This Wednesday, September 17, the US central bank is expected to cut its key interest rate by 25 basis points. A decision already priced in by the markets, but far from trivial, as inflation remains above target and employment slows down. Behind this monetary shift, investors are looking for a signal. Temporary shock or catalyst for a new cycle? From bitcoin to gold, through Wall Street, all assets are watching Jerome Powell’s verdict.

US Federal Reserve (FED)

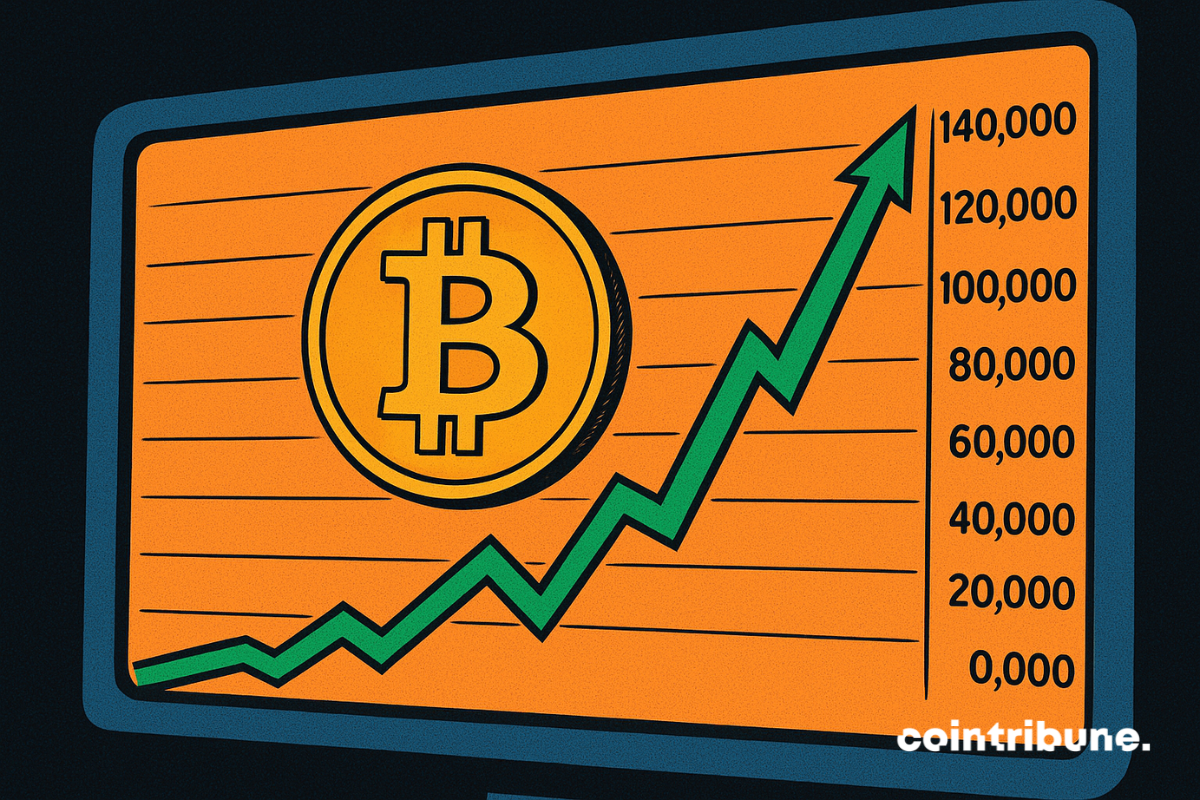

Bitcoin has broken records ten times this year. Spending Christmas closer to 150,000 dollars than to 100,000 dollars is not far-fetched.

The ECB freezes its rates, the FED is preparing to cut them... What if, in this monetary ping-pong, it was ultimately the real economy that served as the lost ball?

The latest US inflation data propels bitcoin to new heights, but analysts remain divided on the short-term trajectory. The flagship crypto flirts with $115,000 as speculation about a Fed rate cut intensifies. Could a new correction precede the long-awaited surge?

The showdown between Donald Trump and the American Federal Reserve reaches an unprecedented threshold. On September 9, the federal court suspended the dismissal of Lisa Cook, Fed governor, decided by the American president. A rare decision that highlights the major stake of this conflict: the independence of the central bank against political pressures. Ahead of a strategic meeting on rates, this judicial halt revives the debate on the limits of executive power in conducting monetary policy.

Bitcoin flirted with $113,000, traders were enthusiastic, the Fed was complacent, and Saylor was euphoric. But without spot buying, beware of a backlash: the intoxication could quickly turn to vertigo.

In the United States, the employment report expected this Friday, September 5, could seal the fate of interest rates. Markets, fueled by hopes of monetary easing, are watching for the slightest sign of weakness. However, the equation remains fragile: a slowdown sufficient to justify a rate cut, without reigniting fears of a sharp economic downturn.

It's not just Bayrou's France that is struggling. Europe is going through a systemic crisis that the ECB's printing press can no longer solve. Despite years of massive injections, the eurozone is sinking into a vicious circle of stagnation and unsustainable debt. It seems that this time, unlike 2008, the ECB can no longer save Europe from the crash.

Crypto markets pulse to the beat of the Federal Reserve. As Jerome Powell mentions a possible rate cut in September, Santiment sounds the alarm. Could the current euphoria be hiding a trap for investors?

