Bitcoin, Binance, Ethereum, Solana and Ripple: The biggest crypto news from last week

From groundbreaking announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of boundless innovation and a battlefield of regulatory and economic struggles. Here’s a summary of the most notable news from the past week surrounding Bitcoin, Ethereum, Binance, and Solana, etc.

The creator of Ordinals unveils a dark truth about Bitcoin!

The creator of the Bitcoin Ordinals protocol, Casey Rodarmor, has recently lifted the veil on a major concern regarding the decentralization of Bitcoin mining. According to Rodarmor, several mining pools, once perceived as independent, are now predominantly controlled by the giant AntPool, calling into question the decentralized nature of the Bitcoin network. These allegations are supported by data from Blockchain.com, which indicates that the AntPool and Foundry pools control a substantial share of Bitcoin block production. Rodarmor suggests the Stratum V2 protocol as a solution, which would increase individual miners’ autonomy in transaction selection, although widespread adoption of this system is facing resistance from dominant industry players.

In the face of this growing centralization, the Bitcoin community is divided between those who defend partial centralization as a necessary evil for the network’s survival and those who advocate for radical reform to preserve Bitcoin’s original decentralized integrity. Rodarmor’s proposal, although supported by key developers, faces technical challenges and reluctance from major mining entities, endangering the vision of a network truly resistant to any form of centralized censorship.

ConsenSys sues the SEC to defend Ethereum

ConsenSys, a major player in the Ethereum ecosystem, has launched legal action against the US SEC, accusing the regulator of overstepping its authority by attempting to regulate Ethereum as a security. The 34-page complaint, filed in a federal court in Texas, challenges the legitimacy of the SEC’s authority over Ethereum and argues that this could paralyze the use of the blockchain in the United States. This legal action comes in response to a Wells notice issued by the SEC, which threatened prosecution for MetaMask’s role in ETH staking.

The situation is tense, with figures like SEC Chairman Gary Gensler intensifying regulatory actions against crypto assets and targeting numerous crypto ecosystem companies like Uniswap Labs. The ConsenSys battle to defend ETH’s status is crucial for the future of the blockchain, as it could define the regulatory framework applicable to cryptocurrencies in the US. The outcome of this lawsuit could have a significant impact on blockchain innovation and adoption.

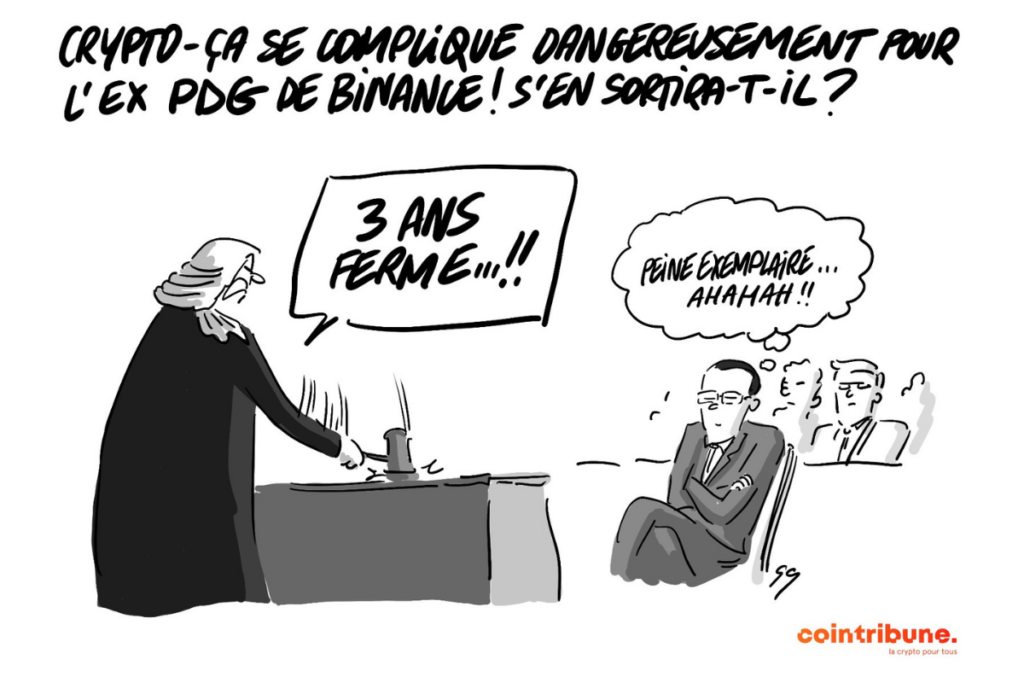

Things get dangerously complicated for the former CEO of Binance!

