🔴🇨🇵RÉCAP – Hausses des prix sur 2 ans :

— Brèves de presse (@Brevesdepresse) January 24, 2024

– Électricité : +44%

– Beurre Président 250g : +41,9%

– Papier toilette Lotus : +33,3%

– Yaourts Danone nature : +32,9%

– Huile Lesieur 1L : +29,6%

– Inflation alimentation +20,5%

– Complémentaires santé : +17,1%

– Péages : +7,8%

– …

A

A

Will the ECB really lower interest rates this summer?

Fri 26 Jan 2024 ▪

3

min of reading ▪ by

Getting informed

▪

Invest

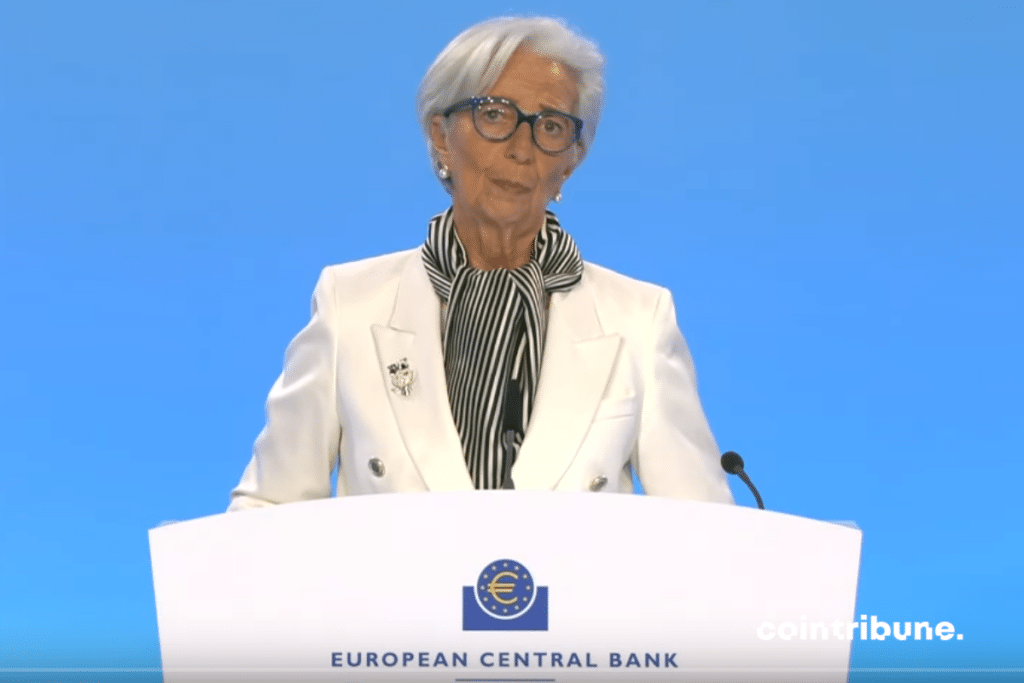

Christine Lagarde has tempered expectations regarding a rate cut this summer, particularly pointing to tensions in the Middle East.

New Wave of Inflation in 2024?

Christine Lagarde did not elaborate further on her confidential remarks made at Davos, stating that the ECB could lower rates as early as this summer.

The President of the ECB even specified that the question of a rate cut had not been discussed. The issue might be considered in March, when the governors have the latest economic projections at their disposal.

But as it stands, the ECB does indeed anticipate a return of inflation to around 2% in the coming months. Unless geopolitical tensions decide otherwise.

Currently, the annual inflation rate is 2.9% in the Eurozone. It remains at 6.1% regarding food products. Here is where we stand over a two-year period in France:

Inflation is slowing down, but prices are not falling. We have to look back to the 1950s to find an annual decline in prices. The system is designed this way. It’s a Ponzi scheme which, in the absence of productivity growth (requiring cheap energy), results in more or less strong inflation…

In response to the question of whether the increase in maritime freight rates could halt the rate cut, Christine Lagarde showed skepticism. “Maritime freight only accounts for 1.5% of the final price of transported goods,” she said.

True, but the cost of transport is much higher for food than for high-tech products like smartphones. Therefore, the impact on the poorest will be significantly higher than 1.5%.

The former IMF President, however, expressed concern over the price of oil and gas. Indeed, Yemen is now threatening to close the Strait of Hormuz through which 20% of the world’s oil production passes.

Considering that most of the oil consumed in Europe passes through it, as well as large quantities of gas due to the embargo against Russia.

In other words, probably do not count too much on a summer rate cut on the old continent. This bullish factor for bitcoin is postponed to a later date.

No matter, ETFs, the halving, and the ECB’s concerns about bank runs will be enough to persuade millions more people to place their savings in bitcoin.

Maximize your Cointribune experience with our 'Read to Earn' program! Earn points for each article you read and gain access to exclusive rewards. Sign up now and start accruing benefits.

A

A

Bitcoin, geopolitical, economic and energy journalist.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.