France is taking a major step in modernizing its financial markets with the launch of the Lightning Stock Exchange (Lise), a fully tokenized equity platform designed for small and medium-sized enterprises (SMEs). Backed by leading French banks and armed with a new regulatory license, Lise aims to bring blockchain efficiency to traditional stock listings and reshape how companies go public.

Europe

What if Europe finally disrupted the established order of stablecoins? Oddo BHF launches EUROD, a 100% euro stablecoin, challenging the dollar's dominance in crypto. A financial revolution underway! Discover the stakes and challenges of this innovation that could change everything.

MiCA was meant to secure the crypto market in Europe, but some actors still bypass the rules. Forum shopping, abusive reverse solicitation, compliance gaps: discover how these practices threaten your money and European financial integrity. #MiCA #Crypto

Less than two years after the entry into force of MiCA, the ambition of a unified European framework for cryptos is faltering. Amid national divergences, institutional criticisms and tensions over passporting, the European Union struggles to deliver the promised coherence. And now, ESMA is advocating to take back control, at the risk of reigniting tensions between Brussels and national regulators.

Bitcoin Reserve: Sweden could join the countries that store crypto to prepare for the monetary future. Details here!

When Christine Lagarde brings down the regulatory hammer, even the crypto giants tremble. The digital euro advances masked but clearly targets stablecoins too comfortable in Europe...

While Europe accelerates towards digital payments and prepares the digital euro, the ECB creates a surprise. It recommends keeping cash at home. This injunction reveals a reality too often overlooked in official speeches: the fragility of digital systems in the face of crises. Such a deliberate return to cash does not mark a step backwards, but a clear anticipation of systemic risks, between outages, geopolitical tensions and cyberattacks.

The battle around "Chat Control" goes far beyond a simple technical issue. Behind this controversial law that the European Union is trying to pass is the very definition of digital privacy at stake. Vitalik Buterin, a major figure in crypto, has chosen to oppose it head-on, warning of a project with potentially explosive consequences.

Nine major European banks join forces for a simple and ambitious bet: a euro stablecoin, tailored for MiCA, designed from the start for on-chain uses. The consortium includes ING, Banca Sella, KBC, Danske Bank, DekaBank, UniCredit, SEB, CaixaBank, and Raiffeisen Bank International. First issuance targeted: second half of 2026.

When cryptos become mirages, scammers become experts: 100 million stolen, 23 countries affected, 5 crooks arrested. And meanwhile, Bitcoin looks elsewhere, impassive.

Europe’s digital euro may not be ready for mainstream use in the near or medium term, according to ECB Executive Board member Piero Cipollone. Despite recent progress in discussions and political negotiations, Cipollone noted that mid-2029 remains the most realistic timeframe for a launch, as key technical decisions are still pending.

Promised for 2026, the digital euro is already causing waves: Lagarde sees sovereignty, Navarrete calls it a useless gadget, and banks fear a digital bank run.

Chat Control wants to scan your messages "to protect." Result? Berlin hesitates, Brussels is confused, and Web3 grabs the popcorn: when Big Brother inspires decentralization.

In Albania, ministers are trembling: an AI named Diella enters the government. Promised transparency, shaken democracy… and the opposition pounds their fists like in a theater.

As the conflict in Ukraine drags on, the European Union opens a new front: that of cryptos. For the first time, Brussels plans to directly sanction crypto platforms, integrating these decentralized infrastructures into its economic measures against Moscow. A discreet but strategic shift, integrating cryptos into the realm of international pressure tools.

Fitch has downgraded France's sovereign rating from AA- to A+, mainly due to governmental instability and difficulties in reducing the public deficit. This situation reveals the failure of the French government, but also massive interventions by the European Central Bank (ECB).

France threatens to block the MiCA passport for certain crypto companies deemed too lenient. Towards stricter regulation in Europe?

