More than two decades after the Gulf War, the Iraqi parliament wants to get rid of the dollar again. Why not embrace Bitcoin?

Theme Payment

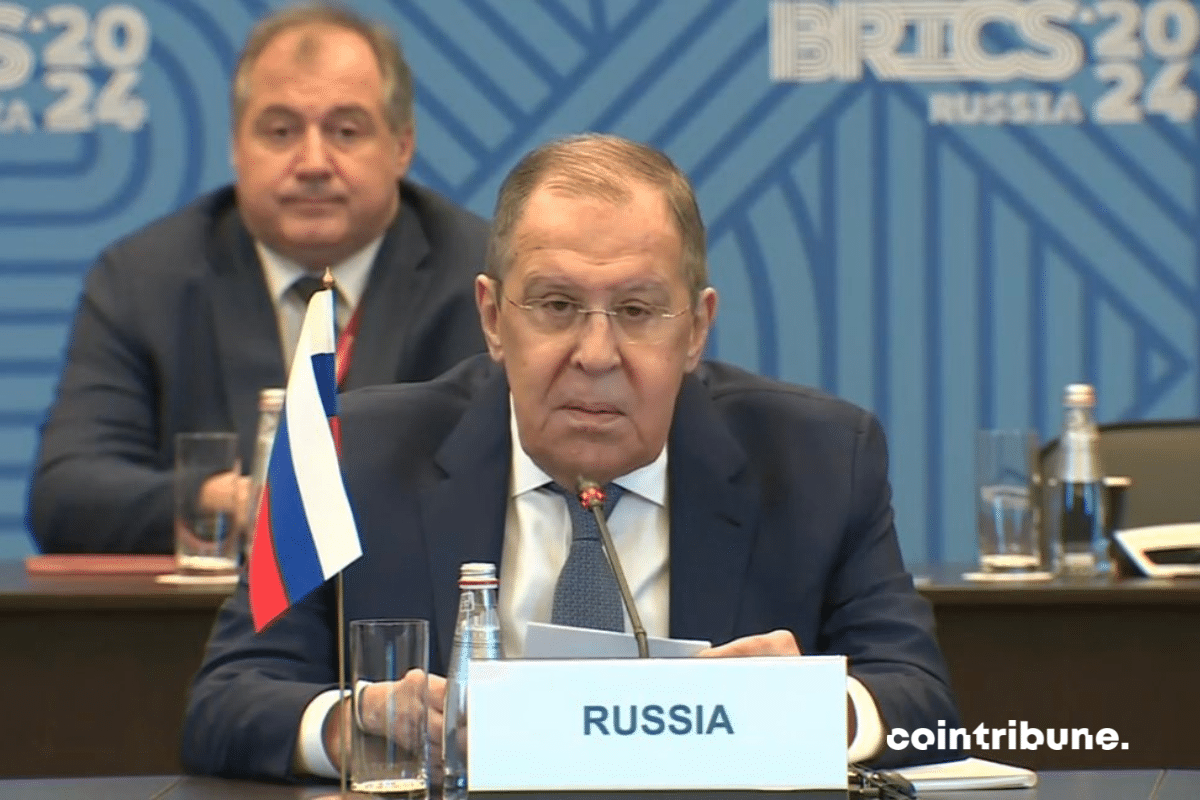

Russia will take over the presidency of BRICS in 2024. Dedollarization will accelerate, as well as cross-border payments involving CBDCs.

We knew that the BRICS were considering, in order to end the hegemony of the dollar, to establish a common currency with possibly a digital option in crypto. It seems that the crypto in question would be bitcoin (BTC) according to the latest news. But can the flagship crypto really be a relevant means of de-dollarization?

The giant of online payment Visa has once again made headlines. Through a strategic alliance with Transak, the platform makes crypto withdrawals via debit card accessible. 145 countries are affected by this development, which highlights Visa's commitment to promoting the sector.

"The Worldcoin ORB promises a crypto revolution through the alliance of AI and biometrics, redefining global access to the economy."

