Ten banks join forces to create Qivalis, a stablecoin designed for fast crypto payments in euros. Details here!

Banque

Bankers were pretending to ignore crypto; now they dive in completely, renaming stablecoins as "infrastructures." PwC rejoices: the future is already tokenized.

Donald Trump accuses JPMorgan of having closed his accounts for political reasons and demands 5 billion dollars before the Florida courts. By directly targeting CEO Jamie Dimon, the president reignites the explosive debate on "debanking," a practice that fuels tensions between the political and financial spheres. This case questions the neutrality of major American banks. While Trump denounces ideological exclusion, JPMorgan, on its side, rejects any accusation of discrimination.

In Davos, the head of Circle promises that stablecoins will not blow up banks. What if crypto became the secret weapon... of AI? Allaire swears no, or almost.

Société Générale, through its subsidiary SG-Forge, and the SWIFT network have just taken a major step forward in integrating blockchain with traditional finance. Together, they executed the settlement of tokenized bonds using a stablecoin backed by the euro, the EUR CoinVertible. This unprecedented experiment, compliant with the European MiCA framework, marks a key milestone towards concrete interoperability between classic banking systems and cryptos.

Morgan Stanley has never been the type to chase trends. So when the bank announces a digital asset wallet, designed for crypto but also for tokenized real-world assets (RWA), the signal is clear. Wall Street no longer just wants to “tolerate” the sector, it wants to hold the keys. According to Barron’s, this digital wallet is expected to launch in 2026 and aim, from the start, at a hybrid mix: crypto on one side, real-world assets (stocks, bonds, real estate) on the other.

The Bank of Japan tightens the screws, cryptos fall, but Bitcoin, that old trickster, attracts big fish. Social panic, full ETFs: explosive cocktail or flash in the pan?

New Trump splash: two pro-crypto figures take the reins of the CFTC and the FDIC. All the details in this article!

The Bank of Japan is about to break with three decades of accommodative monetary policy. An almost certain rate hike puts markets under pressure. Contrary to usual expectations focused on the Fed or the ECB, it is Tokyo that worries. For bitcoin, the prospect of a stronger yen and the drying up of the carry trade revives fears of a liquidity shock. In an already fragile market, this pivot could redefine short-term balances.

American banking giants are now playing the bitcoin card. Michael Saylor lifts the veil on a massive and silent adoption: eight of the ten largest banks offer loans secured in BTC. Figures, players, and stakes of a revolution that is disrupting finance.

Accused of closing crypto accounts linked to Trump, JPMorgan denies and denounces unfair rules. All the details here!

While some are still looking for the "send" button on their crypto wallet, Singapore is about to roll out tokenized bonds in CBDC. Should we expect a subtle revolution?

When crypto plays central banker, the Fed sweats under its suit. Stablecoins, hidden treasures, and plummeting rates: guess who really runs the world?

The Basel Committee's rules on cryptocurrencies could change the game in 2026. Between bank adoption of stablecoins and crypto integration, a financial revolution is underway. Are banks ready to take the leap? The answer could change everything for your investments.

Michael Saylor sees bitcoin soaring to the skies, Wall Street is converting... What if the crypto guru was still right despite geopolitical turbulence?

While cryptos wreak havoc in pockets and ideas, Francophone Africa plays a digital card... but wouldn’t this revolution have a little hint of the euro?

The Governor of the Bank of England, Andrew Bailey, emphasizes that stablecoins could play a key role in the transformation of the British monetary system. By stating that they can reduce the country's dependence on commercial banks, Bailey opens the way to a deep reflection on the future of money and credit in the United Kingdom.

Nine major European banks join forces for a simple and ambitious bet: a euro stablecoin, tailored for MiCA, designed from the start for on-chain uses. The consortium includes ING, Banca Sella, KBC, Danske Bank, DekaBank, UniCredit, SEB, CaixaBank, and Raiffeisen Bank International. First issuance targeted: second half of 2026.

Banks are screaming disaster, Coinbase responds with numbers: stablecoins do not swallow deposits, but happily crunch the $187 billion in banking fees.

On September 13, Binance Coin (BNB) crossed a symbolic threshold by briefly surpassing the market capitalization of the Swiss bank UBS. Such an event illustrates the rising power of cryptos against traditional financial institutions. Changpeng Zhao, co-founder of Binance, immediately reacted, calling on banks to "adopt BNB". As the crypto reaches a new all-time high, this statement revives the debate about the integration of native tokens in banking strategies in the era of decentralized finance.

The ECB freezes its rates, the FED is preparing to cut them... What if, in this monetary ping-pong, it was ultimately the real economy that served as the lost ball?

New project: a crypto bank could be launched in Russia. We deliver all the details in this article.

Trump pushes banks to love crypto. Yesterday demonized, today courted, the Web3 industry settles in the vaults of fiat. But who is really orchestrating this spectacular turnaround?

