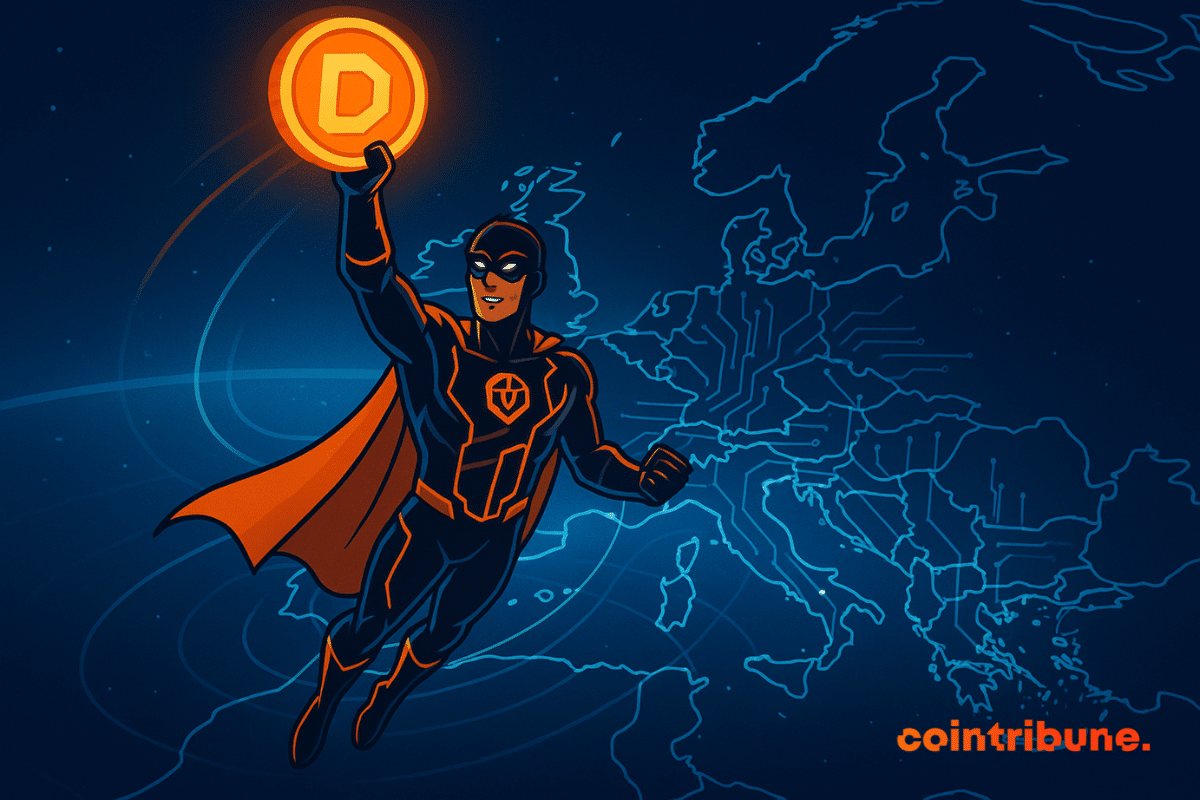

The digital euro could change everything: instant payments, financial sovereignty, and an alternative to private cryptos. However, despite ready technology, European legislators block the project out of fear of privacy risks. Which crypto will disappear if the digital euro arrives in 2026?

