The European Union stands on the brink of a historic change with the impending implementation of the MiCA regulation (Markets in Crypto-Assets), aimed at regulating cryptocurrencies and enhancing transparency in the market. Among the many implications of this regulation, the fate of the USDT stablecoin, issued by Tether, raises significant questions. This token, which holds a central position in crypto transactions worldwide, could be banned or restricted in Europe if authorities deem it does not meet MiCA's requirements. However, as the deadline of December 30, 2024 approaches, no clear directive has been communicated. This situation has led to varied responses among major exchange platforms. For instance, Coinbase has taken the lead by removing USDT from its European services and opts for a conservative approach in the face of regulatory uncertainties. Conversely, major players like Binance and Crypto.com keep the stablecoin accessible, as they bet on future clarifications. This climate of ambiguity reflects the scale of the challenges posed by implementing MiCA and highlights the need for a harmonized framework to avoid disrupting a rapidly growing sector.

Europe

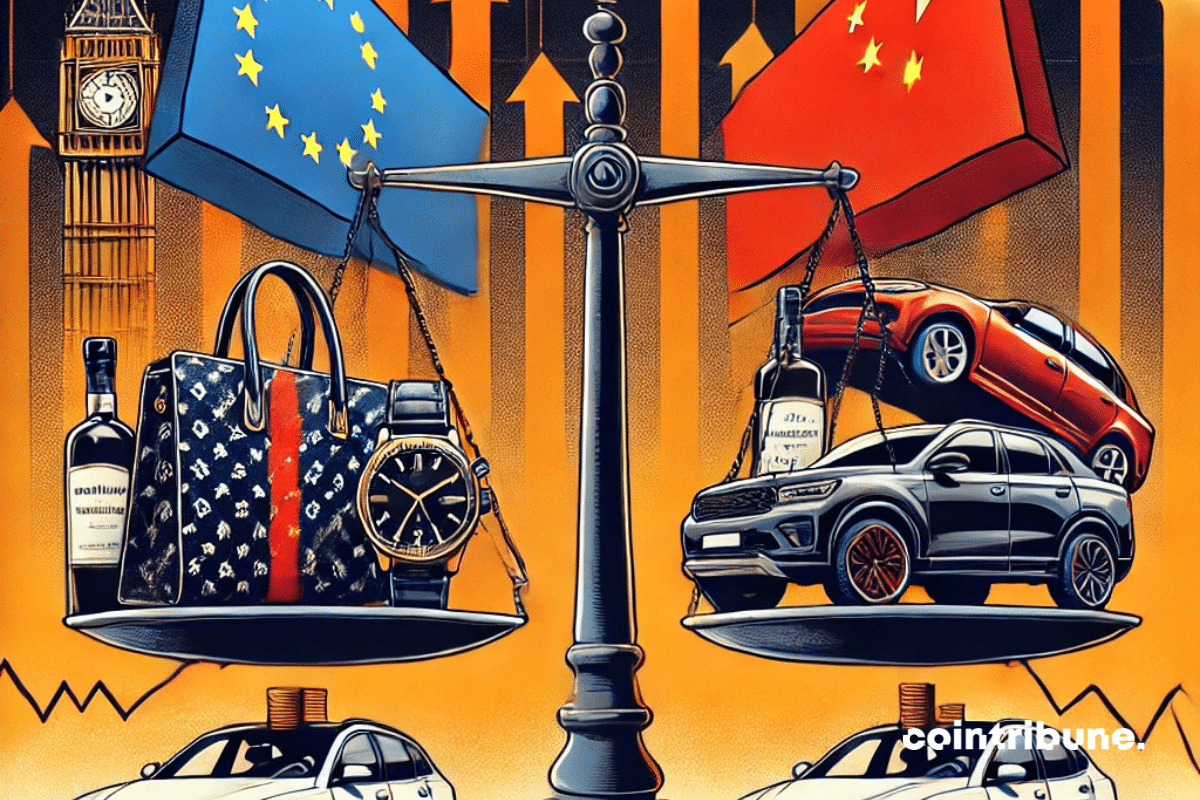

Global trade is going through a period marked by increasing tensions, where diplomacy and economy intertwine in strategic rivalries. Indeed, China's opening of an anti-dumping investigation into European cognac imports signals a new front in the trade conflict with the European Union. This move, perceived as a direct response to European accusations against Chinese subsidies for electric vehicles, reflects an escalation of economic retaliations between two major powers. Such a case goes beyond a mere trade dispute. It raises fundamental questions about the balance of international exchanges and the role of institutions like the World Trade Organization in arbitrating these disputes in an increasingly complex rivalry context.

