Panetta believes that only a central digital currency can mitigate the risks posed by foreign platforms. Details here!

Europe

Christine Lagarde dreams of a digital euro supplanting the dollar in global exchange reserves. The United States, on the other hand, is betting on bitcoin.

Musk leaves the government before mandatory transparency. Tesla is in free fall, X is down, he seeks refuge in his factories. Is the economy of the empire already on borrowed time?

What if the euro finally established itself as a global reference? In Berlin, Christine Lagarde surprised her audience by asserting that the European single currency could replace the dollar as the main pillar of international reserves. Behind this bold statement, the president of the ECB outlines a clear strategy: to provide the European Union with the necessary levers to exert financial and geopolitical influence. Thus, in a reshaping world, this ambition redefines monetary power dynamics and places the euro at the center of a new global equilibrium in the making.

Trump keeps the suspense going, Brussels breathes, the stock market dances. But behind the curtain, the threats still loom. Who will emerge victorious from this customs waltz?

The BRICS Trade Ministers approved this week the "Declaration on WTO Reform and Strengthening the Multilateral Trading System." This is a document in which the group reinforces its commitment to strengthening the multilateral trading system. Additionally, the proposal includes reform of the World Trade Organization (WTO). This declaration also addresses issues such as data governance, sustainability, and strategies through 2030. Meanwhile, the President of the United States, Donald Trump, has once again threatened the European Union (EU) with a 50% tariff starting June 1.

A phone call, a truce? Trump puts away the customs missiles. The European economy is breathing, but for how long? Ursula whispers, Donald retreats. Suspense is high until July.

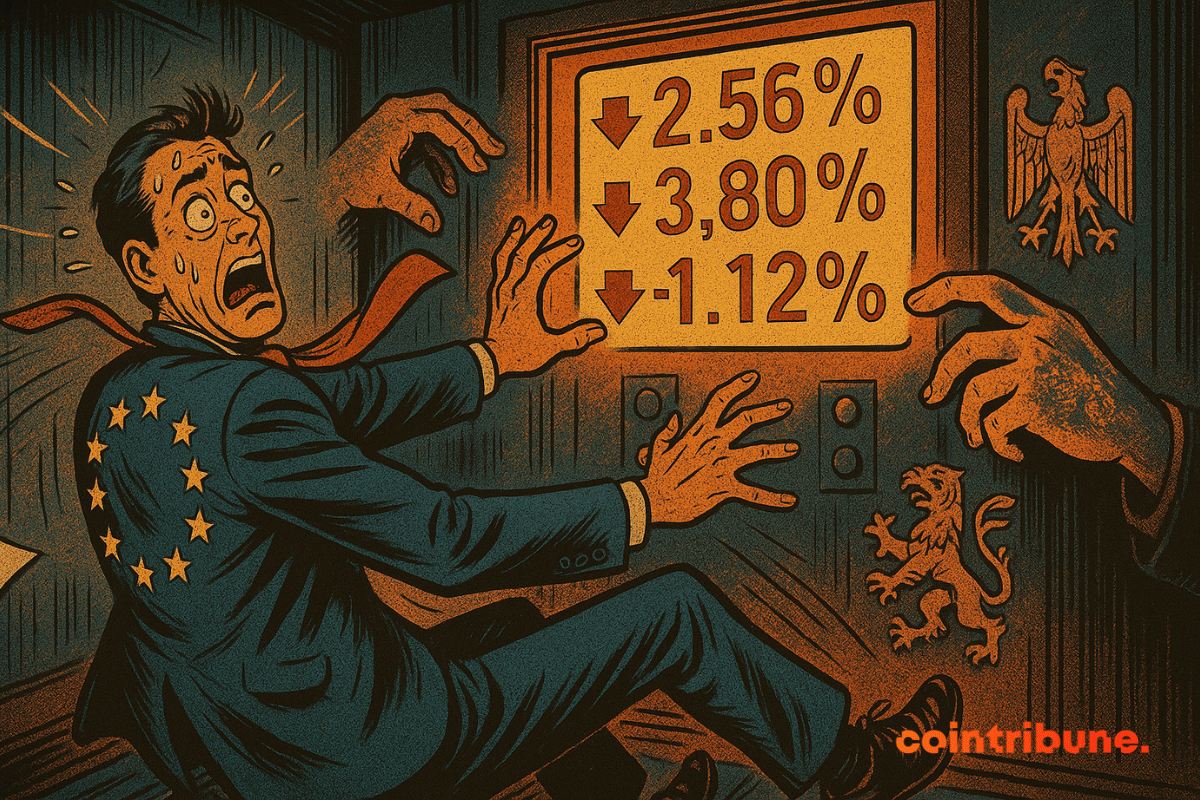

The return of Donald Trump to the global economic arena was enough to shake the markets. On Friday, a terse statement on Truth Social ignited the powder keg: 50% tariffs on European imports starting June 1. The reaction was swift. Wall Street wavered at the opening, traders hurriedly adjusted their positions, and the crypto market felt the shock: Bitcoin dropped by 4%, leading to liquidations of over 300 million dollars.

As the conflict in Ukraine bogs down, the European Union crosses a strategic threshold. On May 20th, Brussels adopted a 17th round of sanctions targeting previously less exposed entities: the Russian ghost fleet, a logistical pillar of oil evasion. This maneuver, synchronized with London, marks a turning point in the economic war waged against Moscow. By hardening its stance, the EU aims to weaken the opaque circuits financing the Russian military effort and maintain pressure on its foreign supporters.

