The old Raiffeisen bank is catching up with Bitpanda, integrating crypto trading into its mobile application.

Europe

"While the historic regulation on AI will soon be adopted, the EU is preparing to establish the European Office for Artificial Intelligence."

"The European Union (EU) further supports transparency in carrying out crypto activities. This is indicated by the recent partnership between the European Council and Parliament to strengthen the diligence measures required of crypto companies in carrying out their operations."

Asked on Twitter, the ECB considers it highly unlikely to ever acquire bitcoin. However, the idea is gaining ground in the United States.

In this article, I will explore the opportunities and challenges for crypto startups in Europe, one of the world's most developed regions.

Discover the recent progress in the framework of the Digital Euro project and the advancements of the rulebook development group.

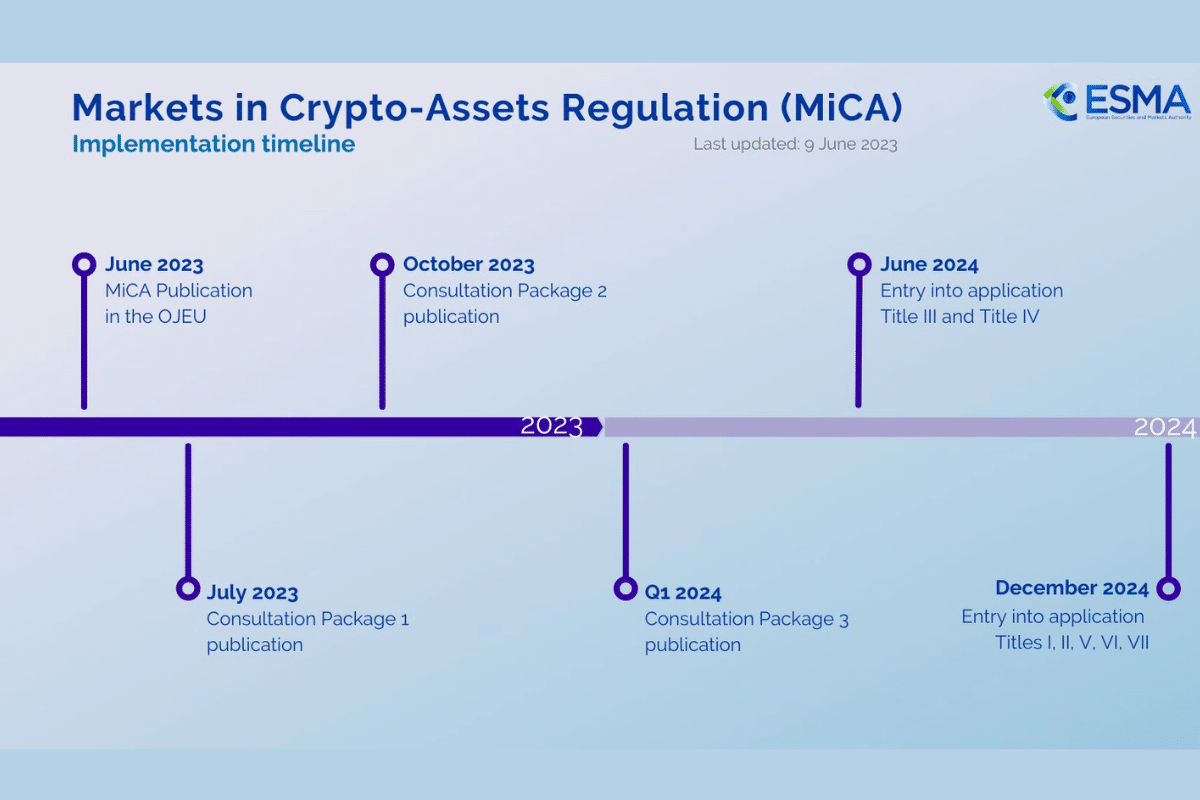

Throughout 2023, the crypto market has significantly grown in Europe. Nearly a thousand crypto platforms have entered the European crypto market. This trend has been confirmed by the remarkable increase in the number of registrations obtained by these entities in recent months. It is expected to continue with the implementation of the MiCA standard.

Wave by wave, the European Union (EU) has taken various sanctions against Russia since the invasion of Ukraine, with the goal of suffocating the country's economy. In this context, the European organization has just adopted a 12th wave of sanctions specifically targeting crypto activities conducted by Russians.

Driven by Bitcoin and Ethereum, cryptocurrencies are gaining momentum in Europe. According to a recent Bloomberg report, the old continent invested over $43 million in crypto funds last week. This enthusiasm contrasts with American and Asian skepticism.

The online brokerage firm Robinhood, known for its zero fees and intuitive interface, has just announced the expansion of its cryptocurrency trading services to the European market. Users from the Old Continent will now be able to buy, sell, and hold Bitcoin, Ethereum, and Solana without any commissions.

For several years, cryptocurrencies have been experiencing a special growth that is reshaping the global financial ecosystem. This dynamic, which is in line with the times, was until recently largely hindered by the absence of regulation in the crypto sector. This situation posed risks of anarchy and led to certain catastrophic events in recent months. To address these concerns, the European Union (EU) has taken the lead by introducing its regulation on crypto-assets markets (MiCA). At a time when several analysts anticipate a bull run in the cryptocurrency market, many specialists believe that the MiCA law will be one of the catalysts for this momentum. Let us analyze this in light of the potential of unprecedented crypto regulation, soon to be fully operational.