Tensions between the United States and the European Union are escalating once again. Donald Trump, known for his aggressive trade policy, has targeted the European trade surplus, which he describes as "huge." The elected American president threatens to impose heavy tariffs if European countries do not reduce this imbalance by significantly increasing their purchases of American oil and gas. This strategy aligns with the continuity of his protectionist rhetoric aimed at enhancing the competitiveness of the United States on the global stage.

The European Union is about to take a major step in regulating cryptocurrencies with the imminent entry into force of the MiCA (Markets in Crypto-Assets) rules. This initiative, praised by some as a step towards better transparency and an increased fight against financial abuses, however, triggers intense concerns among industry players. Indeed, the regulation requires the removal of USDT, the most widely used stablecoin in the world, from regulated platforms within the EU. Such a decision could disrupt the balance of European markets and call into question their attractiveness on the global stage.

In 2024, Bitvavo reached a major milestone by recording a trading volume of nearly 100 billion euros, thus consolidating its position as a leader in the European crypto market. This exceptional performance is the result of a combination of several favorable factors that propelled the platform to new heights.

Europe, always trailing Washington, should soon align itself by lifting the curse on bitcoin.

Discover the hidden aspects of the ECB's digital euro project, scheduled for 2025, and its implications for the future.

In an already fragile global economic context, the Chinese slowdown acts as a shockwave for European companies in iconic sectors such as luxury and automotive. While these industries had grown accustomed to sustained growth driven by the appetite of the Chinese market, the signals from the third quarter paint a grim picture. Behind the numbers lies a faltering economic model, which raises deep uncertainties about the future of trade between Europe and China.