Revolut is setting up in Paris, spending a billion, hiring 200 people... But behind the neobank, will crypto go all in to dominate the European economy? A mystery to follow.

Unbeknownst to the general public, a monetary shift is taking place in Europe. The US dollar is losing ground there. Since the beginning of the year, foreign companies and funds are demanding payments in local currencies, revealing a strategic fracture at the heart of continental finance. This movement, far from being anecdotal, aligns with the ambitions of the BRICS, who are determined to erode the hegemony of the greenback. Discreetly, it is the very architecture of international trade that is wavering, driven by an emerging alliance in search of economic sovereignty.

Trump eases up (a bit) on customs tariffs: the economy breathes, analysts cough, and Beijing chuckles. 90 days of truce, or 90 days until the storm?

As the conflict in Ukraine reaches a critical juncture, Kyiv and its Western allies are proposing a comprehensive, unconditional ceasefire for 30 days. Supported by Washington and major European capitals, this initiative aims to create a pathway for negotiations. However, beyond the call for a truce, one question looms: will Moscow see this as a genuine hand extended or a tactical maneuver concealing a strategic advantage for Ukraine? The answer could reshape the balance of power diplomatically.

The European Union is ending anonymity in crypto transactions. Starting July 1, 2027, any transfer exceeding €1,000 will be required to reveal the precise identity of the sender and the recipient. According to Paschal Donohoe, president of the Eurogroup, these new anti-money laundering rules (AMLR) clearly place blockchain and digital assets under the direct oversight of European authorities. For crypto enthusiasts, this measure represents both a necessary revolution and a painful betrayal.

The stock market reacts positively to the Fed's decision to keep interest rates unchanged. Discover the key figures in this article!

European markets began the week without a clear direction, caught between two major uncertainties: the upcoming decisions of central banks and fears of a global trade tightening. On Monday, May 5, the main financial markets show clear caution, illustrated by slightly declining indices and low trading volumes. Indeed, investors are anxiously awaiting the next announcements from the Fed and the Bank of England, in an environment where every monetary or diplomatic signal can shift the trend.

When Elon Musk plays politics with Trump, it's Tesla that stumbles at the start. Between free falls, a hesitant board, and angry tweets, the Empire of the tweet dangerously wavers.

The European Union is tightening the screws on anonymity in the crypto sector. From 2027, confidential tokens and anonymous accounts will be banned, marking a historic turning point for the ecosystem. The goal: to strengthen the fight against money laundering and impose total transparency on market players.

While Asia rushes and America funds, Europe shuffles paperwork, piles up regulations, and waits for innovation to knock at its door… with form B-27.

The EU is trying to avoid a trade war that would harm its economy. This article explains how.

Tether throws a stone into the European regulatory pond: its CEO categorically refuses to submit USDT to the MiCA framework. A decision that could disrupt the stablecoin market in Europe, weaken crypto exchanges, and highlight a front-line opposition between regulation and global financial innovation.

Europe, once hesitant about Bitcoin, wants its MicroStrategy: TBG plans for 260,000 BTC by 2033. A strong plan that tickles the ECB and shakes the markets.

CZ, as an apostle of the crypto freedom, bet 500 million on X to free the tweets... all while hoping that Elon Musk hunts down the bots that are proliferating.

At the Token2049 conference in Dubai on April 30, Changpeng "CZ" Zhao, former CEO of Binance, did not mince his words: Europe is almost absent from the debate on crypto adoption. According to Zhao, while countries like the United Arab Emirates and Bhutan are accumulating bitcoin and ethereum as strategic reserves, European countries are moving "nowhere."

Bunq, the well-known European neobank for digital nomads, is expanding its offering: it's time for cryptocurrencies! The app now allows users to manage savings and crypto in one basket, thanks to Kraken.

The Ekaterina Djanova case resembles a financial thriller where crypto, organized crime, and judicial loopholes intertwine. While this 38-year-old Frenchwoman, nicknamed 'the shadow banker,' has been languishing in prison for two years, a legal twist could set her free. Behind this possible legal escape lie burning questions: how does the crypto system facilitate large-scale money laundering? And to what extent does digital impunity extend?

While the dollar tap dances on a thread of presidential tweets, the euro is trotting towards the monetary throne, galvanized by the missteps of its starry rival.

At the tumultuous intersection of spirituality and speculation, a cryptocurrency named LUCE defies conventions. As the Vatican mourns the death of Pope Francis, this meme token, inspired by the mascot of the Holy Year 2025, emerges as a modern paradox. Between prayers and algorithms, the crypto community stirs, turning a sacred event into a financial playground. How could a simple cartoon trigger such a profane frenzy?

The digital euro, a future digital currency issued by the European Central Bank, is set to profoundly transform the European monetary landscape. According to the ECB, this CBDC could replace up to 50% of banknotes in circulation and significantly impact bank deposits! Thus marking a strategic turning point for Europe in the face of digital assets.

In a world where information often blends with misinformation, Telegram, the encrypted messaging app, found itself at the center of an unprecedented controversy. While France claims to have forced the platform to comply with European regulations following the arrest of its founder, Pavel Durov turns the accusation around: according to him, it was the French authorities who delayed implementing the procedures stipulated by the EU. A rhetorical duel that reveals deeper tensions over the control of tech giants.