As the European Union is set to adopt its landmark law governing artificial intelligence (AI) systems, a group of 33 EU-based technology companies warns against excessive regulation that could hinder innovation.

Following the recent attacks funded by Hamas through crypto, European lawmakers are considering tightening regulations by imposing identity verifications for all cryptocurrency transactions, even those below €1,000.

The EU Council and the European Parliament have recently reached a provisional agreement on the European Digital Identity (eID). However, this agreement raises legitimate concerns regarding the privacy of citizens, particularly in the context of a potential interconnection between the eID and the future central bank digital currency (CBDC).

The year 2023 will be remembered as a tumultuous period for cryptocurrency investors. While the market faced challenges, such as the overall cryptocurrency market cap contraction, Ethereum's depreciation, and a decline in total value invested in decentralized finance (DeFi), it also witnessed significant progress. Among these advancements, notable developments include continued institutional adoption, a growing interest in layer 2 solutions, and, most importantly, significant changes in cryptocurrency regulation. This article will specifically explore the recent developments in cryptocurrency regulation within the EU and on a global scale. Let's take a closer look.

Ensuring that the digital euro doesn't become a tool for surveilling Europeans. This is, in a way, the wish of the European Data Protection Board (EDPB) and the European Data Protection Supervisor (EDPS). These entities have recently called on the EU to establish a “privacy protection threshold” for cryptographic transactions in the euro. Let's take a closer look!

The European Union marks a decisive step in the crypto sphere. In response to the rise of this sector, the EU is arming itself with new rules to ensure greater tax transparency. But what do these standards mean for crypto holders and the industry itself?

It's a fact: decentralized finance (or DeFi) and crypto are well and truly present on the European market. In a detailed report, the European Securities and Markets Authority (ESMA) takes a close look at this new financial era. Read on for more details!

Crypto regulation remains a subject that is both complex and controversial. The reason for this is that, at the current moment, there is still no clear and harmonized legal framework within the European Union. Indeed, the European Parliament has already adopted the MiCA crypto standard. However, some uncertainties persist. Hence the second consultation launched by ESMA, the European Securities and Markets Authority.

No cryptocurrency transaction should go unnoticed by the Bank for International Settlements (BIS), as they develop a suitable system to track cryptocurrency exchange flows throughout the European territory. Several European central banks have joined them in this initiative. Let's take a closer look!

The European Union is to fork out nearly €1 million (in fiat or crypto?) to assess the environmental impacts of cryptocurrencies and bitcoin mining activities. Does this mean that Brussels prefers strict regulation of these activities to the ban? In any case, crypto-enthusiasts will be sure to follow the progress of this study, especially the publication of the first reports. The fate of bitcoin mining and crypto activities in Europe will in fact depend on it.

It has been several months since the ECB unveiled its digital euro project, an announcement that continues to reverberate in the financial markets. A recent statement by Christine Lagarde, President of the ECB, has garnered particular attention from the crypto community. According to the ECB President, the digital euro (to be distinguished from a cryptocurrency) will not be anonymous. This revelation raises deep questions about privacy protection, and many analysts are also pondering the potential implications of this digital euro project on cryptocurrencies.

Binance, the giant cryptocurrency exchange platform, is facing disruptions with its payment partner, Paysafe, in Europe. Some European users are experiencing difficulties in making euro withdrawals due to early closures initiated by Paysafe.

After complying with the FSMA's decision, the Belgian regulator for cryptocurrencies and finance, Binance had to suspend its activities in the country back in June. Three months later, the world's largest cryptocurrency exchange announces a triumphant return to Belgium. What has changed since then? Let's delve into it.

The European Union (EU) is currently preparing for the implementation of the MiCA crypto standards. This law aims to regulate stablecoins. Today, this regulation is sparking debates and concerns regarding its impact on the crypto market, especially on stablecoins.

While the United States, through the SEC and CFTC, grapples with regulatory challenges in the cryptocurrency market, Germany is forging ahead. Currently, numerous German banks have already stepped into the exciting world of cryptocurrencies, and some local financial institutions believe it's time to embark on this adventure. This includes the Stuttgart Stock Exchange, which plans to launch crypto staking next year.

In recent years, cryptocurrencies have grown exponentially in the European region. Cryptocurrencies can be used for different purposes, such as investment, trading, savings, or payment methods.

The SEC, often known for its outbursts against companies operating in the crypto market, has just made a big decision. The American regulator has just accepted BlackRock's application for a Bitcoin exchange-traded fund (ETF). This decision could mark a new turning point in the institutional adoption of bitcoin (BTC).

The European Central Bank is working on the upcoming launch of new banknotes. The financial institution considers the project important enough to involve Europe's citizens.

Investments in cryptocurrencies such as bitcoin have exploded in recent years. To provide a better framework for them, or to some extent to profit from their rise, some European countries have defined tax rules that their citizens holding cryptoassets must comply with. In this article, we take a look at the differences between these countries' tax regimes.