While most nations are still hesitant to take the step, Kazakhstan is accelerating. Its president, Kassym-Jomart Tokayev, has just announced the creation of a national cryptocurrency reserve, accompanied by a clear call to build a true ecosystem of digital assets. A bold decision for this Central Asian country, already a major player in global mining.

While some still dream of Bitcoin at $200,000, Mastercard slips the USDC under the rug and pays the bill in stablecoin... Quietly, but surely.

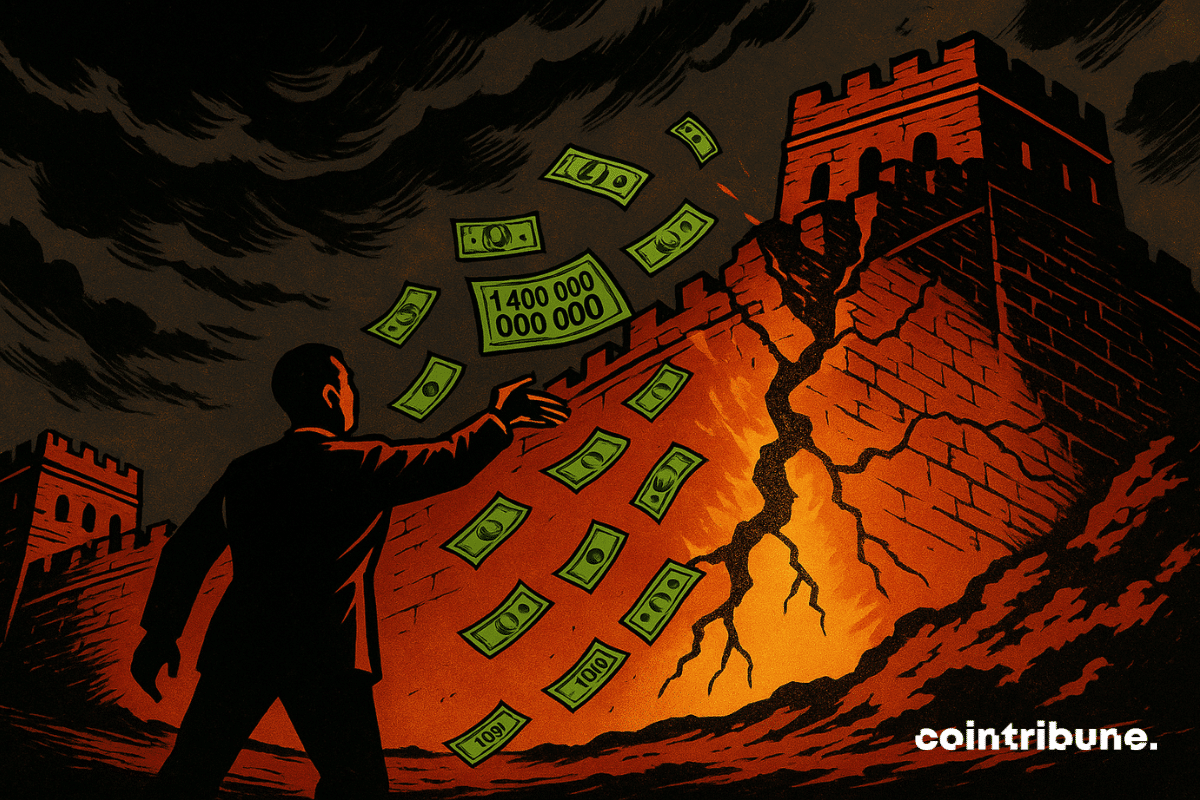

Faced with a wave of critical maturities on $4,000 billion of debt, Beijing launched an unprecedented monetary response. In August, the People's Bank of China injected $1,400 billion to avoid the suffocation of its bond market. More than an emergency measure, this intervention marks a strategic turning point in managing Chinese financial flows. In a context of global tensions, this technical gesture speaks volumes about Beijing's determination to maintain control over its economic cycle.

While Bitcoin and Ethereum monopolize attention, XRP is quietly establishing itself as one of the most strategic projects in the crypto landscape. Beyond speculation, some analysts mention an ongoing "historic wealth transfer." This bold statement reflects the alignment of key indicators: regulatory advances, banking integration, and technological performance. XRP, long in the background, could very well reshape global payment circuits.

Ripple wants to become a banker, XRP attempts a spectacular comeback, and Wall Street applauds. The once rebellious crypto is settling into the plush chairs of regulators. How far will it go?

The BIS stands up to defend the Fed. Can the economy withstand a monetary crisis? The details in this article!

While Americans pamper stablecoins, the Bank of France bares its teeth: crypto, dollar, and sovereignty do not mix well for the guardians of the monetary temple.