US banks are diving into the magic of Ripple's XRP, speeding up international payments for an enchanting financial future.

The possibility of a common currency for the BRICS has been making headlines for several months. The latest news is that three out of the five member countries of the organization are particularly ready for the realization of this revolutionary monetary option from a geopolitical point of view. Here's which ones.

The SPFS international payment system, the Russian equivalent of SWIFT, is now available in over twenty-five countries. What about Bitcoin?

In general, the year 2023 has been particularly dynamic for the crypto industry. Specifically, the crypto payments segment is no exception as it has achieved exceptional performance throughout that year. This is at least what a recent study by crypto firm CoinGate indicates.

The American bank JP Morgan believes that the Chinese yuan could take over the crown of hegemony in the financial markets from the dollar. In 2023, the currency of the Middle Kingdom has continued to gain importance. This situation benefits the BRICS, of which China is one of the most influential members.

Iran has recently called on the BRICS to establish a common currency to replace the dollar. This challenge to the dollar by Iran, but also increasingly by Saudi Arabia, explains why the Americans want to put an end to the Iranian regime. The end of the petrodollar would no longer allow the United States to finance its monstrous deficits through other countries.

Discover the Ripple Payments guide that reinvents IT payments. Fast, secure, and transparent cross-border transactions!

After China, Russia has just finalized an agreement with Iran to trade in their local currencies instead of the US dollar. When will it be the turn of Bitcoin?

The United States finds itself at a strategic crossroads today. Despite the increasing power of China and the BRICS, the military potential of the United States is declining. As military conflicts multiply around the world, are we witnessing the end of American military superpower and the death of liberal democracy?

Throughout this year, the flagship cryptocurrency, bitcoin (BTC), has shown unparalleled resilience. Its performance positions it as one of the most efficient assets in the financial market this year. These are the conclusions of a recent crypto study conducted by Kaiko Research.

Wave by wave, the European Union (EU) has taken various sanctions against Russia since the invasion of Ukraine, with the goal of suffocating the country's economy. In this context, the European organization has just adopted a 12th wave of sanctions specifically targeting crypto activities conducted by Russians.

Central Bank Digital Currencies (CBDCs) are not popular. They are strongly criticized for the threats they pose to individual privacy. However, the crypto firm Ripple has just released a white paper that promotes the utility of these controversial assets.

While making bitcoin (BTC) a legal currency in its territory, El Salvador worked to provide financial instruments favorable to this policy. The country has made progress in this direction, with the Digital Assets Commission (CNAD) approving the issuance of the world's first bitcoin (BTC) bonds.

It's official, China is number 1. And by a long shot. The international monetary order is going to change. Bitcoin is waiting for its moment.

Did the Russian president just suggest the use of bitcoin for international transactions?