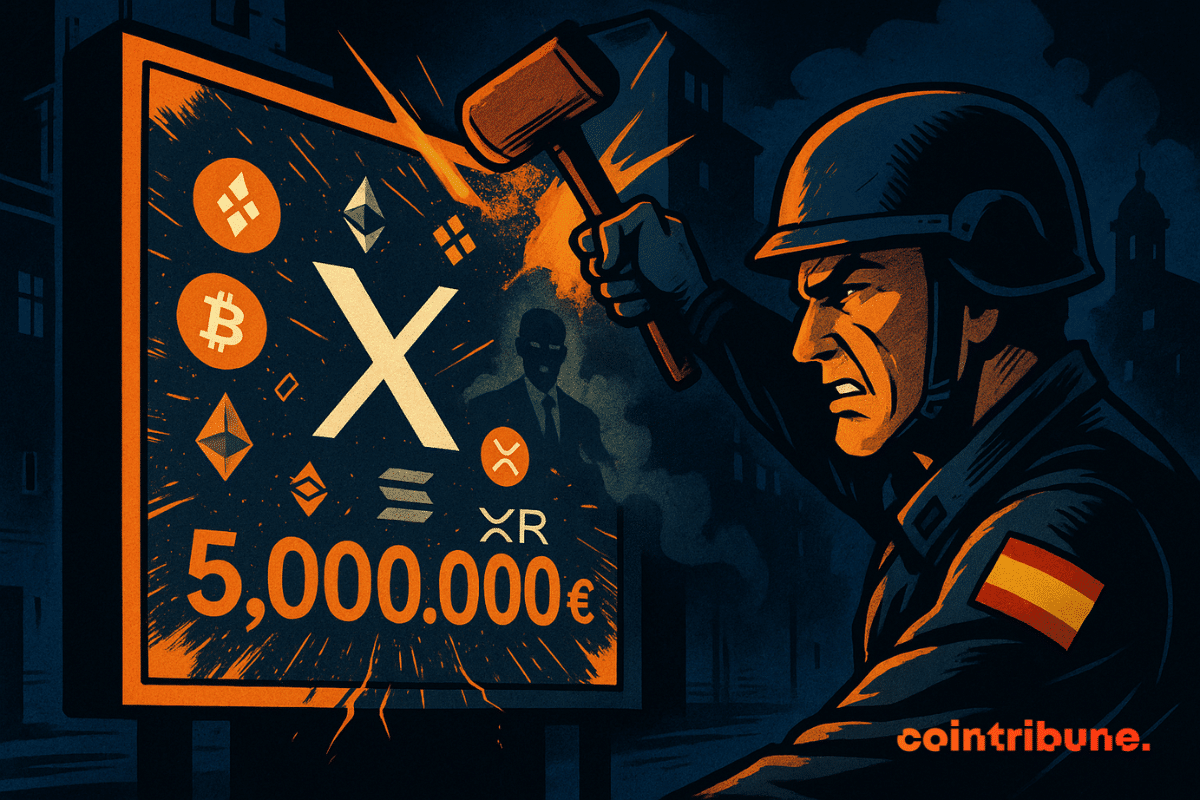

As the European MiCA regulation gradually comes into effect, the Comisión Nacional del Mercado de Valores (CNMV) of Spain has decided to set clear, almost abrupt, guidelines for crypto players operating on its territory. No prolonged grey areas, no regulatory wavering. The message is clear. Comply, or leave

Over the past year, OKX has been steadily expanding across Europe—we're listening to what traders want and building the products they need. From advanced trading tools to deeper liquidity and new institutional partnerships, Europe has quickly become one of the most important regions driving OKX’s global growth.

When the EU regulates, it sometimes tailors the rules... MiCA stalls, ESMA heats up, states hesitate: in the crypto jungle, Brussels dreams of cutting local freedoms short.

The UK is moving quickly to strengthen its position in digital finance as part of its 2026 growth plan. Pound-pegged stablecoins are now the central play in a regulatory push to keep the country competitive as Europe develops new rules. Clear timelines, new testing routes, and pressure from nearby markets are pushing the region toward a more structured stablecoin system.

Elon Musk and the EU face off in an unprecedented duel after a historic $140 million fine. Between tech regulation, geopolitical tensions, and American support, this clash redefines digital rules. Who will emerge victorious from this war?

Brussels pulls out all the stops by wielding a "SEC" European style. Startups in panic, regulators in a trance. What if tech innovation takes a hit?

Poland’s parliament failed on Friday to overturn President Karol Nawrocki’s veto of a bill intended to tighten crypto rules. The outcome blocked Prime Minister Donald Tusk’s plan to expand oversight and left the country without a clear path forward. Lawmakers must now reconsider how to align with EU standards while avoiding heavy pressure on local firms.

