Investors are rushing towards memecoins as major cryptocurrencies face financial difficulties.

US Federal Reserve (FED)

The famous bitcoiner and entrepreneur Balaji Srinivasan has just published a diatribe against the United States. According to him, the federal government is on the verge of bankruptcy and being swallowed by trillions of dollars in debt. Faced with such a crisis, the Fed would activate the largest money-printing policy in American history to divert money from taxpayers.

At the San Francisco conference, Jerome Powell confirmed that interest rates would remain unchanged until the inflation situation improves. This announcement is weighing on the crypto market, with Bitcoin falling by 1.35% in one hour.

The FED meeting could shake up the Bitcoin market. A crucial decision on interest rates will shape the future of the crypto sector.

The American Congress could validate the holding of crypto in banks. This would promote widespread adoption of bitcoin.

The Fed surprises with rate cuts in view, while volatility reigns in the crypto markets.

According to Peter Schiff, a monetary tightening aimed at bringing inflation to 2% would cause the collapse of the US financial system. The Fed finds itself facing a dilemma between price control and support for growth.

The inflation data will be released this Tuesday! It will determine whether Bitcoin can continue its upward recovery or not.

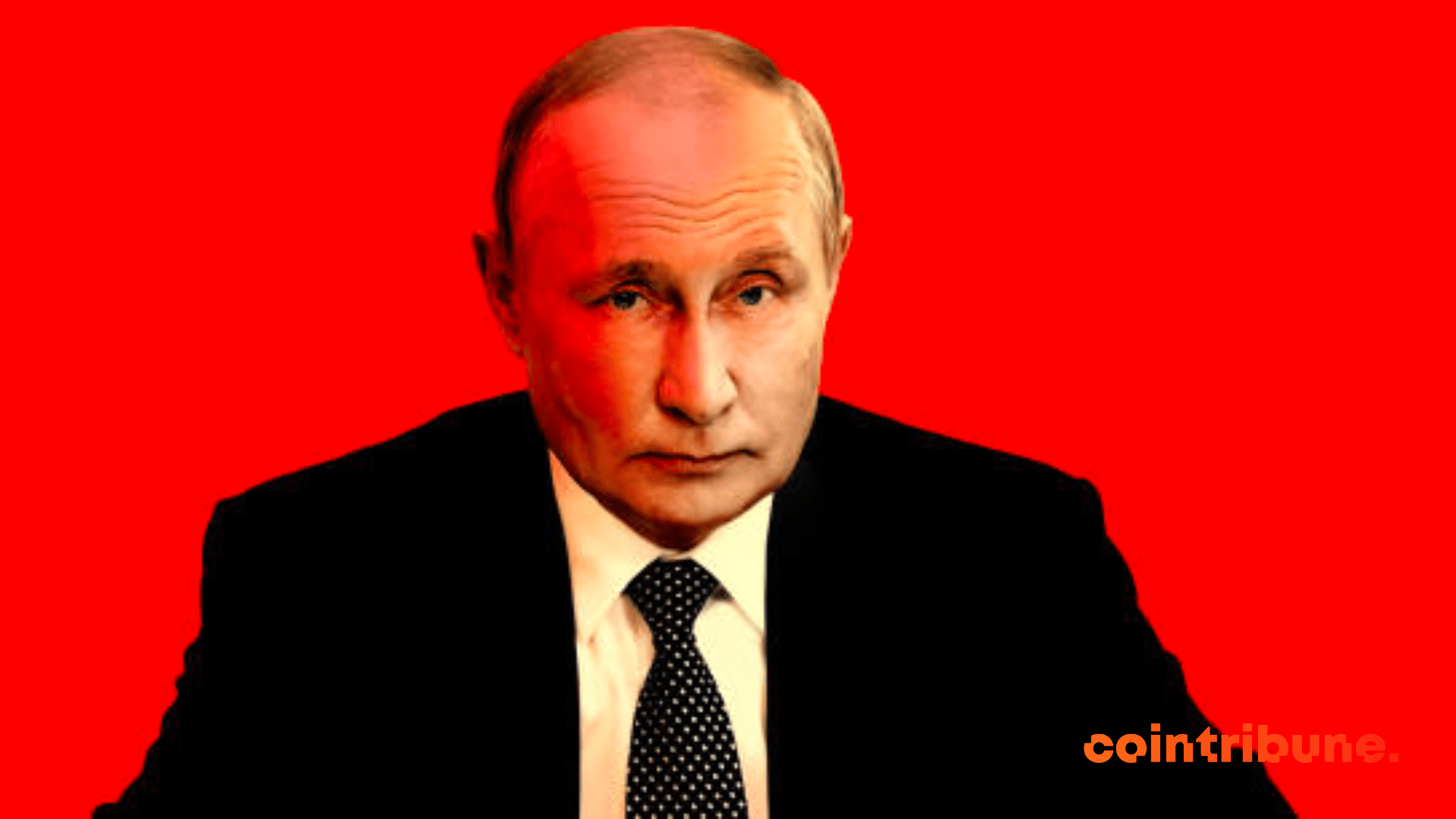

Tucker Carlson, the former Fox News journalist and potential future vice-president of Donald Trump, recently visited Russia to interview Vladimir Putin. This exciting interview comes at a time when Donald Trump has reaffirmed his desire to dismantle NATO and even encourage Putin to invade Europe. Should we expect a Polish invasion by Putin, 80 years after Adolf Hitler?

As their popularity continues to grow, stablecoins, these cryptocurrencies backed by traditional currencies, worry the FED. Why

The recent optimism on Wall Street regarding stocks suggests a possible rebound for cryptocurrencies in the near future.

SOL, down 10.7% in a month, struggles to surpass $104, raising persistent questions.

The next decision from the Fed on interest rates could significantly influence the price of Bitcoin.

The famous economic analyst Noah Smith recently wrote an exciting article about bitcoin. He mentions the recent approval of ETFs by the SEC and the secret interests of certain bitcoiners. His thesis is striking: there would be an increasingly powerful Bitcoin lobby that would act in the shadows to create monetary chaos in the world.

During his campaign, Trump opposes the CBDC, claiming that it would give "absolute control over your money" to the federal government.

A reduction in the Fed rates in 2024 could encourage crypto investors to turn to DeFi returns and stablecoins.

Iran has recently called on the BRICS to establish a common currency to replace the dollar. This challenge to the dollar by Iran, but also increasingly by Saudi Arabia, explains why the Americans want to put an end to the Iranian regime. The end of the petrodollar would no longer allow the United States to finance its monstrous deficits through other countries.

