Amid alarming inflation, a new trend is emerging in Turkey: more than half the population is now embracing cryptocurrencies as a financial haven. Here's an overview of this transformation.

Cryptoactif

As the crypto sector continues to evolve at dazzling speed, Binance, the crypto trading giant, once again appears to be at the forefront of innovation. With the launch of ColLabs by Binance Labs, the promise is bold: to transform the way investors perceive and interact with the Web3 ecosystem.

In the impenetrable crypto sector, every decision, every action carries weight, especially when it emanates from the most influential entity on the globe: the United States. PeckShieldAlert's recent investigation is causing quite a stir: the US government, so critical of crypto, is actually one of bitcoin's biggest holders.

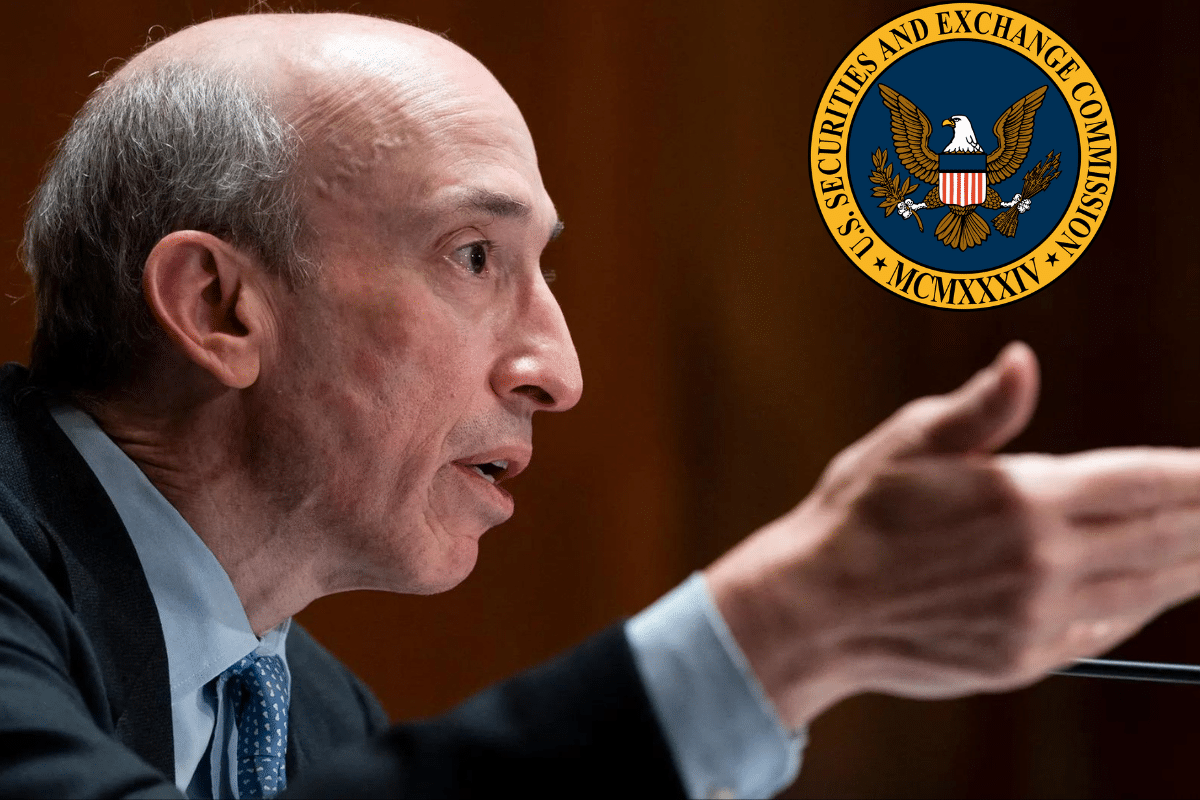

The ever-changing crypto arena recently witnessed a major victory for Grayscale, marking a significant rout for the SEC. At the heart of this event, two giants of the cryptosphere, Ripple and Coinbase, scan the horizon with renewed confidence.

The crypto sector is evolving at a relentless pace. Technological upheavals and major market players are constantly shaping the financial landscape. Among these players, Binance is undeniably one of the titans. And recently, its involvement in the Lightning Network has become a hot topic of discussion.

Over the past few days, Binance has been at the center of a whirlwind of events, including the suspension of SEPA transfers. Today, the platform is bidding farewell to over 60 crypto trading pairs. What are the reasons behind this decision?

At the intersection of technology and finance, digital assets and blockchain are emerging as inescapable forces shaping our future. Indeed, from one sector to the next, these technologies are finding more relevant and innovative applications than ever before, promising a freer, more personalized future. But given current trends, what can we expect from the blockchain and crypto industry in the next 3 years? We've investigated the question for you.

Despite an unstoppable bear market, bitcoin (BTC) is still attracting investors. This infatuation with the flagship crypto is no accident. It's based on the financial relevance the asset has built up over the 14 years of its existence. A period during which the asset has seen its lows. The asset's lowest valuation was $0.001, its first estimated value in October 2009. The flagship crypto has also experienced highs. In November 2021, the price of bitcoin reached a valuation of $69,992. This figure remains, by far, the highest ever reached by bitcoin since it came into existence. Will the leading cryptocurrency return to this level again? Indeed, bitcoin seems to be facing a glass ceiling. Benefiting from the dynamics of the crypto market, the asset has twice reached a price of $30,000 this year. A level that the flagship crypto was subsequently unable to break through. Yet many players in the crypto industry don't seem to trust these trends. Indeed, many of them have repeatedly expressed their optimism in this regard. They believe that, given current economic and financial conditions, the price would explode. Could this be the reason why many asset managers are scrambling to buy as many bitcoins as possible? Find out below.

