During the Qubic 2025 Hackathon in Madrid, a French team stood out among the best global talents. Under the name QuLang and supported by Frekaz Group, this delegation immersed itself for 48 hours in the demanding universe of Qubic, characterized by technical intensity, teamwork spirit, and decentralized ambition.

Bitcoin has once again crossed the symbolic threshold of 100,000 dollars, rekindling investor optimism. Analysts are now pointing towards a new historic peak beyond 110,000 dollars by the end of May. What are the factors driving this renewed confidence?

Ripple Labs and the U.S. Securities and Exchange Commission (SEC) are close to concluding their long-running legal dispute. The two parties have reached an agreement involving a $50 million settlement payment. The case, which has spanned nearly four years, centered on whether Ripple’s sale of XRP constituted an unregistered securities offering.

A flagship asset of the 21st century, bitcoin fascinates as much as it divides. While its price already defies traditional financial standards, some experts predict a surge towards one million dollars. Long considered marginal, these projections are now gaining traction in economic influence circles. Financial institutions, renowned investors, and regulatory figures are sketching a future where BTC could become an essential store of value in a world shaken by inflation, monetary distrust, and a rapidly accelerating institutional adoption.

Changpeng Zhao, also known as CZ, the former CEO of Binance, speaks directly to investors who panic during bitcoin corrections. As the flagship cryptocurrency reaches historical highs, his message resonates as a golden rule for jittery investors. How to keep calm when the markets are in turmoil?

Bitcoin is experiencing a spectacular surge, with over 344,000 new wallets created in just 48 hours. This explosion of adoption, fueled by the fear of missing out (FOMO), marks an unexpected return of a phenomenon often perceived as outdated. While the growing enthusiasm around BTC demonstrates renewed confidence, this dynamic also raises questions about the strength and sustainability of this rise, as well as its potential long-term repercussions.

Three years after the failure of Diem, Meta returns to the crypto universe. This time, the company is exploring the use of stablecoins to pay creators on its platforms. By betting on USDC or USDT, it is embracing a more flexible approach focused on adoption, stability, and global financial inclusion.

While Solana parades on X with memes, Ethereum, the immovable rock, endures. Institutions, on the other hand, prefer solid ground over buzz: the fortress holds strong, for now.

The Bitcoin DeFi ecosystem shows contradictory signals. The Rootstock platform records a spectacular increase in its network security in the first quarter of 2025, even as the total value of investments and user activity significantly decline.

BlackRock's Bitcoin ETF records 18 consecutive days of gains. A powerful bullish signal for BTC? Analysis.

The U.S. Senate rejected the GENIUS Act bill yesterday, which aimed to regulate stablecoins. With a vote of 48 against 49, far from the 60 votes needed, this bipartisan legislation faced unexpected opposition from Democrats, jeopardizing the regulatory future of dollar-backed cryptos. But what are the real reasons behind this legislative failure?

Morgan Stanley estimates that bitcoin is now significant enough to be considered an international reserve currency.

The bitcoin market has recently freed itself from its winter timidity. Fueled by a resurgence of optimism in financial markets, it has reached its highest level since January. Good news is piling up: an unexpected trade agreement, rising global indices, and a massive influx of digital capital. This combination of factors creates fertile ground for bitcoin.

AI in crypto: an impressive breakthrough! AI DApps challenge the leaders of Web3. Analysis of the figures from DappRadar.

In Dubai, a unique initiative is shaking up Web3 norms. The crypto exchange Bitget is teaming up with SWEAT, the pioneering ecosystem of the movement economy. Goal: turn daily walking into digital purchasing power. An unexpected bridge between the physical world and decentralized finance, unveiled at the Dubai Esports Festival.

Donald Trump, master of political staging, found himself caught in his own game. Manipulated by a pro-XRP message, he unwittingly becomes the main actor in a crypto lobbying operation. An explosive affair where political influence and blockchain interests clash in a scandal at the top.

It is rare for an NFT project to still create an authentic thrill in the crypto universe. Yet, Doodles has just made a splash. In just 24 hours, this colorful collection saw its sales soar by 97%, flirting with $1.1 million. This surge is no coincidence: on the horizon, a certain crypto DOOD is tantalizing investors.

The U.S. Office of the Comptroller of the Currency (OCC) has confirmed that banks can now help customers buy and sell crypto assets held in custody. They are also allowed to provide and outsource cryptocurrency custody and execution services, provided these activities are backed by strong risk management.

Arizona makes a significant move in the emerging world of digital assets. In May 2025, the state makes headlines by announcing the creation of a strategic bitcoin reserve (SBR). This bold decision demonstrates an unprecedented political will. It illustrates how dollars forgotten by citizens can be transformed into a forward-looking position. More than just a symbolic gesture, it represents a step toward the integration of bitcoin into the dominant economic landscape.