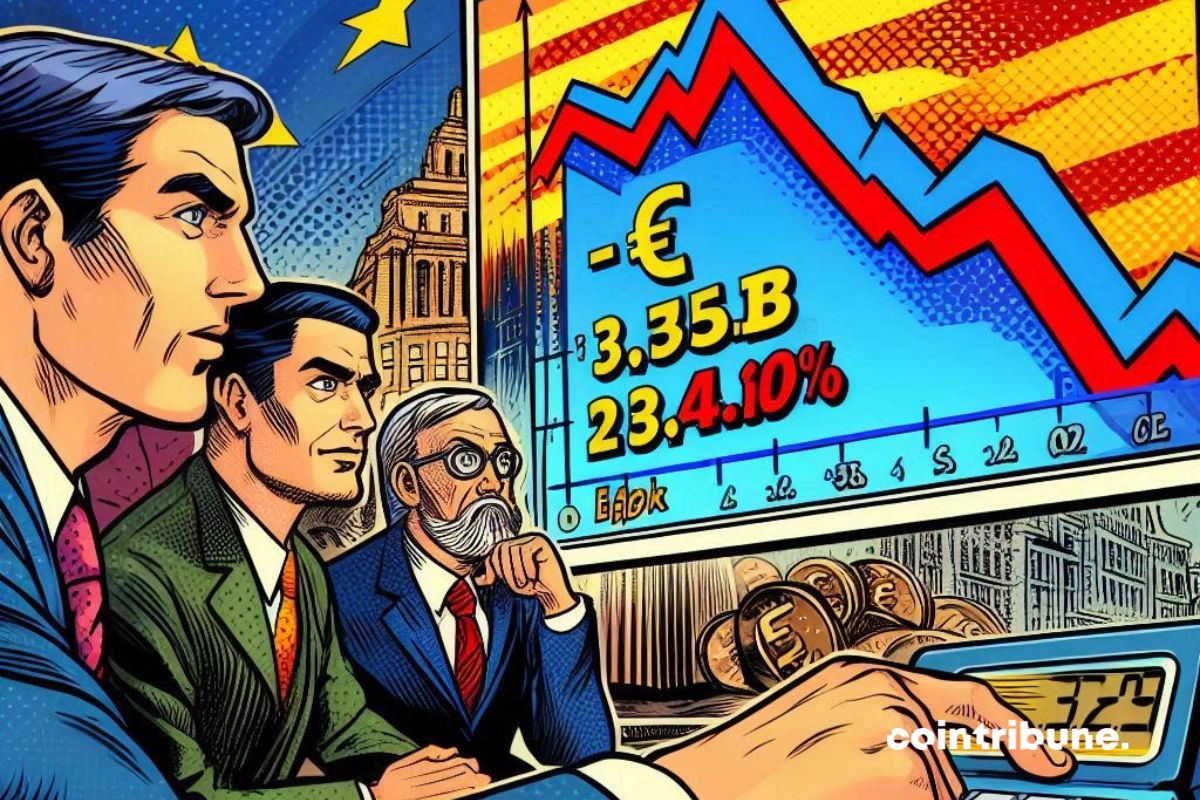

The currency market is experiencing particularly marked turbulence in recent days, as the dollar continues to show spectacular strength against the euro. To the point that some analysts anticipate a critical threshold: parity between the two currencies. This dynamic, which represents a two-year peak, raises concerns among economists, businesses, and investors, with potential repercussions on the European and global economy.

MiCA in conductor mode: two stablecoins land in Europe, but banks are playing a risky tune.

The European Union is about to sign a historic agreement with Mercosur, leaving France on the sidelines. Despite protests from Paris, the European machine seems to be moving at full speed. But what is really happening behind the closed doors of Brussels? When Europe ignores French protests France says no,…

The Bank of France, like a warrior of old, demands order over the chaos of cryptocurrencies, calling for Esma for support.

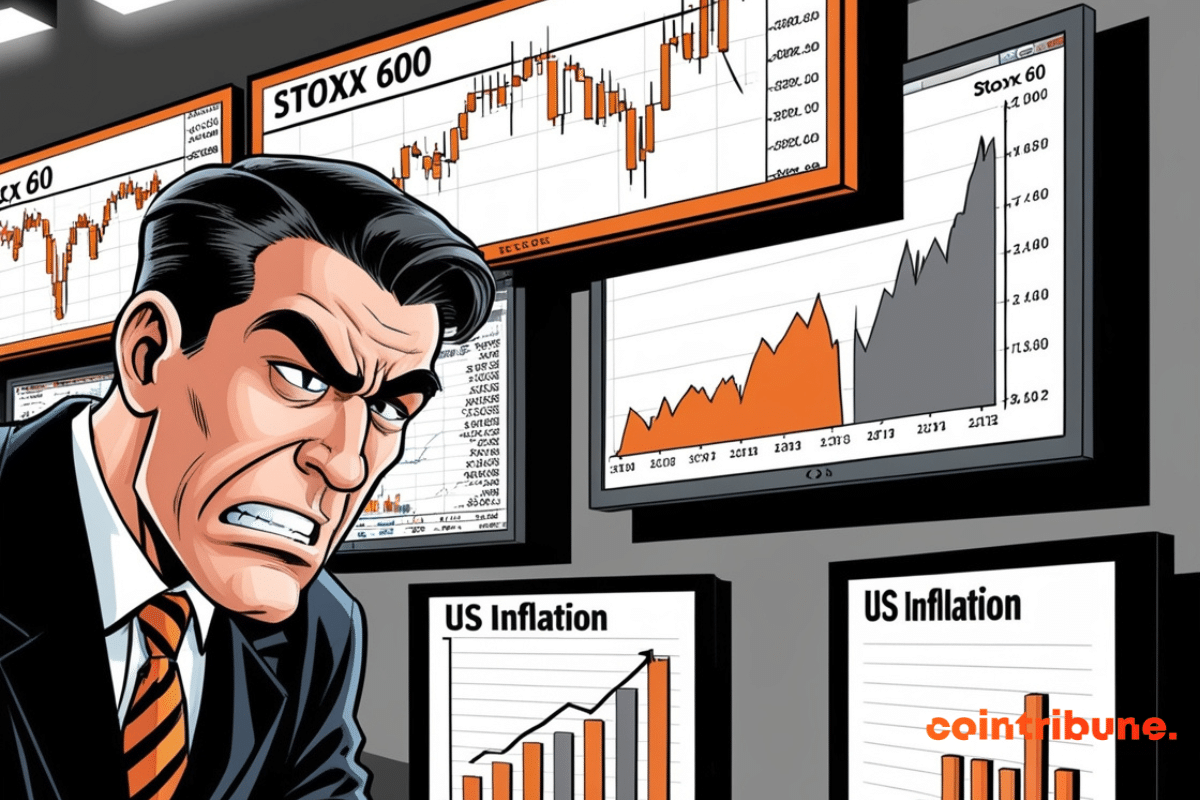

"Suspense among traders: American inflation, the new obsession of Wall Street! Europe is calm, but Siemens and Just Eat are having fun."