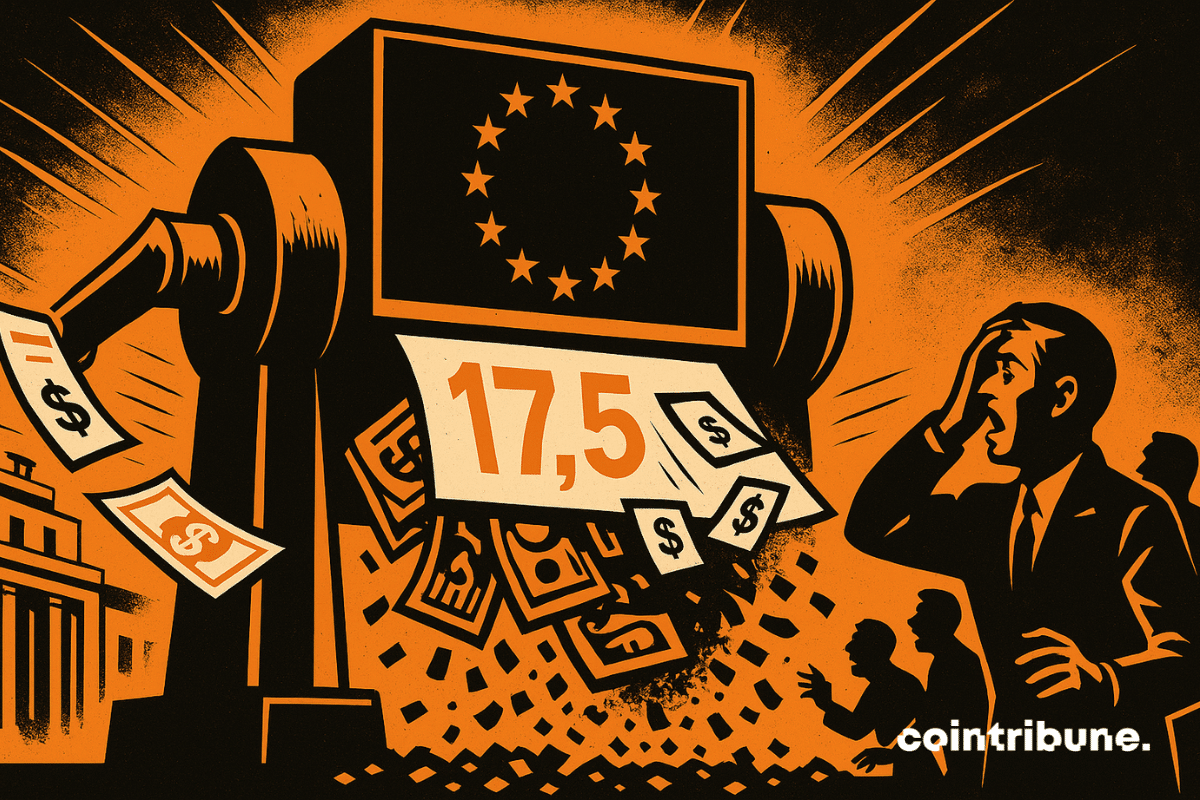

European regulators are targeting $17.5 billion of cat bonds held in UCITS funds. ESMA considers these securities, exposed to natural disasters, too complex and risky for retail investors. If the European Commission follows this recommendation, a wave of forced sales could shake an already strained market.

As the war in Ukraine enters a critical phase, Donald Trump throws a wrench in the diplomatic pond. The American president stated that no new sanctions against Moscow would be taken as long as NATO countries continue to buy Russian oil. This statement exposes the persistent fractures within the Alliance and revives the question of its strategic coherence towards Russia.

The ECB freezes its rates, the FED is preparing to cut them... What if, in this monetary ping-pong, it was ultimately the real economy that served as the lost ball?

While OpenAI blazes at 500 billion, the start-up Mistral inflates its sails to 11.7 billion. Cocorico or European mirage? AI has found its Gaulish rooster.

Crypto exchange Bybit officially launches its payment card in the European Economic Area with an exceptional welcome offer of 20% cashback. An aggressive strategy to conquer the European crypto payments market.

Bybit, the world’s second-largest cryptocurrency exchange by trading volume, is advancing its European expansion. Bybit EU Group took this next step with the formal application submission for a license under the Austrian implementation act of the Markets in Financial Instruments Directive (MiFID II) through one of its Austrian entities, Bybit X GmbH.

The European Central Bank intensifies its communication around the digital euro. Piero Cipollone, board member, presented new arguments in favor of the project to the European Parliament. Will the ECB manage to rally users who are still largely detractors?

Tokenized stocks captivate the crypto world, but ESMA warns of risks of confusion for investors. Details here!

Institutional-grade technology will enhance the integrity of the world’s second-largest cryptocurrency exchange. The surveillance platform combines advanced pattern analytics with comprehensive market data to meet MiCAR obligations.