Changpeng Zhao, the former CEO of Binance, faces an increasingly precarious legal situation with the US Department of Justice (DOJ) now seeking a three-year prison sentence against him. According to the DOJ, Binance allowed money laundering and funded various illicit activities through its platform, thus exploiting a regulatory void and facilitating transactions related to the black market and scams. This increase in the potential sentence reflects the seriousness with which US authorities view these violations and aim to make this case a deterrent example for the entire crypto industry.

While earlier statements suggested a rather favorable legal situation for Zhao, the current turnaround with a request for a more severe sentence marks a potentially significant turning point.

Bitcoin VS Gold: Crypto takes the lead with minimized inflation!

Bitcoin has reached a new significant milestone in terms of inflation following its fourth halving, where the reward for each mined block dropped from 6.25 BTC to 3.125 BTC, thus limiting daily production to only 450 BTC. This reduction has lowered Bitcoin’s annual inflation rate to just 0.85%, compared to gold’s 2.3%, positioning Bitcoin as a potentially more stable store of value and less prone to inflationary erosion than gold. With its advantages of divisibility and portability, Bitcoin is also increasingly considered a modern and viable means of exchange.

Bitcoin’s inflation reduction should have a notable impact on the crypto market, by enhancing its capability to preserve value over time. This might lead to an increase in trading volumes and broader adoption by investors and financial institutions who see it as an attractive diversification asset. Nevertheless, it is important to keep in mind that Bitcoin remains subject to significant volatility, which could continue to affect its price.

Institutional demand skyrockets for Solana

Solana (SOL) has witnessed a spectacular increase in demand among institutional investors, according to a recent survey by CoinShares. The study revealed that nearly 15% of the surveyed fund managers, who collectively manage 600 billion dollars of assets, have incorporated Solana into their portfolios, marking a clear increase from previous years where Solana was not as present. This growing popularity is attributed to Solana’s technological advances and increasing market visibility, making it an increasingly viable alternative to Bitcoin and Ethereum.

The rising interest in Solana is part of a broader context where altcoins are gaining ground as valid investment options. Fund managers see Solana as having high growth potential, with a record of 3% of average assets allocated to digital assets, up from only 12% previously. This increased adoption comes as investors increasingly look to diversify their portfolios with innovative technologies, although future progress will largely depend on regulatory developments and overall economic conditions.

Binance loses over 30% of its market share in one year!

Binance, once dominating the cryptocurrency exchange market with 81% of shares, has experienced a significant decline, now controlling only 55% of global volume. This market share loss comes in a context of increased competition from platforms like OKX and Bybit, which have upped their market share by 4.3% and 2.2% respectively. Furthermore, a significant transfer of assets from Binance to other platforms, such as Coinbase, is observed.

The challenges for Binance are not limited to increased competition, but also extend to regulatory affairs. With accusations and lawsuits affecting its reputation, along with a 4 billion dollar fine paid last year, the platform is under pressure. This situation is complicated by legal entanglements of its founder, Changpeng Zhao, who faces a possible three-year prison term. Despite these challenges, Binance remains a major platform, noted for its reliability and security, and continues to dominate an evolving crypto market.

Bitcoin: A Swiss referendum for the crypto adoption by the central bank

In Switzerland, Bitcoin advocates are mobilizing for a second attempt to integrate cryptocurrency into the national reserves of the Swiss National Bank (SNB). This initiative, led by Yves Bennaïm and other influential figures such as Luzius Meisser, seeks to reinforce Switzerland’s financial independence and neutrality against major fiat currencies and foreign central bank influences. An initial attempt in 2021 failed to gather enough signatures to trigger a referendum, but Bitcoin supporters have returned with reinforced economic arguments, claiming that early adoption could have increased Switzerland’s national wealth by 32.9 billion dollars.

The debate regarding the integration of Bitcoin into the SNB’s reserves is fueled by international developments, such as the approval of Bitcoin-based ETFs in the United States and Hong Kong, which show an increasing integration of cryptocurrency into traditional financial systems. Proponents of the proposal hope that Bitcoin’s integration could help Switzerland maintain its financial sovereignty in a world where cryptos play an increasingly central role.

That’s the essentials to remember for this week. But if you want a more detailed recap and in-depth analysis directly in your inbox, please do not hesitate to subscribe to our weekly newsletter.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.