Donald Trump's election to a second term as President of the United States could redefine the balance of power between Europe and its traditional ally across the Atlantic. In the face of this political upheaval, European leaders are confronted with critical questions about the future of their security, their strategic autonomy, and their economic partnership with the United States. As Europe is already weakened by internal tensions, Trump's return rekindles fears of an American disengagement in defense matters, as well as the threat of a trade war.

On Tuesday, October 29, 2024, Brussels approved a drastic increase in customs tariffs on electric vehicles imported from China. Such a measure follows a thorough investigation into the massive subsidies granted by Beijing to its national manufacturers. For Europe, it is a matter of industrial survival. While some applaud a necessary step to protect a struggling automotive market, others fear global economic repercussions.

The introduction of the digital euro is causing a major confrontation between the European Central Bank and the EU member states. At the heart of this battle is the control of a new monetary instrument that could disrupt the balance of financial power in Europe. Nine countries, including France and Germany, are already openly opposing Frankfurt's ambitions.

The new MiCA (Markets in Crypto-Assets) regulation from the European Union promises to deeply shake the crypto universe. As the legislative framework is set to come into force by the end of the year, industry figures, like Tether’s CEO Paolo Ardoino, express their concerns. According to him, the banking reserve…

The ECB bites into Bitcoin: a scathing report, sharp criticisms, and a well-felt war of interests behind the scenes.

105 billion Europeans in ETFs, and still nothing to declare for Bitcoin. One would think that traders are hibernating.

CAC 40 in difficulty: the real estate crisis in China hampers growth. How does the Paris stock exchange react?

The ECB lowers its interest rates to 3.25% to stimulate the economy! What does this mean exactly for you?

MiCA-compliant stablecoins dominate the crypto market in Europe! Here are the secrets behind this exceptional growth.

France is undergoing an unprecedented budget crisis. The deficit is likely to exceed 6% in 2024. France now risks bankruptcy, which would plunge the entire euro area into the abyss.

The EUR/USD exchange rate recently dropped to around 1.0900, influenced by an increasingly accommodative market sentiment towards the European Central Bank (ECB). This bearish trend, observed for four consecutive sessions, is primarily due to expectations of an interest rate cut by the ECB during its upcoming financial meeting scheduled for this Thursday.

The trade war unfolding between the European Union and China is taking an unexpected turn. As the first sanctions hit strategic sectors such as electric vehicles and spirits, a new player enters the turmoil: European luxury. This economic stronghold, which symbolizes both creativity and prosperity in Europe, now finds itself at the center of speculations about potential Chinese retaliation. But behind this apparent storm, a more subtle equilibrium is taking shape. Experts, aware of the colossal economic stakes for China itself, are questioning: Will Beijing really take the risk of stifling one of the engines of its domestic consumption? In this article, we will first analyze the immediate consequences of this crisis on the financial markets of European luxury. Then, we will delve into the long-term perspectives and scenarios that could shape the relations between these two economic giants.

Asian financial markets are plunging, and this shockwave is resonating far beyond the Pacific, reaching European and American stock exchanges. While China delays deploying sufficient stimulus measures, Wall Street is trying to recover, supported by the tech sector. But for how long? The global stock market is going through a…

The escalation of trade tensions between the European Union and China regarding tariffs on electric vehicles threatens to shake the global economy. While Brussels has voted in favor of these measures, Beijing is preparing its response, casting a shadow of targeted reprisals over the European countries most supportive of this decision.

As the Livret A softens, the ECB adjusts its glasses. Verdict in 2025: it's going to sting!

France, with a deficit nearing 6%, is fighting against stagnation in its economy and promises a return to normal by 2029.

Is Europe doomed to economic decline? This is the question that haunts minds as the Old Continent loses ground against the United States in terms of productivity. A much-anticipated report from Mario Draghi, former Italian Prime Minister, paints an alarming picture of the situation!