The European Union wants to entrust ESMA with a key role in crypto supervision. With MiCA, an ambitious reform is taking shape, balancing enhanced security and concerns about innovation. This extension of powers could change everything for investors and platforms. Essential details to know.

While stablecoins worry many central banks, the ECB adopts a surprisingly measured tone. In its latest financial stability review published on November 20, it considers these assets to represent "only a limited risk" to the eurozone. A reassuring position, which the institution justifies by still marginal adoption and an already existing regulatory framework. However, behind this apparent calm, the ECB calls for vigilance given the rapid market evolution and emerging cross-border risks.

While the ECB dreams of a well-behaved digital euro, a French crypto startup is spending £30 million to hack the bank... but with the regulator's approval. Hats off.

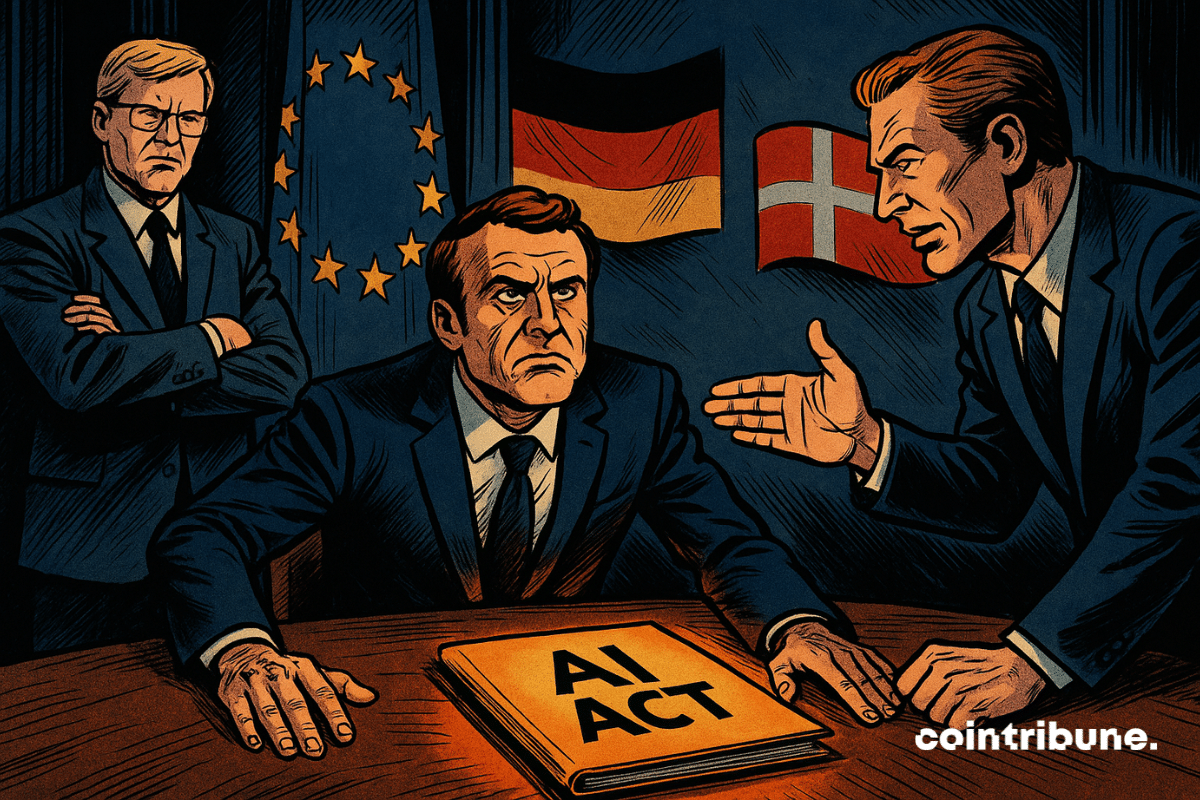

In Brussels, while some regulate AI to the point of suffocation, Paris and Berlin advocate for breathing space. Bureaucrats panic, startups suffocate, and innovation awaits an emergency exit.

Crypto on promo, X turns a blind eye, Spain pulls out the fine book. Musk aimed for the stars but ends up with his feet in regulatory mud. Cryptos cost.