It's not just Bayrou's France that is struggling. Europe is going through a systemic crisis that the ECB's printing press can no longer solve. Despite years of massive injections, the eurozone is sinking into a vicious circle of stagnation and unsustainable debt. It seems that this time, unlike 2008, the ECB can no longer save Europe from the crash.

In the midst of geopolitical reshuffling, the European Union and the United States have just ratified a trade compromise presented as a bulwark against escalation. Supported by Ursula von der Leyen, but strongly criticized by Mario Draghi, the text crystallizes a European dilemma: guaranteeing transatlantic stability or fully defending the continent's industrial interests. Between diplomatic balance and tariff concessions, this new agreement revives the debate on Europe's economic sovereignty.

Unknown to the general public but omnipresent behind the scenes of power, Palantir works with governments and multinationals by exploiting data. Valued at over 400 billion dollars after a 2000% increase since 2023, it represents either the investment opportunity of a generation or the next speculative bubble ready to burst.

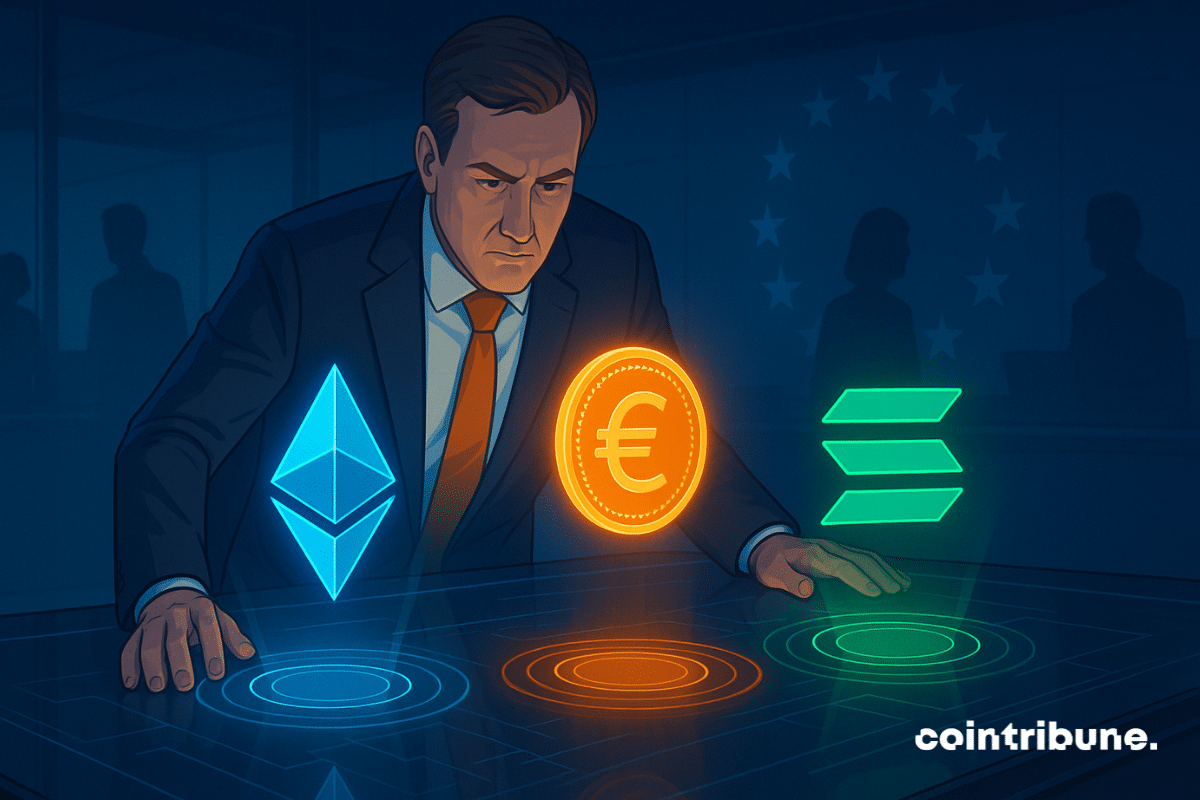

The European Union is considering anchoring its future digital euro on public blockchains like Ethereum and Solana, according to Financial Times revelations. This choice would mark a major break from centralized approaches, like China, and could redefine the balance of monetary sovereignty in Europe.