The crypto greenback is waging its war: while rivals battle in plain sight, USD1 climbs the rankings, propelled by the Trumps and boosted by billions.

The former CEO of Celsius, Alex Mashinsky, has been sentenced to 12 years in prison for fraud by a federal court in New York. A surprising decision, at a time when Donald Trump begins his second term with several presidential pardons granted to major figures in the crypto sphere. While markets were predicting a light sentence, this conviction shows that certain red lines will not be crossed.

The crypto market surged on May 8, 2025, driven by a spectacular rise in Ethereum. In just a few hours, the asset jumped 22% to surpass $2,200, triggering a strong reaction throughout the crypto ecosystem. This rapid surge is a reminder of the market's reactive power and reignites speculation around the world's second-largest cryptocurrency.

A turning point has just been reached in the history of global assets. On May 8, Bitcoin surpassed Amazon in market capitalization, entering the top 5 largest valuations in the world. This milestone not only reflects market performance but also crystallizes the rise of a decentralized network against a giant of traditional tech. This clash between two economic visions redefines financial hierarchies and emphasizes the growing foothold of cryptocurrencies in global balances.

Volume on fire, traders on the lookout, SEC in ambush: XRP is stirring and taking off. Resistances are wavering, the rise towards $3 may be unfolding before our eyes.

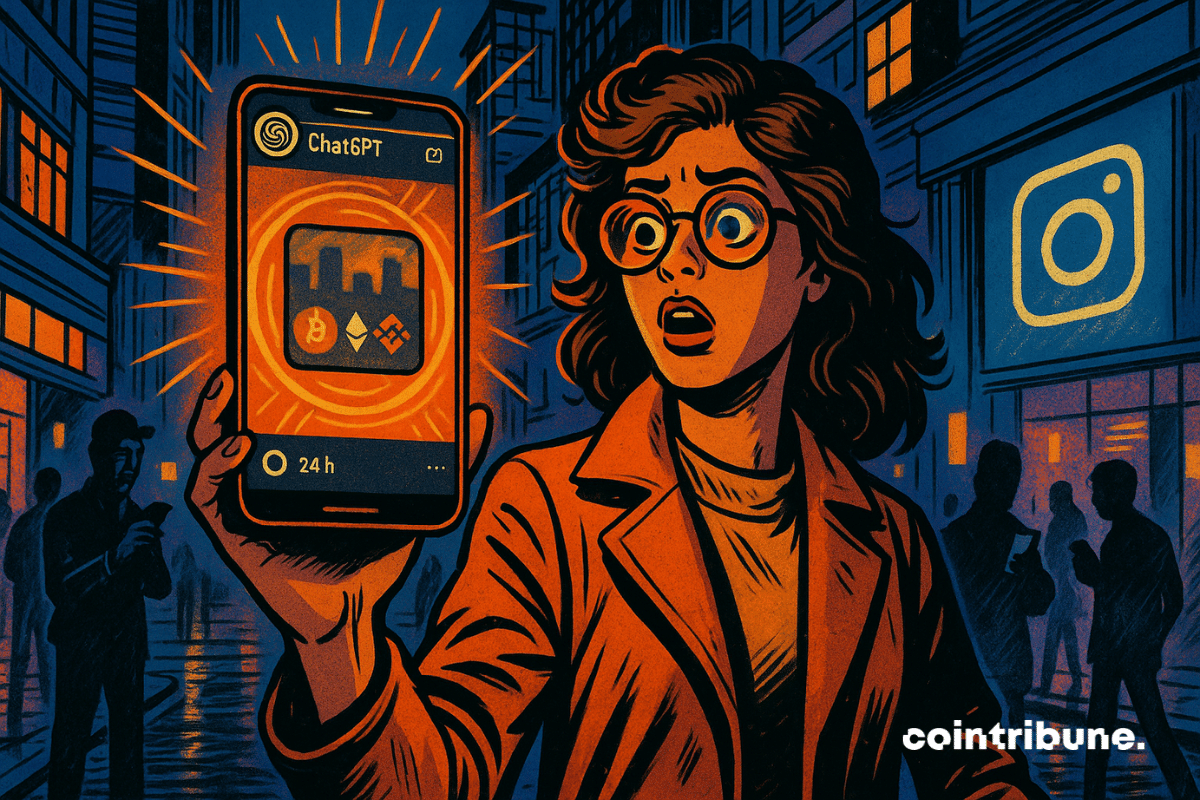

In an ecosystem where every signal can shift the market, an Instagram story is enough to sow chaos. On May 8, the official ChatGPT account published a link to a Pump.fun contract, a platform known for hosting ephemeral and highly speculative tokens. Thus, the effect was instantaneous: suspicions of hacking, doubts about intent, distrust toward official channels. When the most influential AI of the moment seems to point toward a questionable project, trust fractures and questions multiply.