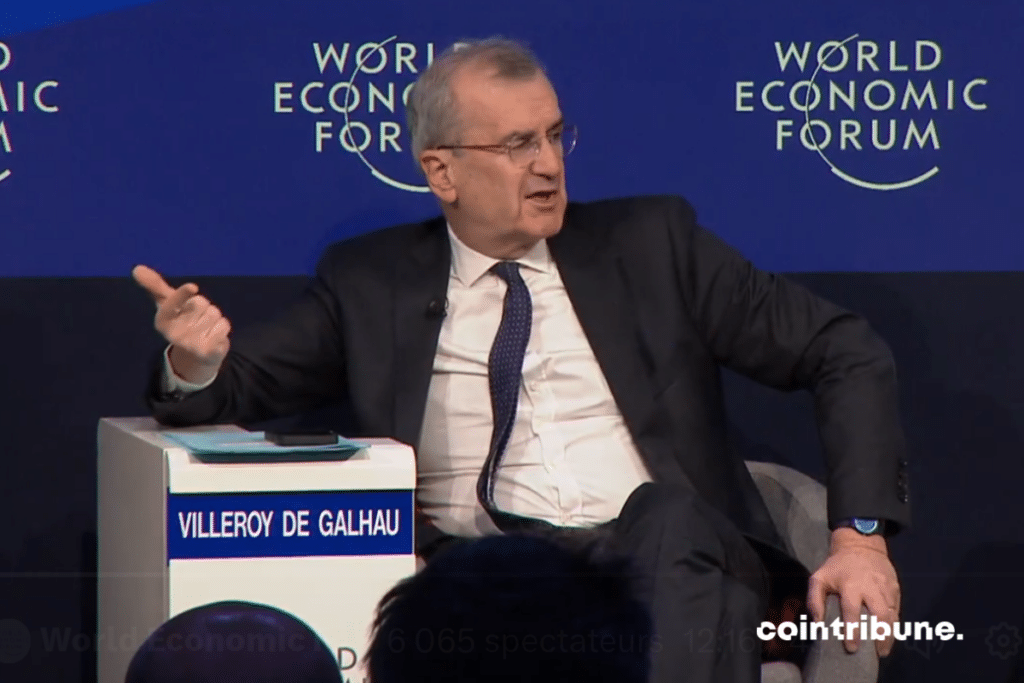

The High Rate Reality with @adenatfriedman (@Nasdaq), @GitaGopinath (@IMFNews), @ChuckRobbins (@Cisco), @steve_sedgwick (@SquawkBoxEurope) and François Villeroy de Galhau (@banquedefrance) #wef24 https://t.co/VOsz1fgCAA

— World Economic Forum (@wef) January 16, 2024

A

A

"The ECB will lower interest rates this summer"

Thu 18 Jan 2024 ▪

4

min of reading ▪ by

Getting informed

▪

Invest

The French Governor of the ECB has let slip during a panel organized by the World Economic Forum. Rates are expected to fall as early as this year. What will be the impact on Bitcoin?

Summer Rate Cut?

In response to whether Goldman Sachs is right in predicting the first rate cut in April, the governor was quite talkative this Tuesday:

“In the absence of a major surprise in the Middle East, our next monetary policy change will be a rate cut, probably this year, but I will not tell you the season.”

Christine Lagarde has anyway let the cat out of the bag today, speaking to Bloomberg, by stating that the ECB will probably start to lower rates this summer. This bodes well for bitcoin…

François Villeroy de Galhau has, however, revealed that the ECB will not lower rates as much as they were between 2015 and 2022 [0%]:

“The new normal will not be the abnormality we experienced from 2015 to 2022; I think that’s an important message. […]

“This new normal will probably depend on two economic variables. First, the medium-term inflation expectations could be higher than those of the past few years. And this because of the famous three Ds: Deglobalization, Demographics, Decarbonization. […]

The second economic variable is the value of what is called the neutral interest rate. We don’t know exactly what this rate is, but we know that it stopped declining for the first time in 20 years. For the eurozone, we estimate that the neutral rate is around 0%. […]

This means that if we take these two variables into consideration, […] our benchmark rate could average around 2% over the entire next cycle”.

For your information, the neutral interest rate (also called R-Star in economic jargon) refers to the benchmark rate which, once inflation is accounted for, neither stifles economic growth nor accelerates it.

No Monetary Easing for Bitcoin in 2024?

Given the latest developments in the Middle East, including the blockade of the Bab-el-Mandeb Strait, we indeed need to be cautious.

Attacks on merchant ships with ties to Israel have doubled the price of container shipping. Routing through Africa pushes the cost to $10,000 for a 12-meter container from Asia to the Mediterranean Sea, versus $1,000 under normal circumstances.

Even the price for a container on its way from Asia to the US West Coast has nearly doubled.

“The Red Sea crisis has driven up transportation costs and indirectly freight rates to the United States,” said Kang Shuchun, director of the Chinese Federation of Logistics and Purchasing to the Global Times this Tuesday.

Let’s also remember that Yemen has threatened to strike Saudi petroleum infrastructure. This wouldn’t be the first time. Production of 5.7 million bpd was halted for several weeks in 2019 following a drone attack.

All this to say that the ECB and the Fed will postpone their rate cuts if inflation rises again.

Quantitative Easing (QE) is also an important variable. Deputy Managing Director of the IMF Gita Gopinath indeed stated at the same panel that “QE should be used less frequently than it has been in the past.” The French governor did not seem to agree…

While waiting for the inevitable rate cut, ETFs and the Bitcoin halving should be enough for Bitcoin to reach new highs.

Maximize your Cointribune experience with our 'Read to Earn' program! Earn points for each article you read and gain access to exclusive rewards. Sign up now and start accruing benefits.

Click here to join 'Read to Earn' and turn your passion for crypto into rewards!

A

A

Bitcoin, geopolitical, economic and energy journalist.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.