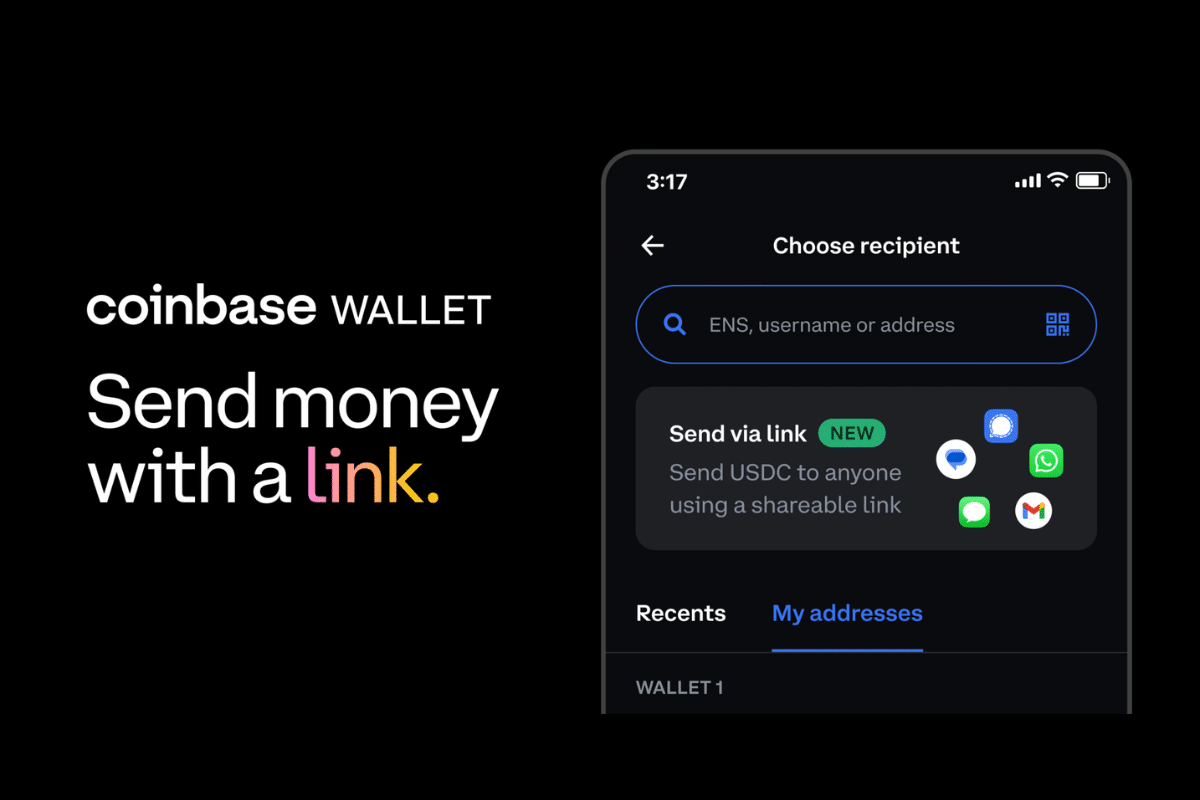

"Coinbase is revolutionizing crypto payments on social networks. Discover how this new service works in this article."

The twilight of the petrodollar is no longer a myth. China and Saudi Arabia are rapidly de-dollarizing their exchanges. When will the petro-bitcoin arrive?

The BRICS member countries plan to launch a common currency for their organization in the near future. At present, there is no indication of the proposed currency's backing. Among analysts, the debate on whether it should be supported by cryptocurrency or gold is ongoing. And the question is not easy to answer. Some data show that cryptocurrency has advantages to offer as a backing for the BRICS currency. The same goes for the precious metal, gold. In this analysis, we will attempt to shed light on what is being said on this subject.

During his campaign for the presidential election in Argentina, Xavier Milei promised that he would work, once elected, to eliminate the country's central bank. Now that it's done, a rumor is emerging about this financial project. Some claim that it was just a campaign promise that the new tenant of Casa Rosada does not intend to fulfill. Javier Milei has formally denied these allegations.

Is the trend towards de-dollarization exaggerated? Is the petrodollar system coming to an end? Will the BRICS go all the way?

The American digital giant is regularly in the spotlight. The issue is its methods deemed unfair to stifle, or even eliminate, any competition. This comes at the expense of users who pay a high price. This is the essence of the collective legal action taken against the company, specifically regarding the use of cryptocurrencies as a P2P payment method.

Kristalina Georgieva actively supports CBDC. She sees these digital currencies as a promising alternative to physical cash.

Yesterday pinned, today fearless. PayPal has just thrown down the gauntlet to the authorities by asserting its determination to pursue its blockchain innovations. Let's analyze this statement that sounds like a declaration of war.

The BRICS countries want to get rid of the influence of the US dollar. This is a high-stakes issue for this group of countries, especially for Russia, which is facing a series of financial measures taken by the West in response to the invasion of Ukraine. It seems that the country is maneuvering to overcome these sanctions. And it is apparently succeeding as the Russian currency, the ruble, has surpassed the dollar in the foreign exchange market.

The de-dollarization continues in Asia. Following nations like India or Indonesia, Thailand is now also shunning the dollar.