It seems that everything is coming together for Bitcoin to have an explosive year in 2024. This week has been more significant than most others in terms of the state of the markets. Two major events happened simultaneously with the release of the latest inflation data and the December meeting of the Federal Reserve, which announced plans for a rate cut.

In the ever-shifting world of finance, a recent event has sparked excitement in the Bitcoin universe: the United States Federal Reserve has announced a significant interest rate cut by 2024. But how has this news ignited the cryptocurrency market? Let us embark on this financial adventure together, where numbers dance and cryptocurrencies soar!

All the pieces are falling into place one after another. Bitcoin ETF, Halving, new accounting standards, and now the Fed.

The brilliant bitcoiner and entrepreneur Balaji Srinivasan has just published a scathing critique of the American state in its handling of the FTX case. According to him, the SBF case reveals the immense level of corruption within the establishment.

Everyone is eagerly waiting for the FED to start lowering its rates (pivot). That's what traders are betting on.

In the face of a diverging path of U.S. dollar inflation from its usual trajectory, the United States Federal Reserve (FED) finds itself in a delicate situation. While the digital dollar project seemed to be the first line of defense, the FED now appears to be turning to a 'Plan B': the tokenization of real-world assets (RWA). Why such a pivot, and what can be expected from it?

As the SEC continues its hunt for crypto exchanges, the United States has decided to put the potential of stablecoins at the service of its economic policy. This is what can be deduced from a speech by U.S. Federal Reserve Chairman Jerome Powell, who acknowledges that stablecoins are a form of currency. Where does this sudden interest in stablecoins come from?

Inflation has been galloping for almost two years, mainly due to the profligacy of central banks. Since then, central banks have turned around and become a little more vigilant. Nevertheless, they face a colossal dilemma: the peril of debt or the peril of inflation. It's reasonable to assume that central banks will react this time, as they have every other time: by rearming their monetary bazooka. If so, it could well be the return of happy days for bitcoiners. Let's talk bull run.

All the ingredients for a 2008-style recession are there, says American investor Jim Rogers. But if their peculiarities are anything to go by, the worst is yet to come.

Unlike other cryptos, stablecoins inspire relatively more confidence among users. This is due to the stability of their value, which correlates with that of a fiat currency. However, their monetary status had never been officially recognized. At least, until Jerome Powell, Chairman of the US Federal Reserve (Fed), did so. Is this a turning point?