Fraktion, a SaaS solution dedicated to tokenization and management of real-world assets (Real World Assets), accompanied in the operation by the investment bank Lukeiōn Advisory, announces the strategic acquisition of Pecule, a French fintech specialized in creating digital financial securities issuance platforms.

Europe has just dealt a decisive blow against one of the largest crypto scams ever dismantled. Over 600 million euros embezzled through fake investment platforms, nine arrests in three countries, and an operation conducted swiftly under Eurojust's coordination. This cross-border crackdown unveils the alarming scale of criminal networks exploiting blockchain to launder funds out of sight. A case that confirms the urgency of a judicial response commensurate with the crypto challenges.

A new European Commission plan to expand the powers of the European Securities and Markets Authority (ESMA) has stirred debate across the continent. The proposal aims to tighten regulatory consistency across crypto and financial markets. However, critics warn that the move could slow innovation and reduce agility within Europe’s growing fintech sector.

Michael Saylor continues his obsession with bitcoin. His company Strategy has just filed a request for an IPO of a share denominated in euros, specially designed to raise funds and acquire even more BTC. Will this initiative be enough to revive a buying momentum that is showing signs of weakening?

Christine Lagarde presents the digital euro as a symbol of trust and unity, promising to revolutionize payments in Europe. But this ambitious project also raises passionate debates: financial sovereignty or risk of increased surveillance? Discover the issues and controversies behind this innovation and the hidden role of bitcoin.

As the global monetary balance is reconfigured under the pressure of digital technologies and sovereign ambitions, Europe goes on the offensive. On October 29, the ECB approved a new technical phase of the digital euro project, the cornerstone of a future European payment system. The goal is to launch, by 2029, a public digital currency capable of competing with private solutions and foreign initiatives, while ensuring monetary control within the euro area.

On October 16, 2025, Bybit EU officially launched its Rewards service, a fixed-term product designed for the Bybit EU Earn platform. This initiative marks an important step in the exchange's strategy to conquer the European market, six months after obtaining its MiCA license from the Austrian financial authority (FMA) in May 2025.

The EU hits Putin where it hurts: unprecedented sanctions against Russian cryptocurrencies, ban on the A7A5 stablecoin, and blocking of complicit platforms. Will the Kremlin retaliate? Discover how these measures could disrupt the economic war and Moscow's circumvention strategies.

Revolut, the well-groomed neobank, joins the European crypto dance with the MiCA license in pocket… and a stablecoin behind the scenes? A revolution in a tie that already irritates the old players.

Leuven, Belgium — November 2025 — After the tremendous success of WAIB Summit Monaco 2025, where over 2,000 Web3 and AI enthusiasts gathered in June to celebrate innovation and the future of decentralized technology, WAIB Summit is now heading to Leuven, Belgium…

Russia has become Europe’s leading crypto adopter with strong growth in institutional activity and DeFi usage.

Robinhood unleashes heavy artillery: US stocks on Arbitrum, tokenized ETFs… The platform is betting everything on crypto, but Brussels and Vilnius might well bring it down.

France is taking a major step in modernizing its financial markets with the launch of the Lightning Stock Exchange (Lise), a fully tokenized equity platform designed for small and medium-sized enterprises (SMEs). Backed by leading French banks and armed with a new regulatory license, Lise aims to bring blockchain efficiency to traditional stock listings and reshape how companies go public.

What if Europe finally disrupted the established order of stablecoins? Oddo BHF launches EUROD, a 100% euro stablecoin, challenging the dollar's dominance in crypto. A financial revolution underway! Discover the stakes and challenges of this innovation that could change everything.

MiCA was meant to secure the crypto market in Europe, but some actors still bypass the rules. Forum shopping, abusive reverse solicitation, compliance gaps: discover how these practices threaten your money and European financial integrity. #MiCA #Crypto

Less than two years after the entry into force of MiCA, the ambition of a unified European framework for cryptos is faltering. Amid national divergences, institutional criticisms and tensions over passporting, the European Union struggles to deliver the promised coherence. And now, ESMA is advocating to take back control, at the risk of reigniting tensions between Brussels and national regulators.