At $37 trillion, American debt reaches an unprecedented level, fueling doubts about the dollar's strength. While markets question, bitcoin climbs beyond $124,000, driving the entire crypto sector to new heights. Between budgetary concerns and a rush toward alternative assets, a shift seems to be occurring.

While Jerome Powell surprises everyone at Jackson Hole with a more accommodative tone, bitcoin and Ether reach symbolic highs again. Investors, fueled by the prospect of a rate cut as early as September, rush back to risky assets. But can this euphoria last?

While traditional markets seek new momentum, Ethereum confirms its central role in the digital financial ecosystem. This Friday, ETH crossed a historic threshold at 4,880 dollars, surpassing its 2021 record. This symbolic peak is part of a global crypto market rally, driven by a more accommodative tone from the Fed and renewed interest from institutional investors. The event marks a strategic turning point for Ethereum, now seen not merely as a speculative asset but as a pillar of future financial infrastructures.

Jerome Powell caught everyone off guard at Jackson Hole by adopting a much more accommodative monetary stance. This unexpected change in tone immediately boosted risky assets. Bitcoin, at the forefront, broke through $116,000. This strategic reversal could mark a major turning point in the Fed's direction.

This Friday, the chairman of the Federal Reserve could deliver his last major speech, in a tense economic context and under unprecedented political pressure. Wall Street, the White House, and all markets are waiting for clear signals. Rate guidance, stance on inflation, Fed independence: every word will count, and could weigh heavily.

On August 29, $13.8 billion worth of Bitcoin options will expire, a deadline that could dictate the market trajectory. BTC just hit its lowest point in six weeks, heightening tensions between weakened buyers and sellers determined to defend their positions. More than just a technical event, this clash over derivatives crystallizes the uncertainty surrounding Bitcoin's immediate future.

Bitcoin in free fall, "hidden hands" at work, and the Fed lying in ambush: who is manipulating the market while traders play prophets?

After several years of heightened caution, the US Federal Reserve changes course regarding banks' crypto activities. The institution ends its specific monitoring program. It believes, indeed, that the risks linked to digital assets are now better understood and manageable within the traditional supervisory framework.

While the majority anticipated a Fed rate cut in September, a key indicator casts doubt. The latest Producer Price Index (PPI) release rekindles inflation fears and cools hopes for monetary easing. This subtle but meaningful reversal reshuffles the deck in a context where Fed policy dictates the rhythm of risky assets, and more than ever, that of the crypto market.

Donald Trump strikes again. After opening 401(k) retirement plans to alternative assets like bitcoin, he appoints Stephen Miran, a pro-Bitcoin economist, to the Federal Reserve board. A move welcomed by the crypto market, propelling BTC beyond 117,500 dollars.

Warning signs are everywhere. Between the explosion of inequalities and record debt, the global financial system is dangerously shaky. Faced with 37 trillion dollars of debt in the United States alone, one question arises: are we witnessing the end of capitalism as we know it?

The U.S. Federal Reserve could initiate a major shift as early as September with a first reduction in its key rates. A scenario now considered by several large banks, including Goldman Sachs, which reshapes the outlook for financial markets. For crypto investors, faced for months with a restrictive monetary context, this expected pivot could rekindle the appetite for risk and serve as a catalyst for a new bullish cycle.

The Paris stock market rises by 0.76% as the Fed could ease its policy in response to the American economic slowdown.

Larry Fink, CEO of BlackRock, recently published a revealing article in the Financial Times about his vision of "globalization 2.0." This new approach aims to direct citizens' savings towards investments in local infrastructure, under the guidance of asset managers like BlackRock.

Prices are rising in the United States, and it’s not a coincidence. Since Donald Trump's return to the White House, his aggressive trade policy is starting to weigh on the economy. The tariffs he has imposed are impacting household wallets, driving inflation up faster than expected.

Less fear around inflation: Bitcoin rises to $109,000, supported by calmer economic forecasts. More details here!

While the stock market progresses timidly, it is the dollar that falters, weakened by the dual pressure of the new trade taxes imposed by Donald Trump and the ongoing hesitation of the Federal Reserve. In this tense atmosphere, investors oscillate between the quest for yield and the caution dictated by the surrounding instability. The apparent calm conceals a palpable nervousness: that of a market that knows that everything can tip at the slightest jolt.

While markets were expecting a clear monetary shift in 2025, Jerome Powell, the chairman of the Federal Reserve, dampened hopes by pointing to an unexpected culprit: Trump. Yes, Donald Trump, back in the White House since January, is leaving his mark on the American economy, to the point of forcing the Fed to play for time. In a context where every word matters, Powell dropped a diplomatic bombshell, accusing Trump's policies of blocking interest rate cuts.

The BIS stands up to defend the Fed. Can the economy withstand a monetary crisis? The details in this article!

Against the backdrop of years of regulatory ambiguity, Washington seems to want to take control of the crypto ecosystem. On June 18, Federal Reserve Chairman Jerome Powell surprised many by clearly supporting two landmark bills on stablecoins and the crypto market. In a changing political climate in the United States, this stance marks a potential turning point for the industry, which has long awaited a solid and predictable legal framework.

By maintaining its benchmark rates for the fourth consecutive time, the Fed has not simply extended a monetary policy. It has taken a stance in a tense economic and political landscape. Stubborn inflation, weakened growth, barely concealed political pressure... The status quo decided on June 18 resembles a statement of intent. Behind the silence of the numbers, a strategy of resistance is taking shape as the central bank finds itself at the heart of an increasingly unstable balancing act.