In the digital whirlwind of our age, instantaneity is king. X, in its quest to redefine payments, turns to the glittering promise of cryptocurrency. Together, they could forge the future of online transactions.

Elon Musk, the owner of Twitter, recently renamed X, is deeply involved in the crypto industry. His infatuation with Dogecoin is an open secret. But the billionaire's ambitions for crypto appear to be much bigger.

In the midst of the U.S. presidential campaign, discussions are heating up around a variety of topics, including Bitcoin and cryptocurrencies, which are attracting a great deal of interest. Ron DeSantis, Governor of Florida and Republican candidate for 2024, is firmly in favor of cryptos. During his campaign tour of New Hampshire, DeSantis firmly promised to end Biden's “war on Bitcoin” and cryptos if he became president.

Cryptos are useful for those who invest funds in them. For some, it's a way of diversifying their asset portfolio. Others, on the other hand, see them as an effective way of disguising the provenance of illicitly earned funds.

For a long time, BlackRock had opposed bitcoin (BTC) as an investment alternative. The financial behemoth has finally turned around and set itself up as an apostle of the flagship crypto.

Over the past few days, Bitcoin's (BTC) value has been declining. This trend, however, doesn't dampen analysts' optimism about the flagship crypto's short-term prospects.

Securities and Exchange Commission (SEC) Chairman Gary Gensler testified before the Senate during a session of the SEC's FY2024 Budget Subcommittee. During his speech, he raised important issues related to the regulation of the crypto sector, calling certain aspects “the Wild West”.

The bitcoin (BTC) market has been buzzing for the past few months. Cathie Wood is convinced that the asset's price will strengthen in the coming months. She expects BTC's valuation to top the million-dollar mark.

Crypto firm LBRY has been embroiled in a lawsuit against the SEC for the past few months. At issue is the determination of the moveable nature of LBRY Credits (LBC), the company's native crypto. The legal battle over the latter has just seen a new twist.

Solana (SOL) is currently not at its best in the crypto market. However, some analysts believe this is just temporary.

The skies over the digital world are decked out in flamboyant colors as the specter of the Web3 revolution rises. The gaming industry, an insatiably vast universe, is not indifferent to this growing phenomenon. Sega, the Japanese video game titan, is about to immortalize its name in this new era, by announcing its very first blockchain-based game.

The recent disclosure of Hinman's documents reversed expectations of a Ripple victory against the SEC. Despite this, some believe the firm's native crypto has significant upside potential.

Experiencing the loss of your Bitcoin account is one of the most frightening nightmares for a cryptocurrency investor. However, in the face of this perplexing situation, there are effective strategies you can deploy to fully recover your data and protect your assets. Whether it's a connectivity issue, the loss of your private keys or passwords, or even if you have been the target of phishing or hacking attacks, don’t panic. Follow the Bitcoin security tips that we will detail in this guide. They will provide you with pragmatic solutions to safely regain access to your valuable bitcoins.

In 2017, Larry Fink, CEO of asset management company BlackRock was scathing about bitcoin. In particular, he criticized the crypto queen as a mafia asset, useful for laundering money. Now, his views on bitcoin's usefulness have changed dramatically.

As a crypto with great potential, ADA is one of those digital assets that perform remarkably well even in the midst of a bear market. Its resilience in a tumultuous market is impressing many investors. Particularly concerned about the future of altcoin, analyst Dan Gambardello predicts an imminent uptrend for this cryptocurrency. He recently shared his thoughts on the future of the digital asset with Twitter users.

Bitcoin has experienced explosive price phases in recent weeks. According to several analysts, the asset's price should continue to rise despite the market's circumstances. Economist Alex Krüger is among those who believe in this prospect.

The blockchain and cryptocurrency industry has seen the development of health and wellness-related projects over the past two years. These are known as Move-to-Earn or fitness finance. These public or private initiatives are attempting to revolutionize the way we take care of ourselves and others!

EU lawmakers have always stated their desire to control banks' dealings with cryptocurrencies. They have now taken a giant step towards achieving this goal. EU MEPs have reached agreement on the capital requirements for crypto-banks. The latter must therefore comply with the new measures in force.

In an era where the boundary between the traditional economy and the cryptosphere is getting blurred, a new milestone has been reached. Coinbase, the US cryptocurrency giant, has just won an unprecedented Supreme Court decision. It's a first for a crypto company, and a testament to how far the sector has come.

In the financial markets, gold and bitcoin are two distinct but highly valued asset classes. Gold benefits from long-standing trust, while bitcoin has managed to establish itself as an essential asset despite the fluctuations it undergoes. According to some experts, both assets have advantages that can be asserted for a long time to come.

The price of Bitcoin recently soared following a series of events triggered by BlackRock's ETF request. Some analysts believe this marks the beginning of a bull run for the flagship cryptocurrency. However, one of them remains cautious about this prospect. Here's why.

The news about the queen of cryptocurrencies is closely followed, and predictions about its future are multiplying by the day. The digital asset has been experiencing an upward trend for the past few days, much to the delight of Bitcoiners. Many analysts agree that it is destined for better days. Renowned investor Michael Saylor is among those who believe this and has recently shared the reasons why he believes Bitcoin (BTC) will continue to dominate the cryptocurrency market for a long time.