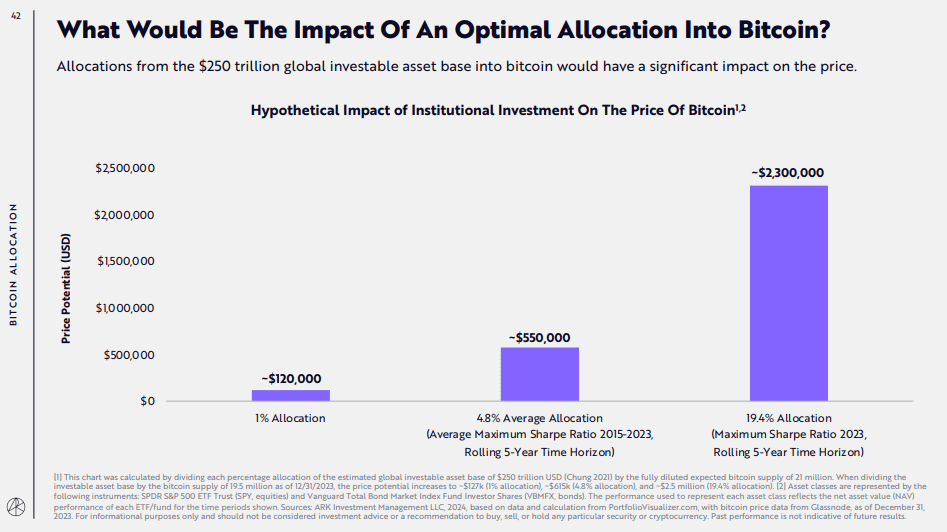

Ark Invest released the Big Ideas 2024 report: The optimal allocation proportion of Bitcoin in the investment portfolio in 2023 is 19.4%, while it was only 0.5% in 2015; globally, if 1% is allocated to Bitcoin, the price potential of Bitcoin reaches $120,000, 19.4% is allocated,…

— Wu Blockchain (@WuBlockchain) February 1, 2024

A

A

Bitcoin at $2.3 billion: ARK Invest persists and confirms!

Thu 01 Feb 2024 ▪

4

min read ▪ by

Getting informed

▪

The SEC gives the green light to Bitcoin Spot ETFs, and it’s a gold rush for bitcoins orchestrated by the magicians of financial assets. According to our counters, ARK Invest has managed to stack up 17,790 BTC so far. Cathie Wood, the mastermind behind the ARKB ARK 21Shares Bitcoin ETF, unveils her latest annual report, where she pulls out of her hat a BTC price forecast flirting with the 2 million dollar mark. Quite the spectacle!

A new Bitcoin ATH in sight thanks to ETFs?

The market prophets predicted that the SEC’s approval of Spot Bitcoin ETFs on January 10th would trigger a bullish frenzy for the queen of cryptos. But lo and behold, BTC only climbed briefly around the $49,000 mark before falling back below $40,000. General disappointment!

However, we concede that BTC trackers have accelerated the multiplication of bitcoins among the big whales of Spot ETFs such as BlackRock, Fidelity, Grayscale, and ARK Invest. And speaking of ARK Invest, their latest batch of nuggets reveals that the rules of the game have been completely turned upside down in the kingdom of institutional investors and their little BTC nest egg.

In this 163-page document titled Big Ideas 2024, ARK Investments dedicated 18 pages to the theme “Bitcoin Allocation” in which is highlighted responses to this question: “What would be the impact of a bitcoin allocation?“

Answer: “An allocation of 250 trillion dollars in investable assets into bitcoin would have a significant impact on its price.“

The chart above suggests that:

- 1% bitcoin allocation as a global investable asset allows for a BTC prediction of about $120,000;

- 4.8% average allocation rhymes with $550,000 per BTC (average maximum Sharpe Ratio of 2015-2023);

- and 19.4% BTC allocation equates to $2.3 million (maximum Sharpe Ratio of 2023, rolling 5-year horizon).

HODLing Will Always Pay Off

Here’s how ARK Invest’s experts view the long-term holding (or HODLING) of bitcoins.

“The volatility of bitcoin can mask its long-term returns. Significant appreciation or depreciation can happen in the short term, but a long-term investment horizon has been the key to investing in bitcoin. Rather than pondering ‘when,’ it’s better to consider ‘for how long.’ Historically, investors who have bought and held bitcoin for at least 5 years have profited from it, regardless of the date.“

It goes to show that HODLing pays off, even if it requires patience.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.